Posted by Eivind Tandberg[1]

The IMF and other development institutions are involved in analysis and technical assistance related to public investment management in many different countries. The IMF’s new Public Investment Management Assessment tool (PIMA) has been applied in about 20 countries, and many countries are pursuing reforms to enhance the quality of their public investment.

One important consideration for countries that get involved in such efforts is to what extent structural and policy changes in public investment practices lead to tangible improvements, including more realistic cost estimates, less delays, and enhanced project benefits. A study from Norway, which has been working to improve its public investment framework for the last 15 years, indicates that such improvements do materialize but that this takes time.

The starting point for the Norwegian reforms was increasing awareness during the 1990s that public investment projects suffered from major cost overruns. An in-depth review of 11 major projects found that the overall cost overruns amounted to 84 percent, and that only three of the projects were completed within their budget. A recent PFM Blog article by Jason Harris showed evidence of similarly massive cost blowouts and implementation delays in Australia.

From 2000, all major investment projects submitted for parliamentary approval in Norway have been required to go through external quality assurance, focusing on cost estimates and cost control measures. The Ministry of Finance signed framework agreements with private consultants who were authorized to carry out this external quality assurance. For each project the consultants estimate the expected project costs (P50), as well as an estimate of the necessary reserves to ensure that the final costs stay within the budget envelope with a likelihood of 85 percent (P85).

The estimates of P50 and P85 are based on detailed breakdowns and risk analysis of different project components, and reflect the inherent uncertainties in any type of project costing. The Parliament’s budget appropriation for a project is based on the P85 estimate. The implementing agency is authorized to spend up to the P50 level, while the difference between P50 and P85 is retained as a reserve at the ministry level.

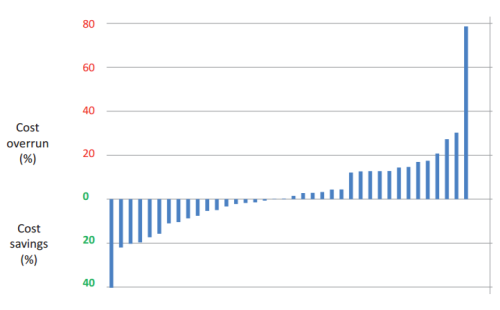

A study conducted in 2013 found that approximately 200 projects had been subject to the external quality assurance scheme since its inception. Reflecting the long lead times for preparation and implementation of major projects, only 40 projects were fully completed with final, total costs being determined. Among these, the average project cost was very close to the P50 level, but there was considerable variation among projects. For most of the projects, the total costs were well within the budget appropriation (P85), but a few projects exceeded this level and one project encountered massive cost overruns

This study indicates that the Norwegian external quality assurance scheme, probably in combination with an increased focus on public investment planning in general, has led to very significant reductions in project cost overruns. Figure 1 provides an overview of the deviation between the P50 estimates and the final costs for the 40 completed projects.

Figure 1: Final Cost of 40 Investment Projects Subject to External Quality Assurance

Source: Investing for Impact, Concept report 36, 2013.

The study is a part of the Concept research program at the Norwegian University of Science and Technology. This program was established to follow and analyze the impacts of the new public investment management framework. It has produced several interesting reports that are available at: http://www.ntnu.edu/concept.

[1] Eivind Tandberg is a consultant and former senior staff member of the IMF’s Fiscal Affairs Department (eivind.tandberg@vista-analyse.no).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.