Effective and efficient public investment is crucial for economic and social development and is particularly important in low-income developing countries (LIDCs). Two recent IMF papers discuss which public investment management institutions may be most important to ensure robust public investment management in LIDCs, and provide advice on specific steps the countries can take to enhance effectiveness and efficiency.

The first paper is Public Investment Management Bottlenecks in Low-income Countries (WP 2024/232). This paper analyzes an extensive data set from more than 80 IMF Public Investment Management Assessments (PIMAs), using statistical methods (principal component analysis - PCA) to identify bottlenecks to effective public investment management in LIDCs. The analysis suggests that five PIMA institutions are systematically highly correlated to estimates of public investment efficiency. This does not mean that these five are the only important institutions – this will depend on country circumstances. But the following five institutions are very likely to be high priorities for reform:

- Project appraisal is necessary to assess the strategic importance and the expected costs and benefits of an investment project, as well as its readiness for implementation.

- Project management should ensure that projects are implemented in accordance with budget, timetable, and specifications.

- Procurement is critical to ensure that the planned project objectives can be realized and avoid corruption and other governance issues during the construction and operation of the asset.

- Availability of funding is a major bottleneck in many LIDCs, where the capital budget is often used as a fiscal buffer and frequently over committed. In-year fiscal resources may be severely constrained due to unrealistic revenue projections and unplanned expenditures.

- Project selection should ensure that the projects with the highest likelihood of achieving a country’s strategic objectives and the highest benefits compared to costs are prioritized, and that these are adequately prepared and consistent with available resources.

The second paper discusses several options for How to Improve Public Investment Management in Low-Income Countries (HTN 2025/001). The discussion covers eight PIMA institutions that are least effective across LIDCs and/or have the most significant impact on public investment efficiency. These include the five institutions noted above and the following three additional institutions:

- Multi-year budgeting is essential for the credibility of project planning and achieving better efficiency of project implementation.

- Maintenance is essential to preserve the value and the performance of public investments; spending on maintenance is considered a highly efficient use of funds to maximize the impact of public assets.

- Monitoring of public assets is a fundamental prerequisite for effective planning of investments and management of the overall public capital stock, including for maintenance.

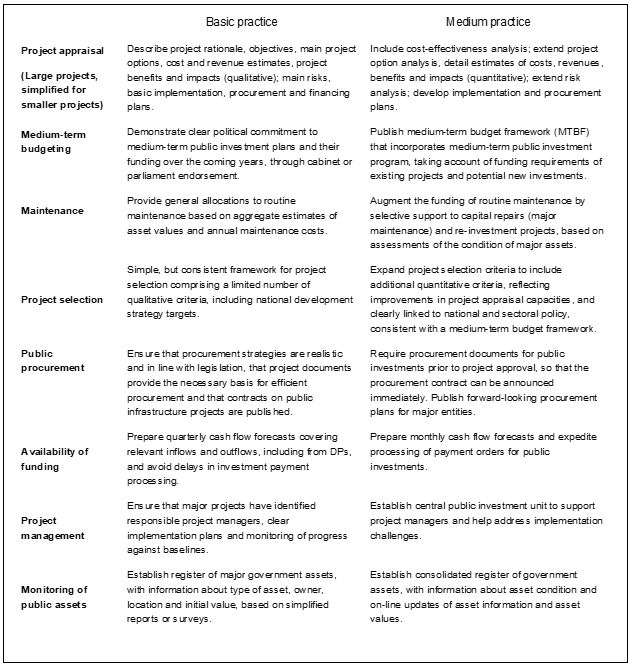

For each of the eight PIM institutions, the note discusses basic practices, which should be realistic initial reform objectives for low-capacity countries, as well as medium practices that may be relevant objectives for medium-term reforms. The main criteria are summarized in the table below. The note also discusses how to overcome reform implementation challenges and consolidate the reforms and provides examples of action plans to implement the different reforms.