IMF Survey - re-posted from the IMF Survey Magazine: In the News website.

- “Efficiency gaps” in public investment spending are large and hinder growth

- Better public investment management can significantly reduce efficiency gaps

- New assessment tools can identify gaps and pinpoint reform priorities

On average, about 30 percent of the potential value of public investment is lost to inefficiencies in the investment process, and closing this efficiency gap could substantially increase the economic dividends from public investment.

Despite widespread evidence of wasteful public investment spending, including for “white elephant” projects that are characterized by large cost overruns, time delays, and inadequate maintenance, cross-country analysis of public investment efficiency remains scarce.

A new IMF study examines the relationship between public investment, infrastructure quality, and economic growth on the basis of the broadest data set yet assembled. It confirms significant waste (“efficiency gaps”) in public investment spending, and shows that strengthening public investment management institutions could close up to two-thirds of the efficiency gaps.

“Public investment can serve as an important catalyst for economic growth, for example by supporting or enabling the delivery of key public services, and connecting citizens and firms to economic opportunities,” said Vitor Gaspar, Director of the IMF’s Fiscal Affairs Department. “But the economic and social impact of public investment critically depends on its efficiency.”

The study finds that increasing public investment efficiency could double the impact of that investment on growth. More specifically, a 1 percent of GDP increase in public investment, would increase output by just 0.3 percentage points of GDP in countries in the bottom efficiency quartile, but by 0.6 percent for countries in the top efficiency quartile.

Narrowing (but persistent) disparities

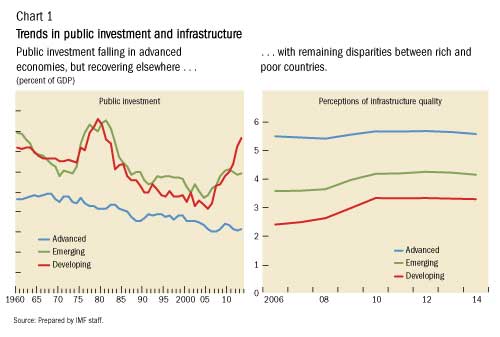

Following three decades of steady decline, public investment as a share of GDP has begun to recover in emerging markets (EMs) and low-income developing countries (LIDCs), but remains at historic lows in advanced economies (AEs) (Chart 1).

Indicators of infrastructure quality and access suggest that the recent ramping up of public investment in LIDCs and EMs has helped to reduce perceived disparities in infrastructure across countries (Chart 1). Convergence has been especially pronounced in social infrastructure, however, large disparities persist for economic infrastructure.

Persistent cross-country disparities in infrastructure quality coupled with the potentially positive effect of infrastructure spending on economic growth make it particularly important to use limited investment funds as efficiently as possible.

Mind the efficiency gap

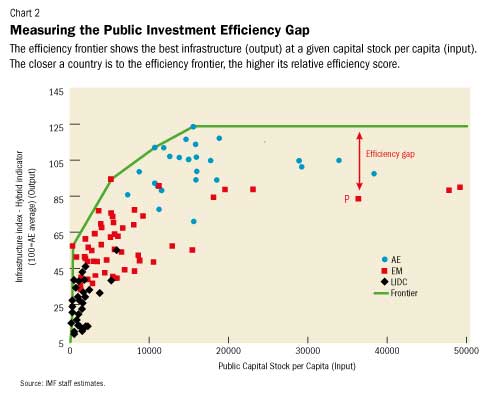

The study explores different approaches to measuring public investment efficiency, defined as the relationship between the accumulated public capital stock per capita and various indicators of the overall quality of and access to infrastructure (Chart 2).

The study looked at 134 countries, the largest investment efficiency analysis carried out to date, and found an average public investment efficiency gap of around 30 percent. The size of the efficiency gap shrinks as income rises, with LIDCs facing a gap of 40 percent, EMs facing a gap of 27 percent, and AEs facing a gap of 13 percent on average.

Start the ball rolling

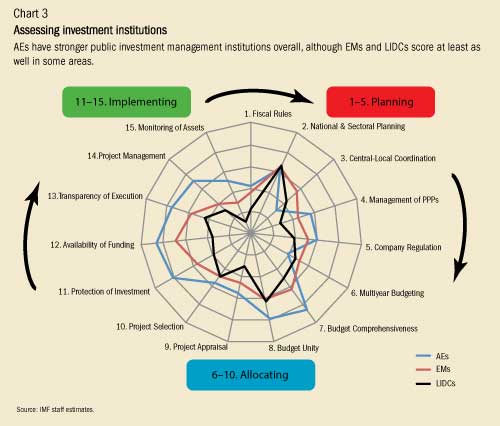

Improvements in public investment management could improve the efficiency and productivity of public investment. Based on a sample of 25 countries, and using the IMF’s new Public Investment Management Assessment (PIMA) tool, the study finds significant scope to strengthen specific institutions involved in managing public investments. The PIMA framework evaluates 15 key institutions in the three phases of the investment process—planning, allocation and implementation. The PIMA framework provides an in-depth assessment of public investment management from a macro-fiscal perspective.

The results suggest that AEs have stronger public investment management institutions overall, but not uniformly so, with EMs and LIDCs scoring at least as well in national and sectoral planning, central-local coordination, and multiyear budgeting (Chart 3). Public investment management arrangements are generally strongest at the implementation phase and weakest at the planning phase.

The study also finds a clear relationship between the strength of public investment management and public investment performance. Countries with stronger public investment management institutions have more predictable, credible, efficient, and productive public investment, with less corruption and rent-seeking.

Priorities for strengthening PIM institutions vary across country groups. For example, AEs should ensure that their fiscal and budgetary frameworks provide stable and sustainable bases for investment planning across levels of government. EMs should focus on adopting more rigorous and transparent arrangements for the appraisal, selection, and approval of investment projects. LIDCs should strengthen the institutions related to the funding, management, and monitoring of project implementation. All countries would benefit from stricter oversight of public-private partnerships and better integration between national strategic planning with capital budgeting.

In line with its role in helping countries become more efficient public investors, the IMF will develop the new assessment into a standard diagnostic of public investment management practices that will help countries define reform priorities.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.