Posted by Eivind Tandberg and Richard Allen[1]

Public investment can play an important role in economic recovery after crises and shocks, and the COVID-19 pandemic is no exception. Countries will emerge from the pandemic with scarce fiscal space, elevated debt levels, and large financing needs, highlighting the need to make every dollar count to ensure efficient investment spending. Many countries that had curtailed investment to finance immediate health and social expenditures during the crisis are now planning to increase investment.

The IMF has recently published a How to Note (HTN) that discusses these issues. Accelerating investments will require balancing speed, due process, and the accountability of decision makers. Countries will need effective institutions and considerable technical expertise to compare projects and make realistic assessments of costs and economic returns. They will face challenges in having projects vetted and approved expeditiously without interference from special interests and rent-seekers. At the same time, short-circuiting essential processes and ill-considered infrastructure projects might create longer-term costs, such as environmental damage and excessive maintenance requirements.

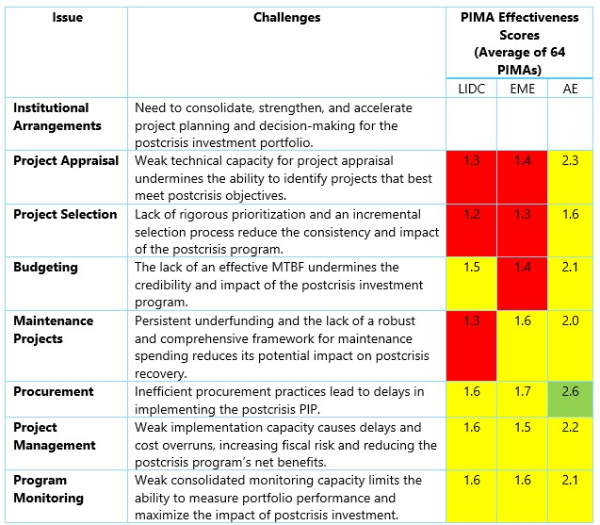

The table below identifies eight PIMA institutions that will be especially challenging to countries in managing the post-crisis recovery.[2] Many countries are short of capacity to address these challenges, particularly low-income developing countries (LIDCs) and emerging market economies (EMEs). The last three columns show average scores for the relevant PIMA institutions. Average capacity levels are only slightly above the unmet levels in many LIDCs and EMEs (shown in red). There are also significant weaknesses in many advanced economies (yellow indicates partially met levels).

Table. Main Issues and Challenges for Postcrisis Investment Programs

Note: A score of 1 indicates that the requirements for good practice have not been met in any institution, 2 means that they have been partially met, and 3 signifies that they have been fully met. AE = advanced economy; EME = emerging market economy; LIDC = low-income developing country; PIMA = Public Investment Management Assessment; PIP = public investment plan; MTBF = medium-term budget framework.

The HTN discusses each of these challenges and their potential solutions, enumerating basic, medium, and advanced practices. Basic practice should be sufficient to help countries with limited capacity meet their postcrisis investment program objectives. Basic and medium practices can be applied quickly by countries with limited capacities and will contribute to long-term institutional improvements over time. Medium and advanced practices provide additional assurances that objectives will be realized. Advanced practices are like recognized good international practices for public investments in normal times.

The main findings of the HTN are as follows:

- Countries should consolidate and accelerate existing project-planning and decision-making procedures.

- Countries’ public investment plans should be revisited, and possible changes made to the prioritization and phasing of projects, accelerating some and deferring or canceling others.

- Project appraisals may need to be updated and supplemented with revised criteria.

- The government should define clear selection criteria based on the economic targets for the overall recovery program.

- The postcrisis investment program should be reflected in transparent medium-term budget decisions.

- Maintenance and capital repairs can be very productive and should play an important role in the recovery phase.

- Procurement processes may need accelerating but should be undertaken with necessary safeguards to support compliance and effective oversight.

- Strong project management is necessary to ensure that projects are implemented on time and within budget, as well as to produce the expected benefits.

- Good portfolio monitoring is essential for assessing progress and assuring the successful implementation of projects in the postcrisis recovery program.

[1] Eivind Tandberg in a Long-Term Advisor with the IMF’s Fiscal Affairs Department. Richard Allen is an international consultant on public finance issues, a former IMF staff member and the Co-Editor of the PFM Blog.

[2] PIMA is the Public Investment Management Assessment framework developed by the IMF.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.