Posted by Ashok Rao[1]

The case for Commitment Control

Expenditure control is an integral part of expenditure management and constitutes a key element of fiscal discipline. It ensures that spending happens for stated purposes, is within authorized allocations, and adheres to fiscal norms. Federal, sub-national, and local governments across the world have time and again run into serious fiscal problems by allowing large expenditure arrears to build up. Arrears accumulate when expenditure is incurred without matching resources (in the form of liquid assets) to discharge the related liabilities. A well-designed Commitment Control system helps monitor and regulate expenditure arrears by tracking spending well before payment obligations materialize. It also helps regulate the availability of cash amongst spending units. Thus, appropriation controls and cash controls are inbuilt in Commitment Control.

Commitment Control in operation

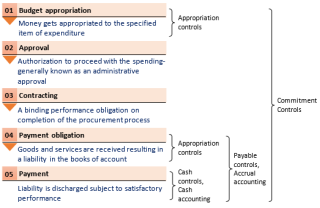

The way Commitment Control operates is illustrated in the chart below. A commitment, as an action or an intention to spend public money, manifests itself at several stages of the expenditure cycle. For sake of simplicity, five major stages of the cycle are shown in the chart, although in practice there may be additional intermediate stages. For example, payments (stage 5) may be preceded by a stage in which cash is allocated to spending units.

As can be seen from the chart, cash controls, accounts payable controls, and appropriation controls operate at different stages of the expenditure cycle. They are, in effect, different manifestations of Commitment Control. In fact, a well-structured Commitment Control encompasses these three controls and extends to earlier stages of the expenditure cycle as well.

Shifting the perspective from when (in the cycle) the control is applied to what is sought to be controlled, Commitment Control can be applied to two variables:

- Unencumbered budget allocations, when it operates as an Appropriation Control, and

- Free cash available at any point in time and its distribution amongst spending units, when it operates as a Cash Control.

Commitment Control helps the public financial manager find answers to the following questions at each intersection of the various stages of the expenditure cycle.

Intersection of Stage 1 and Stage 2 – How much of the aggregate spending allocation in the budget has been approved? How much of the allocation is available for further spending?

Intersection of Stage 2 and Stage 3 – How many (and what amount) of the approved expenditure proposals have been converted into contracts? Are there dropouts at this stage necessitating a potential reallocation of budgets to other eligible expenditure? What is the amount of projected expenditure in coming months (or years in the case of multiannual allocations) that has been committed through towards contracts with suppliers?

Intersection of Stage 3 and Stage 4 – How many (and what amount) of the contracted amounts have crystallized into concrete liabilities? What is the likely cash requirement in the coming months (or years)? Is there a buildup of expenditure arrears? If so, is it within acceptable limits?

Intersection of Stage 4 and Stage 5 – How should available cash be distributed amongst spending units and amongst accounts payables? What visibility do the data provide into the government’s future liquidity position? Is there any mismatch of assets and liabilities that could unbalance the government’s Treasury management?

Commitment Control - A step towards accrual

For governments that are on a purely cash-based system of accounting, Commitment Control can significantly improve their budget management and cash management functions. It puts a lot more information in the hands of decision-makers that a conventional accounting system omits. With a well-functioning Commitment Control system in place, data on liabilities—a critical piece of information for accrual accounting—becomes readily available. This makes the transition to full accrual easier.

Commitment Control - A step beyond accrual

While accrual accounting has an undisputed advantage over cash accounting in terms of the coverage of fiscal reports and fiscal transparency, it suffers from the drawback that liabilities are recorded only when the underlying obligations materialize, in other words, when the contracted goods and services are received. To be used effectively for cash planning or budgeting, information produced by accrual accounting needs to be supplemented with data on expenditures to be incurred in the future. Commitment Control helps fill this data gap thus improving the utility of the financial statements.

To conclude, regardless of whether a government follows cash or accrual accounting, there is a persuasive case for implementing Commitment Control. Governments that are on the path of transition to accrual accounting should incorporate elements of Commitment Control into the design of their accounting systems and Financial Management Information Systems from the beginning.

[1] Ashok Rao is a PFM consultant from Bengaluru, India. He is the Executive Director of Management and Governance Consulting (www.magc.in).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.