As a public financial management expert, a Chartered Accountant, and an Australian Certified Practicing Accountant (CPA), I’ve spent much of my career navigating the intricate world of International Public Sector Accounting Standards (IPSAS) and implementing accounting reforms across various countries.

|

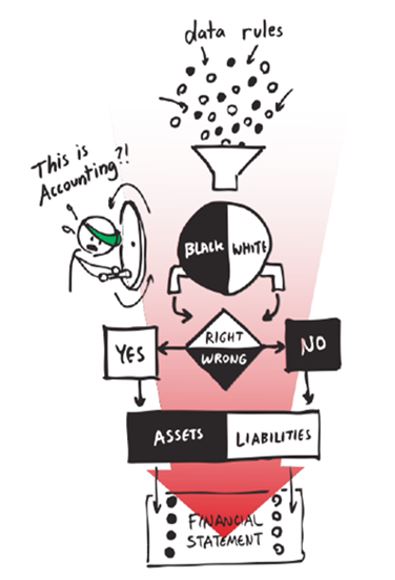

Many professionals—both inside and outside the accounting field—view accounting as a routine task of tracking expenses and revenues, as though it’s just glorified bookkeeping. In this simplified version, accountants merely tally figures, file reports, and move on. But in reality, accounting is a highly technical, standards-driven discipline that requires deep analytical thinking, professional judgment, and a mastery of complex financial frameworks. |

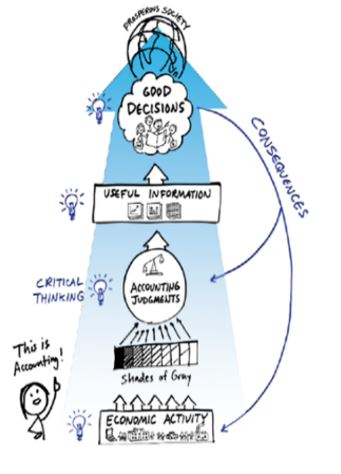

Accounting is not just about compliance and reporting; it is the foundation of effective decision-making. Governments and organizations rely on accurate financial information to make strategic choices that impact fiscal policy, service delivery, and long-term financial sustainability. Every entry in an accounting system contributes to a larger narrative that informs policy decisions, resource allocation, and economic planning.

Decision-making in the public sector requires accountants to do much more than simply record transactions. They must analyze financial data, identify trends, and anticipate future financial risks. Accountants provide insights that help decision-makers answer critical questions:

Effective financial decision-making requires a strong analytical skillset. Accountants must: |

|

- Interpret Financial Data – Identifying trends, anomalies, and financial risks requires more than just reading balance sheets; it demands critical thinking and a deep understanding of financial principles.

- Assess Risk – Financial decisions come with inherent risks. Accountants must evaluate uncertainties related to revenue projections, contingent liabilities, and the economic impact of policy changes.

- Model Scenarios – Using financial models, accountants can forecast different economic scenarios and advise policymakers on potential outcomes.

- Communicate Insights – The ability to translate complex financial information into clear, actionable insights is crucial for guiding leadership and stakeholders.

IPSAS is not just about financial reporting; it’s about accountability, transparency, and fiscal sustainability. With over 40 standards covering topics from asset valuations to contingent liabilities, financial instruments, and foreign exchange transactions, IPSAS requires much more than a surface-level understanding.

Consider IPSAS 17: Property, Plant, and Equipment. Some might assume it simply involves recording asset purchases. In reality, it requires assessing recognition criteria, measuring impairment, evaluating revaluations, and ensuring compliance with disclosure requirements. Now, multiply that level of complexity across all government-controlled entities and you begin to see why “just tracking assets” is an oversimplification of Herculean proportions.

One of the most persistent myths is that accrual accounting is just about recognizing transactions when they occur rather than when cash moves. If only it were that simple.

The misconception that accounting is purely mechanical ignores the intellectual rigor it demands. Beyond just following rules, accountants must:

- Interpret Standards – Knowing what IPSAS 23 says about non-exchange transactions is one thing; applying it to grant revenue with performance conditions is another challenge entirely.

- Exercise Judgment – Estimating the useful life of an asset or determining the fair value of a financial instrument is as much art as it is science.

- Navigate Ambiguity – Public sector environments often require accountants to interpret standards in ways the original drafters never envisioned.

During a technical assistance mission, a colleague once remarked that we could “wrap up the accrual implementation roadmap in a week.” As if reconciling decades of cash-based financial data, identifying all government-controlled entities, and establishing opening balances for a consolidated statement of financial position were akin to assembling IKEA furniture—frustrating, yes, but ultimately straightforward.

The goal isn’t to disparage those outside the accounting profession. Their expertise is critical to public financial management.

Accounting is not just about numbers on a page. It is the backbone of financial transparency, accountability and decision making. A well-functioning public sector accounting system ensures that governments understand their financial position, make informed decisions, and, ultimately, serve their citizens more effectively.

So, the next time someone says, “Accounting? How hard can it be?” hand them an IPSAS manual. Better yet, invite them to help reconcile a government’s opening balances. By the end of the exercise, they might just see accounting in a whole new light—and possibly require a strong cup of tea.

Graphics are from the Pathways Commission, put in place to further the education of future accountants in the US by the AICPA and AAA