Accounting reform is a ‘hot topic’ and pressure exists from international organisations like the World Bank and IMF and consultants, for countries to adopt the international accrual standards of public sector accounting (IPSASs). Countries are attracted by the broad promises of accrual accounting, including increased transparency, better decision making and higher accountability. The European Commission is considering the development of specific European accrual accounting standards (EPSASs).

Questions arise, however, whether this is an appropriate reform for all countries at present and whether the benefits of the reform can be achieved without other reforms occurring. Some European countries (e.g., Germany and the Netherlands) prefer to remain using a modified form of the cash basis of accounting.

SIGMA/OECD has recently published a study on public accounting reforms in four countries, three of which aim to join the European Union (Serbia, Georgia, Montenegro) and one being a ‘neighbourhood’ country (Morocco). This study (https://www.oecd.org/en/publications/public-accounting-reforms-in-the-western-balkans-and-european-neighbourhood_505f903e-en.html) has important messages for countries wishing to follow the same route.

The impact of a too rapid and ill-prepared move to accrual accounting can be greater costs with little or no benefits without a range of other reforms being undertaken. SIGMA’s analysis is informed by recent empirical academic literature and case studies of four EU member states, including Latvia and France, that have adopted full accruals and Netherlands and Germany that remained on a modified cash basis. The study's conclusions do not, on balance, advocate that for transition economy countries, moving to full accrual accounting should be a short- or medium-term priority.

The study contains a valuable summary of four different bases of accounting, namely cash, modified cash, accruals and modified accruals. It also summarises the difference between the purposes of private and public sector accounting. ‘Profitability’, for example, is a key private sector indicator but not generally an objective of governments. Public accountability focuses on the sustainability of public finances in the medium term. Traditional indicators for judging the effectiveness of fiscal management of governments, such as the budget deficit and the stock of public sector debt, are closely linked to this aim.

The study identifies the users of government accounting information as:

- i Legislative bodies for budget authorisation and accountability purposes;

- ii Public sector managers for financial management and control;

- iii Citizens and the wider public for the transparency of the government’s financial management; and

- iv Supra-national bodies for the effectiveness of the government’s fiscal supervision.

The IPSAS framework regards as primary users the service recipients and resource providers (citizens and taxpayers) and their representatives (the legislature). The evidence from this analysis of the four countries indicates that parliaments have little involvement in accounting reforms. Engagement with other stakeholders, such as the supreme audit institution, has also been limited.

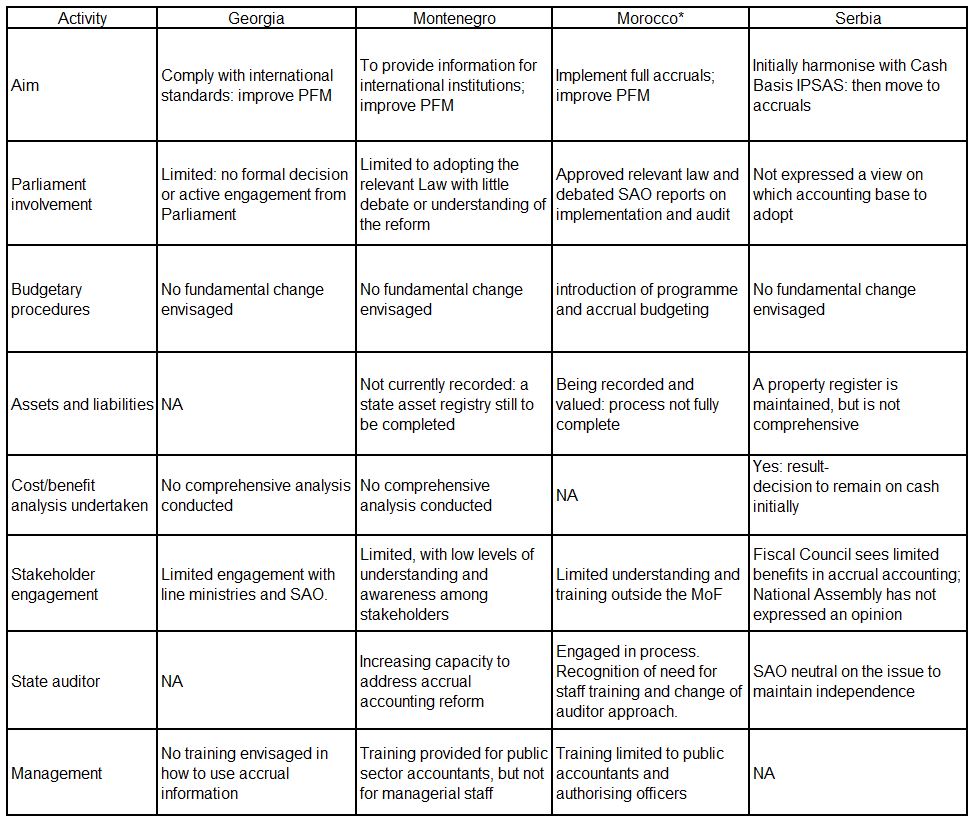

A summary of the results of the study for each country is shown below. It is noticeable that changing the accounting base is not followed up with any rethinking of the management organisation or with the training of managers.

*the references to Morocco include some information not included in the SIGMA study

The report advises that, in countries facing governance and corruption challenges, moving to full accrual accounting should not be considered a short or medium-term priority. Countries should first seek compliance with the IPSAS cash basis standard. They should also seek to improve the management of their fixed assets and liabilities, and their internal and external audit capacity.

Countries should also look for ways to make public management more cost-effective. Specific examples are not referred to in the study but could include the delegation of some public finance (e.g., internal control) functions from the finance ministry to other ministries, and reform of internal organizational structures and accountability arrangements. Overall, the aim should be to enhance the financial literacy of managers.

However, if a government wants to apply the accrual IPSAS, the SIGMA study suggests that a country should:

- Undertake a cost-benefit analysis of the proposed reform;

- Consider the adoption of accrual budgeting;

- Involve key stakeholders in the discussion of the reform objectives, not least parliament and the external auditor.