Illustration by Urban 3.

Posted by Dag Detter[1]

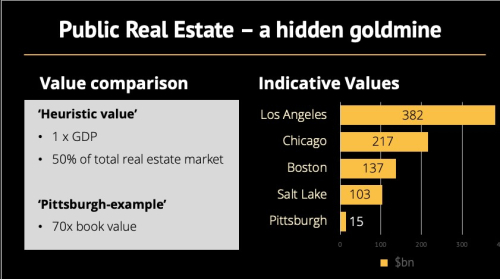

Governments around the world, and at every level (national, regional, local) own assets of immense economic value – not the least real estate - without realising it. What’s out of sight is out of mind and out of budget - and so this vast wealth is excluded from the calculus of government financial decision-making. An Asset Map offers a simple way of demonstrating the truth of this proposition, in any city, region or country.

It is a failure of government accounting that these huge assets are systematically ignored or understated on public sector balance sheets and in the budget process. A direct, and very worrying, consequence is that there is no “accountability” for how well the assets are managed. Accounting and financial management fail fundamentally when accounts do not reflect financial reality, and do not deliver results that are reflected in the government’s financial statements.

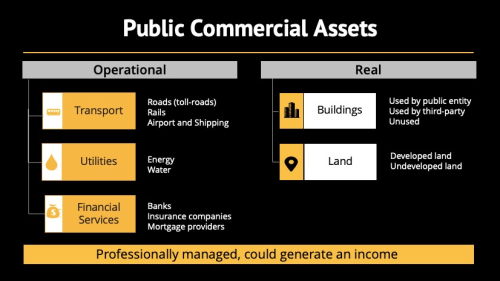

Public Wealth Funds (PWFs) offer a means of ensuring that these assets are managed in ways which deliver sustained economically efficient performance and direct financial dividends to government. Professionally managed public assets could add globally almost $3T in revenues, every year. An Asset Map, an indicative valuation of all public commercial assets (operational and real estate) within a given jurisdiction, would be a way to capture the benefits of identifying and managing assets without solving the much tougher - but very important - challenges of public accounting and financial management.

Source: Public Wealth of Nations.

Commercial assets can all earn an income, as similar assets do in the private sector, fulfilling the same functions and servicing the same type of customers. Yet, governmental accounting standards often state that public assets are different from private sector assets, as their sole purpose is to fulfil a specific public policy. It is a small step from this statement to a presumption that the need for these assets will never change, and hence that they should therefore never be sold. This is the main reason why government accounting standards require public assets to be booked at historical cost, or if this is not known, at no value at all. And with each year, the present reality of how these assets are used, and what they are truly worth, diverges from their historical use, or their historical value. When we think of the time periods involved - decades, or even centuries - it is perhaps not surprising that government accounting can fail so dramatically to capture the current value of public commercial assets.

So proper accounting is vital, but takes time to implement. Balance sheet management over the long-term requires accrual accounting, but there are ways to accelerate the benefits by focusing on some of the low-hanging fruit. By transferring commercial assets to Public Wealth Funds, the benefits of efficient management can be realized much more quickly.

A PWF structured as an independent holding company, can be set up to manage commercial public assets. Using the same tools of financial management as the private sector, a PWF makes it possible for the government to maintain ownership and manage assets professionally, while interacting with the private sector on equal terms. It should emulate the best international standards of listed companies including those pertaining to corporate governance, transparency, and incentive structures. The establishment of the holding company structure could also better attract private sector funds and foreign direct investment, thereby drawing in the additional resources and expertise needed to help a country, region or city develop.

Establishing a PWF requires political will that has historically been lacking in many countries notwithstanding the vast potential benefits. A two-step approach could be considered, where the first step is a pilot exercise that does not put the entire system at risk. This is where the Asset Map comes in.

The Asset Map works like a feasibility study. It provides an estimate of the potential value, yield, and structure of a certain asset portfolio, if professionally managed.

Having a better understanding of the structure and value of the assets would make it possible to formulate a value creation hypothesis, namely how to close the performance gap with similar operational assets in the private sector, as well as develop public real estate to its best and highest use. International experience has shown that publicly owned operational assets are less productive than private firms by one-third, on average. Also, most of the vast portfolios of public real estate are not required to deliver a policy objective, or could be used for a more suitable purpose. The types of assets capable of creating greater economic value include parking lots, empty spaces of land over and around railroad networks, as well as abandoned ports, military facilities, hospitals, industries, and schools.

Given that the alternative in many countries could be a prolonged period of austerity, rethinking how governments view public assets is now a moral goal, as much as an economic one. Making this change will be difficult for governments in both developed and developing countries. But the evidence is clear: the commercial management of assets by a PWF delivers material gains. This time of crisis calls for the most effective use of public assets. Testing this ‘new’ technology in the public sector, through an Asset Map could prove critical for re-establishing sustainable public finances — if not now, when?

[1] Posted by Dag Detter, Principal of Detter & Co. The piece will be presented at an IMF Fiscal Affairs Department Seminar on September 1, 2021.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.