Posted by David Walker[1]

The United States faces a financial crisis, with soaring debt levels and trillions of dollars in unfunded health and social security obligations. Radical reform is required to avert disaster argues the country’s former Comptroller General.

America was once the world’s leading creditor nation: now it is the world’s largest debtor nation. Today, the greatest threat to the US government’s future is its own fiscal irresponsibility. In this regard, while Osama bin Laden has been held accountable for his actions, it’s now time for policy-makers to put the government’s finances in order before the markets hold the country accountable for its inaction.

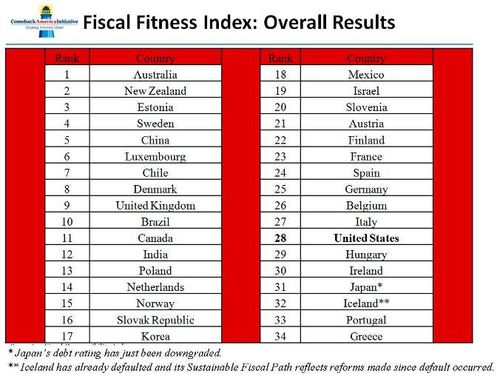

In March 2011, the Comeback America Initiative (CAI) and Stanford University released a Sovereign Fiscal Responsibility Index (attached below) based on each country’s fiscal space, path, and governance. Fiscal space was defined as the amount of additional debt a country could theoretically issue before a fiscal crisis is imminent; the fiscal path is an estimate of the number of years before it will hit maximum debt capacity; and fiscal governance is an indicator of the strength of a government’s institutions, its fiscal controls, and its transparency and accountability to its citizens.

The US ranks far below the average in all three of these categories and it is 28th out of 34 countries in the area of fiscal responsibility and sustainability – below Spain and Italy and only a few notches above Greece, Ireland, and Portugal. The report suggests that the US could face a debt crisis just two to three years from now.

On the positive side, several of the highly ranked countries on the list faced their own fiscal and currency challenges within the past 20 years. They engaged in needed reforms and significantly improved their fiscal posture – proving adjustment can be done.

The report also showed that if congress and the president could work together to pass fiscal reforms that were the ‘bottom line’ fiscal equivalent of those recommended by the National Commission on Fiscal Responsibility and Reform in 2010, the USA’s ranking would improve dramatically, up to the 8th position out of 34 nations. In addition, the US would achieve fiscal sustainability for over 40 years.

For the US to restore fiscal sustainability, President Obama has to discharge his leadership responsibilities as chief executive officer of the US government. He entered the game with a speech on 13 April 2011 in which he largely embraced the work of the National Commission, although with a longer time frame for implementation and less specifics on social insurance and other proposed reforms.

The president also endorsed the debt/GDP trigger and automatic enforcement concept that the CAI had been advocating. Under this concept, congress could agree on a set of statutory budget controls that would come into effect in 2013. Such controls should include specific annual debt/GDP targets with automatic spending cuts and temporary revenue increases based on an agreed upon ratio in the event the annual target is not met.

The president and congressional leaders reached an agreement about half way through the current fiscal year to resolve funding levels for fiscal 2011 and avert a partial shutdown of the federal government. However, Washington policy-makers took about 88% of federal spending, along with much-needed federal tax reforms, ‘off the table’ during the debate over the 2011 budget.

In essence, they have been arguing over the bar tab on the Titanic, when we can see the huge iceberg that lies ahead. The ice that is below the surface is comprised of tens of trillions of dollars in unfunded Medicare, Social Security and other off-balance sheet obligations.

Many other major industrialised nations face similar challenges that are driven primarily by demographic trends, longer life-spans, and rising health care costs. It is, therefore, vital that the US changes course before it experiences a collision that could have catastrophic consequences, both domestically and around the world.

Clearly, both major political parties in the US must ultimately come to the table and put aside their sacred cows – this is especially challenging in a non-parliamentary system with two major political parties.

Democrats need to acknowledge that the current social insurance contract has to be renegotiated – Social Security is underfunded by about $9trn. In addition, the health care reforms in 2010 will result in higher federal health care costs as a percentage of the economy. And, according to Medicare’s independent chief actuary, the cost of the reforms to the Medicare programme could be over $12trn in current dollars more than advertised.

Republicans need to acknowledge that the US can’t just grow its way out of the federal fiscal hole. They need to admit that all tax cuts are not equal and that there is room to cut defence and other security spending without compromising national security. While they are correct to say that our nation’s fiscal challenge is primarily a spending problem, they must recognise that some additional revenues above historical levels will be needed to restore fiscal sustainability.

All parties also need to understand that the US can’t inflate its way out of this problem and needs to take steps to improve the nation’s competitive posture. This means that some properly targeted and effectively implemented critical infrastructure and other investments may be both needed and appropriate, even if they exacerbate the short-term fiscal challenge.

So, where should Washington go from here? First, congress and the president should reach a compromise agreement on an appropriate level of spending cuts in 2012, while also providing for some additional properly designed and effectively implemented critical infrastructure investments.

Second, they should agree to re-impose tough statutory budget controls that will force much tougher choices on both the spending and tax side of the ledger beginning no later than 2013.

Third, they should authorise and fund a national citizen education and engagement effort to help prepare the American people for the needed actions and to facilitate elected officials taking them without losing their jobs.

Fourth, they should create a credible and independent process that will provide for a baseline review of major federal organisational structures, operational practices, policies and programmes in order to make a range of transformational recommendations that will make the federal government more future-focused, results oriented, successful and sustainable.

Spending levels certainly need to be cut. Policy-makers should be targeting greater cuts than have been recently considered, but over a longer period of time: for example, real spending cuts of $125–$150bn over several years.

The next order of battle items should be corporate tax and Social Security reform. Corporate tax reform will help to improve competitiveness, enhance economic growth and generate jobs. The Social Security programme should be made solvent, sustainable, secure, and more savings oriented. These efforts should be followed by broader tax reform.

The US then needs to rationalise its health care promises and focus more on reducing costs in another round of health care legislation. It must also begin a multi-year effort to re-baseline the federal government’s organisations, operations, programmes and policies.

We will soon know whether Washington policy-makers are up to the challenge and whether they will start thinking more about doing their job rather than keeping their job. They need to focus on their country rather than their party and on results rather than rhetoric.

The challenges that exist in the US exist in many other countries to varying degrees. There is also an increasing amount of interconnectivity and interdependency in today’s world. As a result, countries need to engage in a range of transformational reforms and citizens need to help ensure that policy-makers act in a timely and responsible manner before a crisis is at the doorstep.

By doing so, we all can help to ensure that our collective future is better than our past.

[1] David M. Walker is the founder and chief executive officer of the Comeback America Initiative and was Comptroller General of the United States from 1998 to 2008. This is an edited version of an article published in the latest issue of Public Money & Management.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.