A Financial Management Information System (FMIS) is a software system that helps a government perform financial management functions, including, and at times without being limited to, budgeting, payments, accounting and financial reporting. Design and development of FMIS is seen as an integral part of any public financial management reform agenda. A recent OECD paper outlines key strategic choices for FMIS development:

- Degree of Centralization – Whether to develop a centralized system for the entire government or allow individual entities to develop their own systems.

- Integration of Functions – How financial management functions are managed within a single IT platform and shared database.

- Ownership Model – Whether to customize off-the-shelf (COTS) systems or develop bespoke solutions.

This article compares India’s FMIS, called the Public Financial Management System (PFMS) with the OECD model in terms of these strategic choices, outlining major challenges therein and suggesting a way forward.

Unlike OECD countries, which began automating financial transaction processing in the 1960s and 1970s, PFMS was introduced in the late 2000s as a management information platform. Earlier initiatives such as COMPACT (Comprehensive Pay and Accounts) and the Government e-Payment Gateway (GePG) laid the groundwork for PFMS. By the mid-2010s, PFMS consolidated these functions into a unified platform for public finance management.

The status of PFMS can be described as following a Partially centralized, Core-Integrated, Bespoke model.

PFMS operates in tandem with ministries’/departments’ IT platforms. The budget portal, the procurement portal (Government e-Marketplace), and tax collection portals work independently but remain integrated through standardized interfaces. All sub-national government treasuries are integrated with PFMS for seamless data exchange. In fact, this takes India very close to most OECD countries. For example, among the 24 OECD countries (constituting 71% of OECD countries) following a partially decentralized and decentralized model, reporting and data requirements, the chart of accounts and the budget classification are centrally determined. On similar lines, PFMS has been able to ensure standardization of data by leveraging upon the common underlying accounting policies, the chart of accounts, standard control point configurations and standard cyber security requirements.

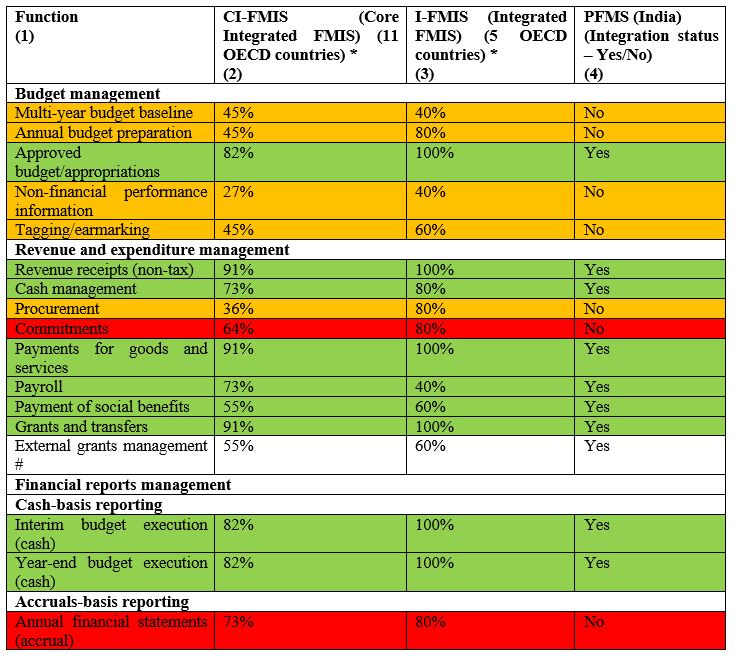

The PFMS has been able to bring most core public finance utilities under its ambit (core-integrated - CI model), namely – cash management, payroll, payment of social benefits including cash transfers, grants and transfers and grant management. A brief comparison is presented below in table 1. However, work still needs to be done to capture commitments and to prepare accounting statements on an accrual basis.

Major differences arise in the technology solution model adopted in India. For most OECD countries, COTS has been the model of choice. On the other hand, India has adopted the bespoke model to develop the system in-house while hiring the services of commercial IT service providers.

PFMS has made a strategic choice to keep its core functions within dedicated data centers. Uncertainty about costs and an evolving landscape of data privacy policy and cyber security has driven these choices. The Government of India has issued guidelines for cloud adoption and empaneled cloud service providers (CSPs). A National Cloud initiative has also been launched2.

Table 1: Integration of core financial management functions in OECD FMIS vis-à-vis

Challenges and Way forward

Despite differences in development models, both India and OECD countries face similar challenges:

- Outdated Systems – Many OECD systems are over 10 years old; PFMS also relies on legacy technology with its last major architectural reform being more than 10 years old.

- Performance and Scalability – Systems are slow and struggle to meet increasing user expectations and transaction volumes.

- Adaptability to New Technologies – Existing designs lack the flexibility to integrate AI/ML and other advanced technologies.

- Real-Time Reporting – There is a growing demand for real-time and advanced financial analytics.

- Regulatory Misalignment – Regulatory frameworks lag behind technological changes.

Technical capacity may not suffice without business process re-engineering. With the integration of Business Intelligence and AI/ML in these processes, changes may also face resistance on the part of users.

Widespread consultations accompanied with pro-active training during implementation/pilot stages will be required to drive the reforms. Adoption of global standards (like ISO 20022, ISO 27701, FIDO, CMMI, etc.) and strong leadership are also key.