Posted by Era Dabla-Norris, Tej Prakash, and Richard Allen[1]

A recently published IMF Working Paper constructs a new index that measures the quality of budget institutions in low-income countries. The quality of budget institutions—defined as the structures, formal and informal rules and procedures that govern budget planning, approval and implementation— is assessed against a list of wide-ranging criteria that measure key characteristics of the budget process in low-income countries.

A sizeable literature has attempted to measure the quality of budget institutions in advanced and middle-income countries by defining quantitative indices and examining their effect on fiscal performance. The present study is the first, however, to focus attention primarily on low-income countries. It develops a composite index of the quality of budget institutions for 72 low- and middle-income countries drawing upon empirical studies, budget survey databases and assessment reports such as the Public Expenditure and Financial Accountability (PEFA) framework, supplemented by data from the IMF, the World Bank, and donors engaged in capacity building in low-income countries.

The paper demonstrates that sound budget institutions are vital if low-income countries are to implement effective fiscal policies. In particular, the global financial crisis has reinforced the key role of budget institutions in enhancing the effectiveness of fiscal policy as a stabilization tool. However, for low-income countries, the importance of sound budget institutions transcends the current crisis. Such institutions help ensure government accountability and prevent leakage of public funds; increase efficiency of scarce public resources; and improve the prospects of maintaining fiscal stability and meeting social development needs.

The budget institutions index

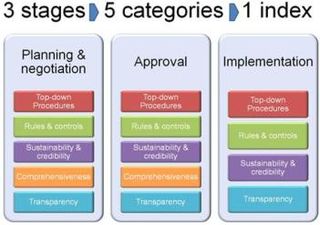

The index breaks new ground by recognizing the multi-faceted nature of budget institutions and is broader in scope than other available indicators. It records the quality of budget institutions along a two-dimensional framework (see Figure 1 below). The first dimension covers the various stages in the budget process (planning and negotiation, approval, and implementation). The second dimension reflects five cross-cutting characteristics of the budget process, with particular emphasis placed on the specifics of the budget process in low-income countries.

The criteria assessed include, for example, the comprehensiveness of budget coverage, as measured by inclusion of information on donor-financed projects, and the size of off-budget expenditures; the degree of centralization of budgetary decision-making; whether the budget is subject to effective rules and operational controls; the ability of the legislature to scrutinize the budget; and whether there is an effective system of internal and external audit.

Differences across country groups

The index allows for benchmarking against the performance of middle-income countries, across regions, and according to different institutional arrangements that deliver good fiscal performance. Some important differences emerge across countries and regions:

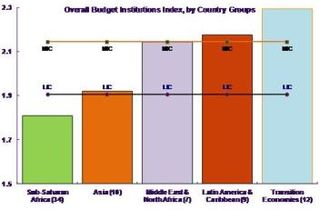

· Across regions, transition economies followed by countries in Latin America and the Caribbean have relatively more developed institutions (see Figure 2 below).

· Despite considerable heterogeneity, low-income countries, on average, have weaker budget institutions as compared to middle-income countries.

· Budget institutions in Sub-Saharan Africa were particularly weak in areas of budget planning and implementation, reflecting fewer checks and balances in the budget process, and less public dissemination of information on the budget.

What the results show

Using the constructed indices, the paper provides some preliminary econometric evidence of the relationship between budget institutions and fiscal performance in low-income countries. The results suggest that:

· Sound budget institutions help foster more responsible fiscal policies, as measured by higher primary balances and lower debt in the period before the crisis.

· Countries with stronger fiscal institutions have better scope to use fiscal policy as a stabilization tool. In fact, fiscal accommodation during the current crisis was higher for countries with stronger institutions.

· The most significant institutions are those related to planning and implementing the budget, and to the sustainability, comprehensiveness, and transparency of the budget process.

Conclusions—and proposals for further research

· While the index seems preferable to other publicly available measures (e.g., the PEFA framework) that present an incomplete picture of the complex dimensions of budget institutions, the methodology outlined in the paper could be usefully extended to other dimensions, to broaden country coverage, and to introduce a time dimension into the analysis.

· The indicators may also be useful in guiding countries toward areas of the budget process that require technical assistance for building stronger institutions.

· Preliminary results from the econometric analysis suggest that further strengthening transparency and comprehensiveness of the budget process in low-income countries are particularly important; and that well developed procedures for external monitoring and audit of the budget are likely to be more effective than those which rely on government self-monitoring.

Figure 1. The Budget Institutions Index

Figure 2. Overall Index Score, by Region and Country Groups

--------------------------------------------------------------------------------

[1] Era Dabla-Norris is the Deputy Unit Chief of the Strategy, Policy, and Review Department (SPR). Tej Prakash is a Senior Economist in FAD’s Public Financial Management 2 division. Richard Allen, currently a consultant for the World Bank, was the Deputy Division Chief of the FAD’s Public Financial Management 1 division when the working paper was written.