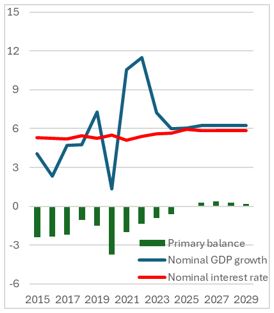

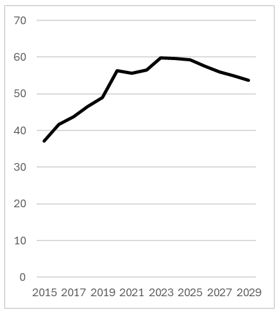

Governments across Sub-Saharan Africa are grappling with the fiscal trilemma: containing debt, meeting development needs through increased spending, and managing resistance to tax hikes. According to the October 2024 World Economic Outlook, while debt-to-GDP ratios are projected to decline, they remain elevated due to persistent risks, including macroeconomic volatility, weak revenue performance, and expenditure pressures (Figure 1). In this challenging context, the adoption and strengthening of medium-term fiscal frameworks (MTFFs) is critical for fiscal sustainability and improved public financial management.

Recognizing these challenges, AFRITAC South (AFS) hosted a regional workshop on “Strengthening Medium-Term Fiscal Frameworks” in Johannesburg from December 16–20, 2024. The event brought together 29 officials from Ministries of Finance and Planning across 10 AFS countries and Kenya. Participants represented macro-fiscal units, budget departments, and debt directorates.

|

Figure 1: Macro-fiscal indicators in Sub-Saharan Africa (2015-29) |

|

|

1a. Debt-GDP ratio (%) |

1b. Nominal GDP growth (%), nominalinterest rate (%), primarybalance(%ofGDP) |

|

|

Source: IMF World Economic Outlook, October 2024

Aligning workshop objectives to capacity development needs

The workshop aimed to deepen participants’ conceptual and technical understanding of MTFFs but also served as a platform to discuss current MTFF implementation challenges, share practical experiences in mitigating strategies and bring awareness to the Fund’s capacity development support. Whilst concepts are often well understood and there is keen interest to implement reforms, practitioners acknowledged the difficulty of translating theory into practice. Navigating institutional boundaries requires a ‘no straight jacket’ approach, and peer learning and technical support are useful in demystifying complex reforms.

Theory and practice were linked by simulating the MTFF formulation and implementation process, using a stylized MTFF tool that was first developed for an in-country mission and adapted for this workshop. Hence, discussions simulated real-world scenarios and participants developed realistic fiscal policy responses.

Common challenges impacting fiscal policy decisions

Despite the unique context of each participating country, several common issues emerged:

- Elevated debt levels and limited fiscal space.

- Persistent expenditure pressures, particularly from public sector wages and materialization of contingent liabilities.

- Shortfalls in revenue collections, primarily due to a large and growing informal sector, which is more difficult to tax.

- Significant macro-fiscal risks posed by interest rate volatility, exchange rate fluctuations and contingent liabilities, as well as other fiscal risks.

- Political interference in budgeting, which undermines fiscal credibility.

- Lack of timely and good quality data to prepare MTFFs which negatively impact the robustness and usability of macro-fiscal forecasts to credibly guide budgets.

- Difficulty to institutionalize good practices or implement new reforms resulting from unsupportive organizational arrangements and weak legal frameworks.

Insights from the workshop

Participants used the tailored MTFF tool to prepare baseline fiscal forecasts and alternative scenarios, incorporating revenue, expenditure, and financing aggregates. They practiced aligning fiscal scenarios with policy objectives, ensuring affordability and fiscal sustainability. Key insights included:

- The importance of balancing revenue-enhancing measures with targeted expenditure reductions.

- Ensuring that the resource envelope is informed by a fiscal objective in defining an affordable spending ceiling.

- The potential of pro-growth policies to create fiscal space.

- The need to account for macro-fiscal risks in budgeting processes.

Country presentations from South Africa, Eswatini, and Kenya illustrated practical challenges and opportunities in implementing MTFFs. While South Africa has institutionalized its MTFF, deficits and debt have continued to grow, necessitating the need to review the anchoring of fiscal objectives and how expenditure ceilings are designed to achieve fiscal sustainability. Kenya has invested in improving the institutional and legislative framework as well technical capacity in MTFFs. Work is ongoing to strengthen fiscal risk management. Eswatini is well resourced with human capital but still faces challenges in implementing its MTFF. Considerable effort and support are required to address organizational and institutional challenges, including improving technical capacity for MTFF preparation and fiscal risk management. Participants also shared their experiences and successful strategies, such as leveraging local data, fostering peer learning networks, and improving cross-departmental coordination.

The light is still shining

The workshop demonstrated the critical role of MTFFs in fostering fiscal sustainability in Sub-Saharan Africa and underscored the importance of building networks and sharing knowledge towards achievement of these goals. FAD support in developing and adapting tools for national use complements related support to improve fiscal management and mitigate macro-fiscal risks to achieve fiscal sustainability and enhance budget credibility.