In the evolving landscape of Public Financial Management (PFM), a recent working paper[1] from the Anticorruption Research Centre (ARC) in Dublin City University (DCU) tackles the pressing issue of corruption and inefficiency in public finance systems. Presented at the European Consortium for Political Research General Conference 2025, the paper offers a comprehensive analysis of the costs of corruption and other efficiency losses using a fiscal space framework and applies them to the United States as a country test case. The hypothesis is that by presenting anti-corruption as a source of fiscal space may help policymakers address corruption more systematically through the budget process.

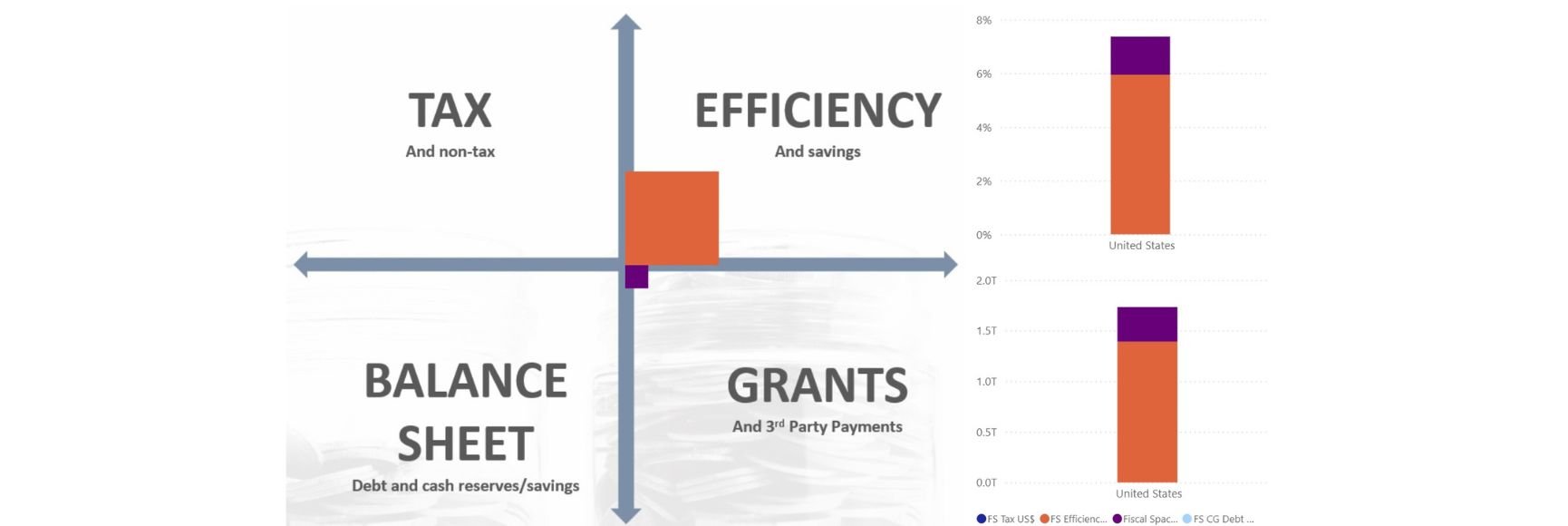

Central to the paper are two innovative frameworks. The first estimates fiscal space across four dimensions: taxation, public debt, third-party spending, and efficiency. The second framework quantifies the costs of corruption and inefficiency, distinguishing between corruption (abuse of power for private gain) and political manoeuvring (use of power in the public interest).

The paper calls for a strategic use of fiscal space to incentivize cabinets to view anticorruption as a source of fiscal space. It emphasizes the importance of aligning budget incentives to combat corruption and improve efficiency. It provides a strong fiscal incentive for governments – especially finance ministers – to reduce corruption. The study also introduces a publicly available global fiscal space model for benchmarking fiscal space and its drivers.

The findings underscore the need for targeted budget actions and reforms to reduce fiscal losses due to corruption. The paper concludes with policy response options and highlights the ongoing research to test these frameworks in other countries.

The paper is the second in a series of papers on the nexus of corruption, efficiency, and politics in public finance systems. The first paper[2], presented at the 2024 ECPR conference, introduced the methodology of how to cost corruption and other inefficiencies by location within a public finance system, at the country level and globally using public data only. It also presented a global costing model and placed it within a fiscal space framework. It emphasised that the way to reduce the losses is multifaceted, but some of the solutions are embedded in the model, with reform being one important way as progress can be measured by all the risk metrics used (e.g., PEFA, CPI, OBI etc).

The paper referenced in this blog is an example of how to apply the fiscal space and costing model in a country context. The study demonstrates the power of the model in revealing risks and problem areas, showing high level capabilities to the benchmarking of financial and non-financial performance against other countries or groups of countries, especially important for relative efficiency analysis. Similar analysis can be undertaken very quickly for any country given all countries are already covered in the single semantic model. A public expenditure review for example, can take a matter of weeks instead of months using this model, and it can be done for almost any country in the world.

The next paper under development moves away from models that use only public data, and focuses on corruption and inefficiency detection models that draw on confidential internal data. The fourth paper plans to bring together the three prior papers and discuss all the different ways governments can tackle the corruption and inefficiency problem through a holistic approach based on a cabinet endorsed process. The holistic approach will look at various areas including the budget process, legislative changes, improvements to disclosure and costing policies, and other reforms.

[1] https://ecpr.eu/Events/Event/PaperDetails/81673. Full paper, slide deck and models are available at: : https://artificialfiscalintelligence.com/afi_home/publications-and-analytics/