Interest in fiscal risk management (FRM)[1] has been expanding globally in the wake of the great financial crisis, the Covid-19 pandemic and successive shocks to the global economy. In Western Africa, Côte d’Ivoire was the first country to introduce FRM in 2017, but others followed.

In 2023, the IMF provided technical assistance on fiscal risk management in Benin, Côte d’Ivoire and Burkina Faso. While the country contexts are different, there are common challenges, primarily the necessity of a closer integration of FRM into the budget cycle. Fiscal risk tools enable the important analysis of major risk, however change is also needed in the mind set of budget decision-makers and practitioners to enable fiscal risk management to take root, this is a gradual process.

In our recent capacity development work in the three Western African countries mentioned above, one of the challenges was to raise awareness of what FRM is and how it impacts the budgetary decision making. A budget practice which integrates FRM, changes the world in which budgeting takes place from one deterministic choices to a stochastic one. The former deals with the different ongoing activities and projects and allocates expenditure accordingly. The latter introduces fiscal risks that will impact the budget with estimated probabilities of deviations from the budget.

Now the question is, what changes in terms of budgetary choices? We claim that the most important changes are mitigation measures that are taken in order to minimize the fiscal impact of the contingent events that could hit the budget. These measures are the core of FRM. Changes also occur in macro fiscal management and in the fiscal strategy, when fiscal risks are factored into the macro fiscal framework, as well as in terms of precautionary measures and provisioning for fiscal risks.

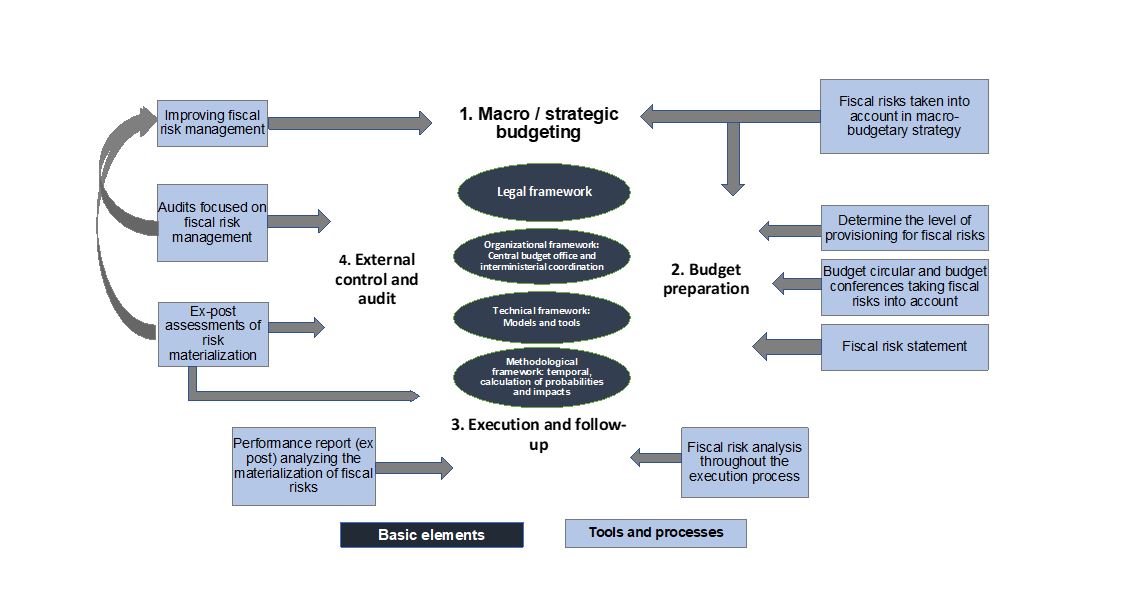

In order to realize the benefits, FRM needs to be integrated into the budget cycle putting mitigation measures at center stage. This necessitates legal anchorage, an interministerial organizational framework coordinated by the central budget office, models and methodological tools. This will also require new processes for dealing with fiscal risks as well as the adaptation of existing tools and processes (see the Figure below).

Core FRM processes include the identification and the analysis of fiscal risks and mitigation measures. These are continuous processes throughout the year, with updates and new analyses. This involves the major risk owning institutions, beginning with the macro fiscal unit, debt management, financial sector risk experts, SOE and PPP experts, and units specialized in climate risks. In this regard, the IMF fiscal risk toolkit for analysis and management of fiscal risks is a very useful resource. Data is fed into a fiscal risk register that is regularly updated and senior decision makers are informed throughout the whole budget cycle. The most visible tool is the publication of a fiscal risk statement (FRS) accompanying the draft budget.

Integrating FRM into the Budget Cycle

Our work with Western African Countries, Benin, Côte d’Ivoire and Burkina Faso has shown that existing practices in the three countries have been focusing nearly exclusively on production of the FRS document. The analytical framework for fiscal risk analysis that determines which time horizon is chosen, short- medium- or long-term and when fiscal impacts are classified as low, medium or high was fragmented and in most instances mitigation measures were too general, containing little specific information and no indications regarding the implementation schedule etc. Clear responsibilities for FRM have been defined in all three countries; in Côte d'Ivoire, a coordination office has just been set up in the Directorate-General for Budget and Finance, and interministerial coordination is being anchored in a committee in all three countries.

To strengthen FRM a recalibration of the efforts along the lines outlined above has been initiated with a focus on the implementation of new analytical tools, in-year analysis, monitoring and reporting systems. But FRM will not stop there. It is a new way of approaching the budget, and therefore needs broad dissemination among all actors of the budget cycle, while tools are an important element, it also really takes a switch in the minds of those involved to succeed.

[1] “Fiscal risks are factors that may cause fiscal outcomes to deviate from expectations or forecast” (IMF, 2016, Analyzing and Managing Fiscal Risks, Best Practices, page 5).