While the global economy is facing an uncertain future, the GCC region (comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) is in a relative sweet spot with strong economic growth, moderate inflation, and fiscal surpluses. Governments in the region are investing heavily in infrastructure to realize ambitious goals to diversify and grow their economies. But without robust policy frameworks for planning and managing public investments, these projects run the risk of falling short of their ambitions.

Sound public investment management (PIM) is about selecting the right investments and implementing them the right way. It is about ensuring that there is a demonstrable need for new infrastructure, that investment projects align with national and sectoral strategies, that government entities coordinate with each other to maximize synergies and that risks are managed effectively.

Analysis by the International Monetary Fund (IMF) suggests that the average country loses about 30% of returns on its investments due to inefficiencies in PIM processes. In the GCC, inefficiencies include non-standardized processes for the appraisal of proposed investments; mismatched funding needs and budget allocations; limited inter-agency coordination; lack of ex-post evaluations of investments; and inadequate performance data and reporting.

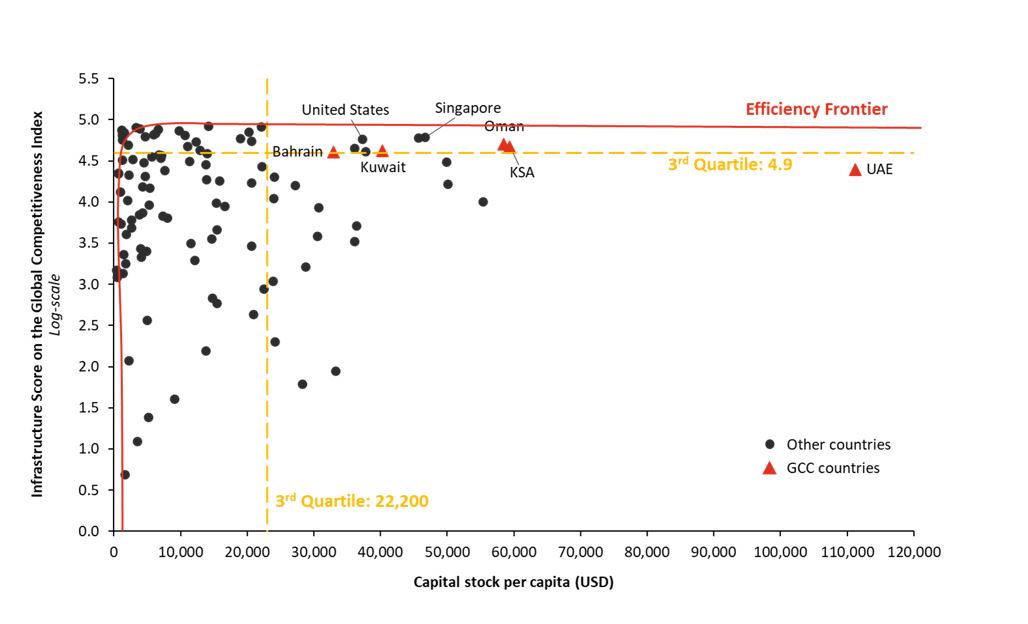

One way of assessing public investment efficiency is to compare the quality of infrastructure against a country’s per capita capital stock. GCC countries have a high level of capital stock per capita and are in the top quartile globally on this measure. However, this doesn’t necessarily translate into infrastructure quality that is commensurate with the amounts invested. The region has room to catch up with countries that are closest to the “efficiency frontier”, which based on IMF methodology is the estimated highest level of attainable efficiency (see chart below).

The IMF suggests that improvements in PIM processes can help countries remove up to two-thirds of their efficiency gap. A comprehensive PIM framework consists of legislation, procedural rules and methodological guidance that combine to strengthen the way that public investment decisions are made and executed by government entities. GCC countries need to strengthen their PIM frameworks in several key areas:

●Alignment of investment plans to national and sectoral strategies.

●Multi-year portfolio planning and rationalization.

●Business case development and independent reviews.

●Investment appraisal and prioritization based on strategic alignment and economic, social, and environmental impacts.

●A strategy for project adjustments, and for the divestment and disposal of assets.

●Implementation monitoring and reporting procedures.

●Ex-post evaluation and feedback mechanisms for improving PIM policies and practices.

By investing in a better PIM framework, GCC countries would achieve three key benefits.

First, an efficient PIM framework can help improve fiscal stability and the credibility of fiscal strategy. It provides a link between the budget cycle and the strategic planning process, whereby the “quality at entry” of investments into budgets is improved and duplication is minimized. It can help increase the predictability of investment cost profiles, which is essential to building credible and feasible medium-term budget plans. It can also improve the quality of reporting, which helps governments identify and rectify poorly performing investments.

Second, a PIM framework can help governments diversify their economies, which is a strategic priority for most GCC countries. Economic diversification can be embedded as a required assessment dimension for building investment rationales, assessing different potential investment options, developing economic cases at the appraisal stage, and prioritizing planned investments and evaluating investments ex-post.

Third, a PIM framework can support GCC governments in making progress against their national sustainable development targets[1]. Governments can use the framework to integrate sustainability controls into the investment lifecycle. For example, spending entities could be required to meet sustainability criteria in their business case and independent review process, and to report on whether investments have fulfilled these criteria.

At a time where the GCC countries are investing heavily to accelerate growth and achieve their economic development objectives, it is important that they put in place robust and integrated policy frameworks to plan and execute their infrastructure investments and close the efficiency gap.

The author would like to thank Zuhdi Hashweh, Sajeda Sajjad Ali Khwaja, Ali Ayyad, Essa Hamdan, Fahad Alkahtani, Faisal Soudi, Gerd Schwartz, Kenny Linn, Geoffrey Kebbell, Richard Boxshall, Jing Teow, Abdullah Tamer and Mahmoud Arafah for their contributions and support.

[1] The UAE has committed to a Net Zero 2050 target. Saudi Arabia has committed to a Net Zero 2060 target and announced the Green Initiative to promote the circular economy. Qatar aims to reduce greenhouse gas emissions by 25% by 2030. Bahrain committed to a Net Zero 2060 target. Oman committed to a Net Zero 2050 target. Kuwait committed to carbon neutrality by 2050 in the oil and gas sector and by 2060 in other sectors.

ESG News. (November 8, 2022). Kuwait Commits to Carbon Neutrality by 2050. Retrieved February 20, 2023, from https://esgnews.com/kuwait-commits-to-carbon-neutrality-by-2050/