Climate change is presenting new analytical challenges for ministries of finance around the world. Higher temperatures and more frequent natural disasters will lead to lower output and revenue growth, higher deficits, and more debt. Increased natural disasters and changing temperature and precipitation are also presenting new and previously unforeseen risks to infrastructure, state-owned enterprises and public-private partnerships.

Following in the recent footsteps of Georgia, Armenia has expanded its fiscal risk framework to assess and manage the risks related to climate change.[1]

A new IMF capacity development report prepared with the Armenian Ministry of Finance details the fiscal risks of climate change over the long term (the next fifty years). The fiscal impact of climate change is analyzed from three complementary perspectives. First, the impact of higher temperatures on the economy is assessed based on empirical analysis of past temperature changes on growth. Second, the flow through of slower economic growth is applied to long-run fiscal projections to identify building fiscal pressures. Third, the cost of climate change-related fiscal risks is assessed to identify the state’s direct exposures to these risks.

Three different climate scenarios are explored in this analysis:

- The Paris scenario of strong global climate change mitigation.

- An unmitigated emissions scenario. This scenario would lead to a temperature increase of around 5.5 degrees over the average 1990s level by 2090−2100. This is an extreme and unlikely warming scenario, but relevant for this type of tail-risk analysis.

- A volatile scenario where the effects of increased climate volatility under the unmitigated scenario are explicitly modelled.

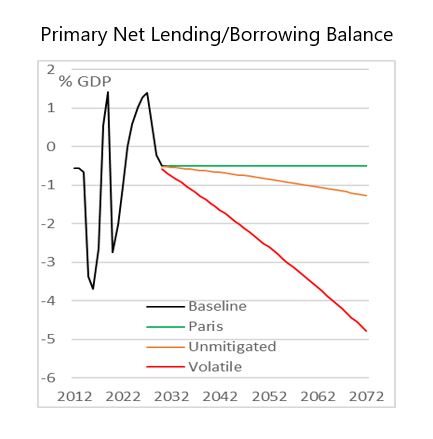

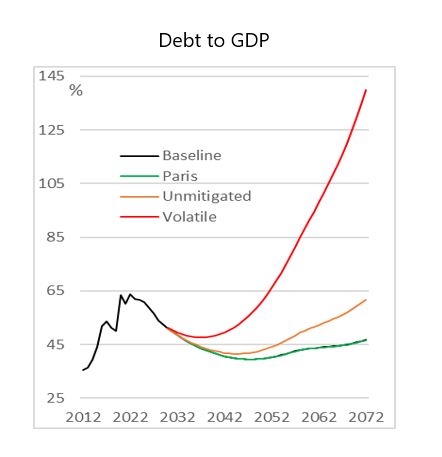

The charts below show that Armenia’s GDP could be around 18 percent smaller in 2072 than the baseline under the most extreme scenario. The primary deficit would be almost 5 percent of GDP, and the debt to GDP ratio could reach almost 140 percent.

The analysis also highlights how higher and more volatile temperatures, reduced rainfall, and more frequent climate change-related disasters would expose the government to a range of discrete fiscal risks. Armenia, for example, has large hydroelectric and water transmission projects, both of which are likely to be heavily impacted by a projected 40 percent decline in water flows. Climate change-related natural disasters could damage infrastructure and generate force majeure events for PPPs. Higher temperatures could compromise the efficiency of thermal power plants and the transmission framework.

By understanding and assessing these fiscal risks now, the Armenian Ministry of Finance is providing an analytical basis for informed policymaking that can help to mitigate these risks in the future.

[1] This technical assistance (TA) was provided with financial support from the European Union.