“Ready or not, we are entering an age of adaptation. And we need to be smart about it.” - Kristalina Georgieva, IMF

Countries across the globe need to prepare themselves for the impact of climate change on their societies and economies. Increasing temperatures and more frequent and severe natural hazards will affect all aspects of human life – human security, health, and well-being.

Climate change will affect the level of output of many countries and challenge their capability to stabilize and support sustainable economic growth and public finances. Natural disasters are likely to disrupt their economies more often and more harshly. Understanding the fiscal risks related to climate change and mitigating their potential impact on the economy and the government budget will be crucial for increasing the resilience of public finances going forward.

Quantifying climate fiscal risks – Georgia takes up the baton

Georgia – a global leader in fiscal transparency – is setting new and high standards for climate change fiscal risk analysis, and fiscal reporting as the government prepares quantitative estimates of the long-term economic effects and fiscal risks of climate change.

In a recent report “Updating the Balance Sheet and Quantifying Fiscal Risks from Climate Change", supported by technical assistance from the IMF, the Georgian Ministry of Finance analyzed the fiscal impacts of climate change from three complementary perspectives:

- The impact of increasing average temperatures on the economy through lower productivity.

- The fiscal costs of more frequent and severe natural disasters.

- The cost of specific climate-related fiscal risks such as state-owned enterprises or public infrastructure.

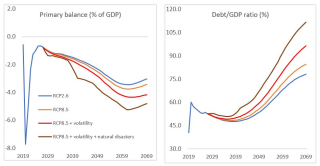

Indicative analysis (see Chart below) shows that climate change could reduce Georgia’s GDP per capita by 13 percent and increase public debt by 18 percent of GDP by 2070. Public debt could plausibly reach 111 percent of GDP if the fiscal costs of more frequent and intense natural disasters are included. In contrast, a strong climate change mitigation scenario, in line with the Paris Agreement, presents a relatively benign fiscal outlook, with debt largely matching the baseline projections.

There is a broad range of climate scenarios that can be applied when assessing fiscal risks, with the focus on the following key scenarios:

- 6. The Paris Agreement scenario, which assumes that these international commitments are met.

- 5. The “business-as-usual” scenario, where the Paris commitments are not implemented, and GHG-emissions continue to rise in line with global economic output.

- 5. Climate volatility. This scenario takes the business-as-usual scenario as a starting point and assesses the economic impact of increased climate volatility as global temperatures rise.

- 5. Climate volatility and natural disasters. This scenario is based on the economic impact of the previous scenario but includes other fiscal effects that may arise with more frequent and more severe natural disasters.

Primary Balance (LHS, % of GDP) and Debt-to-GDP (RHS) under various climate scenarios

Climate change fiscal risks and the role of the Ministry of Finance

By identifying, analyzing, and reporting fiscal risks related to climate change, the Ministry of Finance in Georgia can estimate the potential economic and fiscal costs of climate change under various scenarios. Through this analysis, the Ministry is increasing the relevance of its fiscal framework and supporting well-informed policy decisions on national climate change adaptation.

Readers interested in more information on this topic can reach out to FADMAST1@imf.org.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.