Posted by Julien Dubertret[1]

Although investment projects often exceed their expected costs, when it comes to capital budgeting, there is a common bias towards overestimating payments. Two main reasons can explain this observation. The first one has to do with line ministries’ over-optimism on investment projects - a much more appealing type of expenditure than current spending - without acknowledging that capital expenditure is often complex and thus subject to delays. The second reason is that the collection and analysis of data on capital projects is often deficient. Simple questions such as how many projects are active, or what are the effective amounts contracted, may be difficult to answer. This can be attributed to a lack of rigorous bookkeeping of commitments.

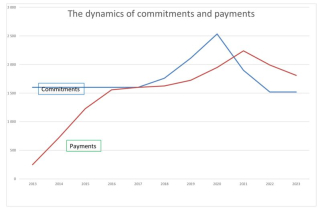

When it comes to assessing payments on capital expenditures, past commitments are critical. In fact, because many investment projects have a multi-year time horizon, the payment needs in any year are mostly determined by past commitments, very little by new projects. Everyone knows how payments can lag commitments, sometimes by several years, as projects are slowly picking up. Conversely, payments can later catch up rapidly precisely when commitments slow down. The following graph – based on a combination of three-, four- and five-year projects –clearly demonstrates the relationship between past commitments and current payments.

In brief, there is an obvious need for a budget instrument that closely follows commitments on capital expenditures and assesses the payments they trigger. Such a tool is essential for accurate budgeting of capital expenditures and especially for making reliable estimates of medium-term spending baselines.

In the French budgetary system, the important concept of commitment appropriations is used in combination with payment appropriations to enable precise budgeting and follow-up of investment projects. Commitment appropriations are defined as authorizations voted in the budget that can be used for capital investment commitments only, whereas capital payment appropriations can be used for payments only. This system has been successfully used in France since 1956 at least and is widespread in other countries that have adopted the French system of budgeting. It is compatible both with a purely annual or a multiannual public finance system, and with line-item budgeting as well as with results-based budgeting. In France, the budget continued using the commitment appropriations system without any change after the 2001 and 2012 organic reforms that set up program budgeting and a medium-term budget framework.

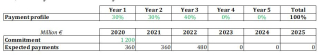

How does it work? The core of this tool is the payment profile that describes how payments relating to a project (a commitment) are spread over budget years. For example, for a three-year investment project, payment instalments may be estimated as 30% of the commitment in year one, 30% in year two and 40% in year three:

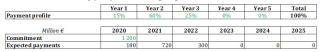

But a more realistic scenario could be 15% in year one, 60% in year two and 25% in year three, which would of course imply very different budgeting constraints:

It is particularly important that this payment profile be discussed and agreed between the Central Budget Department in the finance ministry and each line ministry. It is fundamental to the analysis of capital budgets. Line ministries are usually known for pushing front-loaded payment profiles, although they may occasionally favor a back-loaded profile in an attempt to make a very expensive project look more acceptable. It is the Budget Department’s role to uphold reality against wishful thinking or budgeting tricks, and make sure a credible payment profile is retained for the purpose of budgeting.

Having assessed the payment profile, the next steps are a matter of common sense, and should be followed both by line ministries and by the Budget Department. First, use actual commitments, not the theoretical ceiling for commitments set in the budget or any other document. Contracted amounts are often below authorized commitment ceilings. Second, check the profile of actual payments. Statistically, they quite often amount to less than 100% of commitments as not all projects started are brought to full completion. Third, check for unused carry-overs from the previous budget year and deduct them from budget payment appropriations for the coming year. It is always fiscally unhealthy to leave appropriations lying around for too long.

It should not be imagined that this tool is challenging to apply. On the contrary, it makes manageable the critically important task of budgeting the consequences of past commitments. It even makes it possible to simplify budgeting in some instances. For example, the budgeting of the hundreds of projects that typically make up a country’s road maintenance or railway maintenance program can be accurately managed through a single budget line with a single payment profile, simply by assessing the observed payment profile that links commitments to payments.

The tool can be applied whenever the budget system provides adequate data on spending commitments, which is the case in most countries. There is no requirement for full commitment appropriations, which can be substituted with any other system of commitment recording and control. Commitment appropriations are not linked with any accounting system, cash or accrual. It does not either require advanced computational techniques. Simple calculations on an excel sheet are all that is required, which means this tool can be used by budget departments and line ministries in low-capacity countries.

Getting broke is not an unlikely outcome of an ambitious public investment policy. To try and minimize this risk, enforcing a strict control on commitments and making sure the budget does not appropriate more than is needed every year, are highly advisable. The tool presented here definitely plays that role.

[1] Inspection Générale des Finances, France.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.