State capacity, the ability of modern states to collect sufficient taxes efficiently, enforce contracts, and provide essential public goods and services - is the foundation of effective governance and national development. Governments with strong administrative and fiscal capacity can collect sufficient tax revenues to provide essential public services including healthcare, education, and public infrastructure.

However, in many African countries, governments struggle to collect sufficient tax revenues due to weak fiscal, institutional and administrative capacity, forcing them to rely on external borrowing and aid. Uganda envisages enhancing its domestic resource mobilization by increasing its tax to GDP ratio from 13 to 18 percent by 2030.

This article explores Uganda’s current tax revenue challenges. It shows how Digital Public Infrastructure (DPI) - such as integrated tax administration systems (ITAS) tools like the Taxpayer Identification Number (TIN) system and the Electronic Fiscal Receipting and Invoicing System (EFRIS) - can be leveraged to enhance state capacity and domestic revenue mobilization.

Weak fiscal and administrative capacity is a serious constraint on domestic resource mobilization, forcing countries in the global south to rely heavily on external borrowing. It can lead to tax evasion, inefficiencies in tax collection and inability to enforce taxpayer compliance. These challenges contribute to persistently low tax-to-GDP ratios, limiting the ability of countries to mobilize sufficient domestic resources for national development.

Across the continent, tax revenue remains far below what is needed to meet growing fiscal demands. According to a 2024 OECD revenue statistics report, the average tax-to-GDP ratio in Sub-Saharan Africa stands at 16 percent, substantially lower than the OECD average of 34 percent. This evidence suggests that there are significant tax policy gaps as well, dominated by large tax expenditures. This contributes to the sluggish growth in revenues including poor enforcement mechanisms, weak compliance incentives, and a large informal sector that remains outside the tax net.

Weak fiscal capacity is evident in the inability to effectively register taxpayers, monitor income, and enforce tax compliance. These issues are compounded by gaps in data and underreporting, which lead to significant revenue leakages. A lack of capacity to assess and collect taxes across various sectors, especially the informal economy, has further restricted revenue generation.

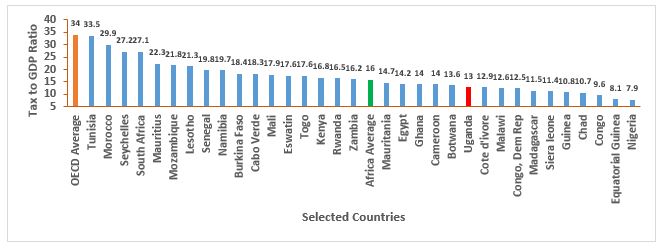

Uganda is no exception. Despite several reforms, the country's tax-to-GDP ratio has stagnated at around 13 percent over the past decade, significantly lower than the regional average shown in the figure below. This stagnation means that the government consistently collects far less revenue than needed to finance public services and infrastructure. With increasing expenditure demands, particularly in areas such as education, healthcare, and energy, Uganda’s reliance on borrowing has intensified, raising concerns about long-term fiscal sustainability.

Tax to GDP ratios for selected African Countries vs OECD average

Source: OECD Revenue Statistics and UNWIDER Government Revenue Database

Digital Public Infrastructure (DPI) presents a transformative opportunity to overcome these challenges. Recent evidence shows that digitalization of revenue administration is not only an efficiency-enhancing investment associated with improved domestic tax revenue collection and a reduction in the VAT compliance gap, but also an improvement in administrative efficiency, and a reduction in taxpayer compliance costs without changes in tax policy. Through leveraging DPI technology, Uganda could potentially enhance tax administration, improve compliance, and expand the tax base.

In recent years, the Uganda Revenue Authority (URA) has introduced several DPIs aimed at enhancing revenue tax collection. These include the integrated Tax Administration system (ITAS) such as Taxpayer Identification Numbers (TINs), the Electronic Fiscal Receipting and Invoicing System (EFRIS), Payment Identification Numbers (PINs) and Digital Tax Stamps (DTS). These tools have significantly improved tax administration, from registration and invoicing to payment processing and compliance monitoring.

For instance, TINs have expanded the tax base by integrating national ID systems, registering over 350,000 informal taxpayers by 2022. Additionally, EFRIS has enabled real-time transaction tracking, leading to a 12 percent rise in VAT collections and curbing tax fraud. PINs have streamlined payments by integrating mobile money and banking platforms, facilitating 25 percent of tax payments digitally. DTS has strengthened market regulation, reducing illicit trade and boosting excise duty and customs collections. These innovations collectively mark a milestone in Uganda’s tax modernization journey.

While Uganda has made significant progress by integrating DPIs into its tax system, there is still room for expansion and innovation. The future of tax administration in Uganda lies in scaling up and optimizing digital public infrastructure. The successes of EFRIS, PINs, and DTS highlight the potential of DPIs to transform tax collection, increase compliance, and boost revenue generation. However, Uganda could further boost its tax revenues by investing in integrating URA systems with third party information. For instance, employers, banks, pension or investment funds could report the taxable income earned by individuals directly to the tax administration. And there could be increased investment in the acquisition of business intelligence systems. to facilitate data analytics,

Nevertheless, digitalizing tax administration in Africa presents notable challenges. A major constraint lies in the limited technical skills and capacity within revenue authorities to effectively utilize these digital investments. This underscores the urgent need for targeted skills development and long-term retention strategies. Additionally, a significant digital gap exists as revenue administrations often advance faster than other government agencies. This hampers data sharing. Furthermore, many smaller taxpayers lack access to digital platforms, limiting their ability to engage with taxpayer-facing modules such as the ITAS which reduces the impact of digitalization on tax compliance.

By embracing technology-driven solutions, Uganda can overcome its long-standing tax revenue challenges and build a more efficient, transparent, and sustainable tax system. A fully digitalized tax administration system will not only enhance revenue mobilization but also reduce reliance on external debt, ensuring long-term economic stability. With the right investments in digital innovation, Uganda can unlock its full revenue potential and achieve a more robust and self-sustaining economy.