Posted by Sailendra Pattanayak and Concha Verdugo-Yepes[1]

Public infrastructure development involves projects that are large, long-term, and complex—all fertile corruption grounds when public officials and other actors process information and make decisions at various stages of the infrastructure cycle for private gain. Complex projects are also characterized by high degrees of information asymmetry, which makes it harder to detect misconduct in terms of inflated prices, inferior quality, or sluggish delivery. As such, some public investment projects have been mired in high-profile corruption scandals involving not only national but also foreign actors.

Corruption in public infrastructure can take many forms, ranging from small bribes to kickbacks, fraud, collusion, embezzlement, extortion, influence peddling, and unlawful beneficial ownership. These corruption risks are analyzed in a Chapter 10 of the recently published IMF volume, Well Spent: How Strong Infrastructure Governance Can End Waste in Public Investment.

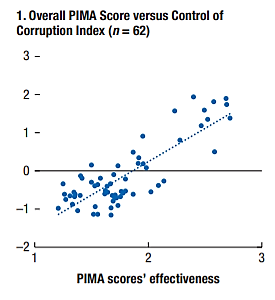

The chapter highlights that corruption is exacerbated when institutional capacity is weak (see chart below). Countries that control corruption well tend to have more effective public investment management and get more “bang” for their investment “buck” than countries that control corruption badly.

Source: IMF estimates based on PIMA databases (2015–18), and the Control of Corruption Index from the World Bank Worldwide Governance Indicators (2010–18). Note: PIMA = Public Investment Management Assessment.

The direct costs of corruption include loss of public funds through misallocations or higher expenses and lower quality of infrastructure. Those who pay bribes aim to recover their money by inflating prices, billing for work not performed, failing to meet infrastructure contract standards, reducing the quality of work, or using inferior materials. This results in much higher costs and lower quality of public infrastructure. Estimates of 20–30 percent of investment project value lost through corruption are widespread.

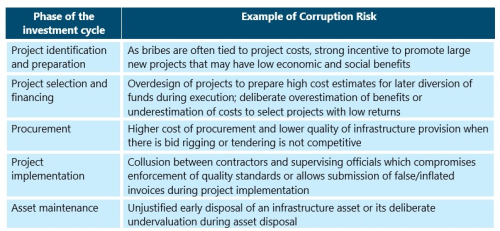

The chapter discusses the types of corruption that generally occur at different phases of the public investment cycle, and their economic costs. It identifies red flags to detect corruption, suggests different mitigation strategies, and provides country case studies.

The various phases of the public investment cycle provide many opportunities for government officials, project funders, consultants, contractors, subcontractors, suppliers, joint venture partners, agents, and other actors to take decisions or manipulate information that create corruption vulnerabilities (see table below).

Specific indicators and “red flags” could help detect corrupt acts and alert policymakers to potential corruption risks, including systemic weak points in the investment cycle. Examples of “red flags” include:

- project selection decisions taken without a feasibility study and project appraisal;

- sole-source contracts or contracts with a single bidder, without prequalification, or both;

- bid selection criteria not clearly defined;

- public officials or their families acquiring a financial interest or employment in a contracting firm;

- substantial change in contract conditions during project implementation; and

- works or services certified without physical inspections.

Identifying the risks of corruption in the public infrastructure cycle and taking effective measures to tackle them are vital to a country’s development and ensuring value for money in the use of public resources.

The chapter proposes a strategy for effectively mitigating corruption risks along the infrastructure cycle. This strategy includes:

- a proactive approach to corruption risk management;

- clear delineation of decision-making authority without conflict of interest;

- transparent frameworks and criteria for taking infrastructure decisions;

- effective arrangements to enforce accountability for the decisions taken;

- a framework for transparent disclosure of relevant information at all key stages; and

- promotion of integrity in the transactions of private firms/actors involved in public infrastructure.

[1] Sailendra Pattanayak is a Deputy Division Chief and Concha Verdugo-Yepes a Senior Economist in the IMF’s Fiscal Affairs Department.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.