Posted by Julie Cooper[1]

All countries have – or aim to have – a computerized system or systems for public financial management (PFM), often referred to as Government Financial Management Information Systems (GFMIS[2]). The aim of a GFMIS is to assist in the reduction of fraud, waste, and abuse, and ensure the efficiency of the entire public financial management (PFM) cycle from budget planning and preparation, through to budget execution and financial reporting. Implementing a GFMIS requires substantial investment but results have been mixed.

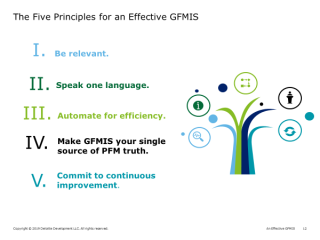

At the May 2019 ICGFM conference, a Deloitte team illustrated five core principles that can be considered when implementing a GFMIS that should lead to better results (see chart below).

First: Be relevant and begin with the end in mind. Ensure the GFMIS is relevant to all stakeholders. Make sure the system produces the reports that are essential for day-to-day activities of every stakeholder.

Second: Speak one language. Have a unified chart of accounts (COA) across the government. While bridging tables can map disparate coding structures, it is more efficient to have one structure for the whole of government. Avoid having multiple ‘dialects’ of the COA that must then be rationalized for coherent reporting.

Third: Automate for efficiency. Use technology to streamline processes and resist customizing the system to accommodate legacy practices and procedures.

Fourth: Make GFMIS the single source of truth. The system must be designed to reflect the government’s finances. Other systems may support it, but it must be the primary source for financial information. There should be no parallel sources of the same type data.

Five: Commit to continuous improvement. There is always a better way to do things. Aim to continuously improve. Identify whatever project will take you to the ‘next level’ and work towards that. The work of implementing GFMIS is never finished.

An investment in a GFMIS can be costly if countries do not assess whether their investment is producing the expected results. Therefore, to ensure that your GFMIS provides a vital service to stakeholders (Principle #1), determine up front the key reports you expect it to produce (the key deliverables essential to your organization).

This is where the donor community can help support PFM reforms, namely by working with the recipient countries to determine and then advocate accurate GFMIS deliverables. As accurate accounting processes result in sound reporting, it is likely that these deliverables will represent sound GFMIS reporting practices, such as producing the trial balance.

Often, legacy systems and procedures remain in place or the GFMIS is used to automate inefficient and ineffective PFM practices. For a country’s GFMIS to have relevance, and withstand changes in the government and the civil service, it should be seen to provide an essential service. Just as funding a government is essential, reliable accounting for government funding is also essential. These five principles can help in achieving that goal.

[1] Julie Cooper is a specialist leader in Deloitte Consulting LLP’s US International Development Public Finance Practice.

[2] This paper makes no distinction between GFMIS, IFMIS, FMIS or Enterprise Resource Planning (ERP) solutions.

Note:

This article is based on a presentation given by Deloitte at the 33rd Annual Training Conference of the International Consortium of Government Financial Managers (ICGFM), held in Miami, Florida, USA, May 2019. The entire presentation can be viewed here.

The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.