Posted by Maximilien Queyranne and Wendell Daal[1]

In 1998, the Government of Jamaica faced a difficult infrastructure challenge. The island’s roads were in decay, Kingston’s congestion was at its peak, road accidents and fatalities were common. The authorities had an ambitious project to address these challenges—create a network of modern highways—but lacked the means and the expertise to build it.

Could a Public-Private Partnership (PPP) provide a solution? A PPP is a long-term contract (20, 30 years) between a government and a private company, the latter constructing infrastructure and providing services that the former usually provides directly. In principle, it allows the government to leverage private sector expertise while transferring some risks of infrastructure projects to its private partner. In 2006, the final section of the new East-West highway was inaugurated in Kingston to great fanfare (see Figure 1). Built through a PPP, it spanned the island, facilitated travel into the capital and opened new opportunities for tourism, tour companies now take cruise ship passengers on visits to Kingston. The highway greatly improved road quality and services, however fiscal costs were higher than anticipated, as the government contributed significantly to total project costs and has not yet received any cash return as traffic was lower than projected.

Despite its challenges, the East-West Highway project has inspired many countries in the region to explore the potential benefits of PPPs to improve infrastructure services.[2] At present, the pipeline of PPP projects in the Caribbean include 31 projects at various stage of development, for a total investment of close to USD 2.5 billion. Could PPPs be the answer?

A new paper by IMF staff discusses how Caribbean countries can benefit from PPPs and use them to address their infrastructure needs, while limiting the potential fiscal costs and risks they create for governments. This paper is the result of a three-year capacity development project which received financial supportfrom the Canadian government. The paper presents the findings of a country survey on existing PPP management frameworks and provides a regional roadmap for better managing fiscal risks from PPPs.

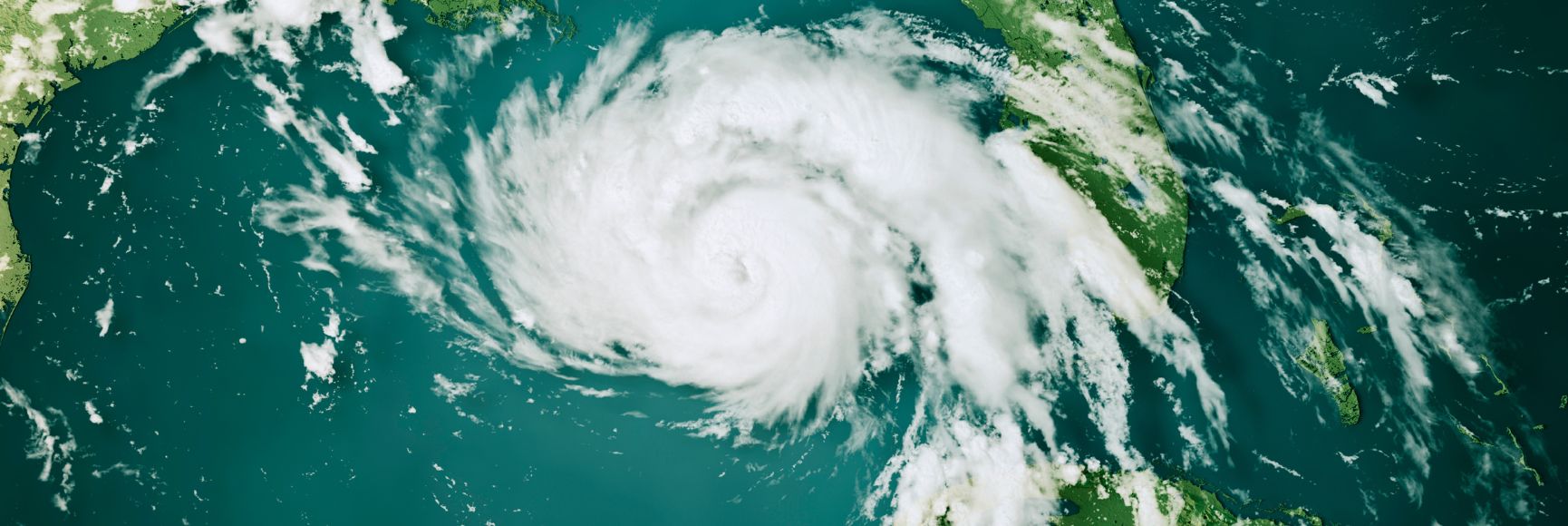

Caribbean countries have made substantial progress in developing their infrastructure. However, over the past decade, both public and private investment have slowed down. These countries face significant challenges investing in infrastructure, stemming from: (i) lack of economies of scale in infrastructure investment; (ii) low access to concessional financing as most countries have already reached a relatively high level of income per capita; (iii) limited access to domestic and global financial markets, and, often; (iv) low capacity for governments to borrow given high public debt burdens. In addition, Caribbean countries are prone to costly and frequent natural disasters and are exposed to the effects of climate change, mainly rising sea levels and increased severity and frequency of tropical storms, which may discourage long-term investment in infrastructure.

PPPs can indeed be an attractive option for developing infrastructure in Caribbean countries. They can crowd in much-needed foreign private investment and generate efficiency gains for these countries as the private sector can bring its drive for results to optimize costs and improve services. However, developing infrastructure projects through PPPs has proven difficult in Caribbean countries, as the projects are often too small to attract global investors and governments lack capacity and funding to manage project development.

Figure 1: Fiscal Iceberg |

|

In addition, PPPs come with significant challenges. In a PPP, the government does not make any payment during construction, as disbursements (by the government or the users) only start paying during operation. It makes PPPs attractive in the short term and creates the illusion that PPP assets are free, but either the government or users will have to repay the private partner. But these direct fiscal costs are just the tip of the fiscal iceberg (see Figure 2). PPPs also create risks that may not be apparent at first but can materialize and have large fiscal implications, this is the submerged and much larger part of the fiscal iceberg. For example, a large proportion of road PPPs have run into difficulties because of over-optimistic projections of tolls collected from users. In many cases, this demand risk is borne by the government, as it guarantees a minimum level of revenue to its private partner.

Our new paper suggests putting in place 5 key elements to better manage fiscal costs and risks from PPPs:

- Most Caribbean countries do not have legal provisions governing PPPs that could help reduce fiscal risks associated with PPPs. They could establish a legal framework for private participation in public-sector projects to guide the relationship between the public and private sector.

- Most Caribbean countries handle PPPs on a parallel track, separate from other public investments and outside the budget. In contrast, best practice suggests that all projects should be subject to the same screening and evaluation processes. Therefore, Caribbean countries would be better off integrating PPP selection and management into the overall public investment processes, including budget processes.

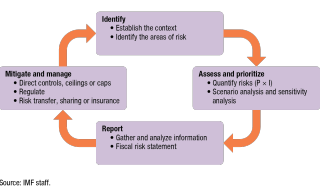

Figure 2: Fiscal Risk Management Framework |

|

- Only very few Caribbean countries have a structured “gateway” process with a strong role for the Minister of Finance to safeguard public finances. Ministries of Finance should be able to stop or suspend a project at any stage if it proves unaffordable. For that, capacities for assessing and preparing projects will need to be build, with the support of the regional PPP unit established at Caribbean Development Bank.

- Few Caribbean countries currently have a transparent accounting and reporting system that covers PPPs. International experience shows that improving transparency on the fiscal implications of PPPs is crucial for strengthening government accountability and improving the management of fiscal costs and risks from PPPs. Until such a system is fully implemented, governments in Caribbean countries should report long-term fiscal implications of PPPs, including fiscal risks, in their budget documents or public debt management strategy.

- Not many Caribbean countries have a framework in place to manage the fiscal impact of PPPs (see Figure 3). Governments should conduct a comprehensive assessment of the long-term fiscal costs and risks associated with a PPP project, including risks arising from potential natural disasters and climate change. They could use the joint IMF-World Bank PPP Fiscal Risk Assessment Model (PFRAM) to assess the long-term fiscal implications and fiscal risks of a portfolio of PPP projects.

- Countries in the region should start developing national policy frameworks for managing risks from natural disasters and better integrate risks arising from climate change into infrastructure design and PPP contracts.

To monitor and manage fiscal costs and risks from PPPs, governments will need to reinforce institutions and develop capacities to fully leverage PPPs while at the same time ensuring fiscal sustainability.

[1] Maximilien Queyranne is an Economist and Wendell Dall is a Senior economist in the Fiscal Affairs Department, IMF.

[2] For the purposes of this paper, Caribbean countries include: Anguilla, Antigua and Barbuda, Aruba, the Bahamas, Barbados, Belize, Bermuda, British Virgin Islands, Cayman Islands, Curaçao, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Suriname, Trinidad and Tobago, and Turks and Caicos.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.