Posted by Staff of the IMF’s Fiscal Affairs Department

Large infrastructure bottlenecks in many countries, as well as gaps in the quality of and access to areas of infrastructure (e.g., education, health, energy, water and transportation) are critical to countries’ economic and social development, and to spur economic growth. Low-income countries need infrastructure to achieve the sustainable development goals (SDGs), emerging markets need to address infrastructure bottlenecks, and advanced economies need more infrastructure to maintain economic growth.

To meet their infrastructure needs, countries can either spend more or spend better. Spending more requires resources (revenue, borrowing, public-private partnerships) which can be costly or unsustainable. Spending better means that with the same resources, countries can get more value out of their investments by reducing white elephants, leakages, cost overrun and waste. Either way, spending more and spending better both require strong infrastructure governance, which the IMF is supporting through its Infrastructure Policy Support Initiative.

The Public Investment Management Assessment (PIMA) is the IMF’s main tool for assessing infrastructure governance over the full investment cycle—from planning to execution—and for supporting institution building in this area. Since its introduction in 2015, it has emerged as a very useful tool for countries, donors, and technical assistance providers alike. PIMAs offer a rigorous framework for assessing infrastructure governance, that comprise the key public investment management institutions of a country.

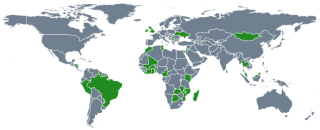

The IMF has recently conducted a stock-taking exercise on the PIMAs undertaken so far. In May 2018, a Board paper was published summarizing the results . This exercise allowed us to draw lessons, and improve the PIMA framework by filling some gaps. The paper analyses the more than conducted to date (see map)—mainly in emerging markets and low-income developing countries, as well as one advanced country (Ireland)—and updates the assessment framework. PIMAs summarize the strengths and weaknesses of country public investment processes, and set out a prioritized and sequenced reform action plan. Eight PIMAs have been or are about to be published, and several more have been done since the Board paper. A survey of member states carried out by IMF staff shows that PIMAs have been well received by member countries.

Countries Undertaking PIMAs, 2015-2018

The PIMAs conducted demonstrate that there is much room for strengthening infrastructure governance, with weaknesses spread across the investment cycle. The results and recommendations of several PIMAs have been used in IMF lending, surveillance, and capacity development (CD) work, and to identify structural benchmarks in Fund-supported programs (examples are Cameroon, Côte d’Ivoire, Ghana, Kyrgyz Republic, Madagascar, and Togo). PIMAs have also improved support and coordination among development partners who provide CD. In Mozambique, for example, the World Bank has followed up the 2016 PIMA with technical assistance on project appraisal and selection, as well as advice on the impact of capital investment on debt sustainability.

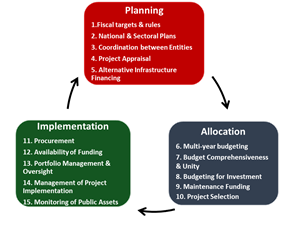

While leaving the structure of the 2015 framework unchanged, the revised PIMA framework highlights some critical governance aspects more prominently (see chart). It emphasizes some key aspects of maintenance, procurement, the independent review of projects, and the enabling environment for public investment (e.g., the adequacy of the legal framework, information systems, and staff capacity and capability). Yet, the revised PIMA framework retains the key features of the 2015 framework, including the three-phase structure (planning, allocation, and implementation) with five institutions assigned to each phase, three dimensions under each institution, and three possible scores (not met, partially met, fully met) under each dimension. The revision has benefited from extensive stakeholder consultation and feedback, including from IMF teams, World Bank staff, and country authorities.

Updated PIMA Framework

Looking ahead, plans for several new PIMAs are in the pipeline, support to the implementation of the recommendations and follow up CD is strongly demanded and interest in member countries is high. Use of the assessment reports will continue to feed CD activities that support better managed, more efficient infrastructure governance, as well as helping countries reach the SDGs. A range of other tools developed by FAD will contribute to improved infrastructure governance and reduce the associated fiscal risks. These tools include Fiscal Transparency Evaluations, the PPP Fiscal Risks Assessment model (P-FRAM), fiscal stress tests, and the balance sheet approach to assessing fiscal performance. The Fund will continue to engage actively with member countries and other organizations—such as the World Bank, the OECD’s Senior Budget Officials (SBO) network and its Infrastructure Group—involved in the analysis of infrastructure issues and related CD activities.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.