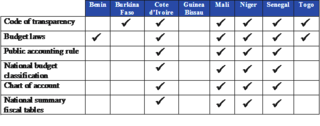

In 2009, the Council of Ministers of the Western Africa Economic and Monetary Union (WAEMU) adopted six regional directives2 on public finance. These directives aim at reforming the public finance system in the WAEMU’s eight member countries3. All countries are required to bring their domestic legislation into line with the directives by January 2012 and to implement the changes by January 2017. The first deadline, however, has already been missed, as indicated in the table below. By October 2014, only four countries have successfully enacted all of the six directives. Three countries have enacted one or two directives and are currently working on the others, while one country has so far failed to enact any of the directives.

Progress in Enacting WAEMU Directives in National Legislation

As shown on the map below, in addition to enacting the directives, most of WAEMU countries are currently working on various aspects of PFM reform. Most progress has been made on budget preparation (e.g., multiyear budgeting), budget classification and program-based budgeting. Progress on budget execution and accounting reforms, however, has been very limited. The map also shows the diversity of work done in the countries and the lack of consistency in the selection of priority areas for reform.

What are the main lessons of the WAEMU reforms?

Which should come first: legal reforms or changes in PFM procedures and systems? One of the paradoxes of the WAEMU reform is that the implementation of new PFM systems doesn’t necessarily match the changes in the legal framework. Some countries that have been lagging in the enactment of the directives appear to be quite advanced in implementing the reforms, and vice versa. In retrospect, it seems that the decision by WAEMU to focus on the formal legal enactment process in a first step may have been a mistake. Single deadlines could have been set for both dimensions of the reform process, leaving it to the countries to determine how to deliver these requirements.

Is the reform too much for the countries to chew on? The WAEMU directives are highly ambitious as they aim at implementing a complete range of PFM good practices: from performance oriented and multiyear budgeting to accrual accounting and strengthening controls over public budgets and expenditures. The directives reach into many areas of PFM that, in other economic and customs unions (the EU for example), have been left entirely to the authority of the member states, with no centrally mandated requirements, legal or operational.

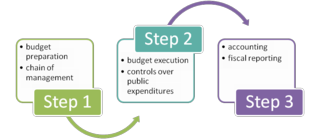

An important issue of prioritization and sequencing also arises. As noted, the empirical analysis at this stage shows a clear preference by the member countries for reforms related to budget preparation. In one sense this is logical, since budget preparation comes first in the budget cycle, followed by budget execution and control issues and later on, as a third step, by accounting and fiscal reporting issues. Critics would argue, however, that this approach, while logical on the surface, fails to recognize that all elements of the budget cycle are interconnected, and that the whole system is only as strong as its weakest link.

How to energize the reforms? \

A comprehensive strategy on the WAEMU reforms would help to better identify priorities, responsibilities and reasonable objectives according to national capacities. Countries that are relatively advanced in implementing the reform at this stage are those that have developed strategies and identified clear actions. On the other hand, as noted, the same countries have tended to focus their reforms on a narrow set of topics (performance budgeting, for example), while ignoring more basic but essential topics such as cash management, accounting and fiscal reporting.

Should more time be allocated to implement the reform? The short answer is “yes”. While the process of drafting the directives was underway, some experts expressed doubts on the capacity of the WAEMU countries to absorb such large changes in only seven years. Events summarized above give credence to this view. Urging the countries to implement what remains of the reform (which is most of it) within the two remaining years seems an unrealistic strategy. Some adjustments should be made to WAEMUs initial schedule. For example, the 2017 deadline could be reformulated to include enactment of the legal framework in all the countries, together with the completion of ongoing work related to budget preparation (step 1 of the above scheme). A revised timetable, extending into the 2020s, should be set for all remaining steps.

Finally, ways should be found to encourage the regional-level (the WAEMU Commission) to play a more pro-active role in identifying solutions. Even though “one size fits all” solutions don’t seem to be relevant, the Commission could make proposals for standardized approaches for issues such as the reform of budget execution procedures and IFMIS. It might also be helpful for the Commission to identify regional benchmarks and comparators, to arrange workshops involving African countries that have successfully implemented new procedures, and encourage the exchange of staff among the finance ministries of the region. Such initiatives could spark ideas and inspire a greater effort at the country level.

1 TA Advisor, Fiscal Affairs Department, IMF. Directive 01/2009/CNM/UEMOA on the code of transparency in public finance management;

2 Directive 06/2009/CM/UEMOA on budget laws; Directive 07/2009/CM/UEMOA on the general public accounting rules; Directives 08/2009/CM/UEMOA on national budget classification; Directive 09/2009/CM/UEMOA on national chart of accounts; Directive 10/2009/CM/UEMOA on national summary fiscal tables.

3 Benin, Burkina Faso, Cote d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo.

Download Bilan des réformes de finances publiques de l'UEMOA

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.