Posted by Salawu Zubairu, Sailendra Pattanayak and Yasemin Hurcan[1]

Nigeria is now the largest economy in Africa and the Federal Government’s (FGN) operations account for more than 13 percent of GDP. However, the management of the government’s cash resources was quite fragmented until a major reform was launched recently to implement a treasury single account (TSA). Prior to this reform, the federal government ministries, departments and agencies (MDAs) held more than 5,000 accounts in different banks. Due to these fragmented banking arrangements, the cash resources of the FGN were not being consolidated and huge cash balances were remaining idle in MDAs’ bank accounts, while the FGN was incurring ways and means charges to meet the cash shortfall. For example, at the end of 2009 the FGN had an overall cash balance of more than 362 billion Naira in the MDAs’ various bank accounts (held both at the Central Bank of Nigeria and commercial banks), but the Central Bank still needed to provide ways and means financing of 147 billion Naira through the Consolidated Revenue Fund to meet the government’s cash requirements. To address this issue and strengthen FGN cash management system, the authorities sought technical assistance from the IMF’s Fiscal Affairs Department (FAD).

Over the last three years, the FGN – led by the Accountant General and the Budget Office - has made steady progress in implementing a TSA with support from FAD. Based on the findings and recommendations of an FAD mission in 2010, the authorities developed a strategy for implementing a TSA in three phases: (i) consolidating the MDAs’ capital expenditure accounts at the Central Bank in Phase I; (ii) bringing revenue and expenditure cash flows of Abuja-based MDAs into the TSA in Phase II; and (iii) bringing cash flows of all remaining MDAs into the TSA in Phase III. The TSA strategy was developed together with the design of an electronic funds transfer functionality as part of a new Government Integrated Financial Management Information System (GIFMIS). The GIFMIS was planned to be rolled out in tandem with the TSA implementation.

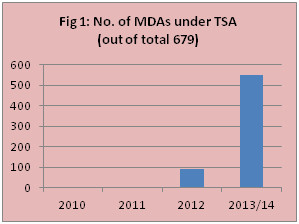

There has been a close collaboration between the FGN and FAD to help implement the TSA which became operational on 2nd April 2012, initially with 92 MDAs including the State House (the Presidency). With Phase I fully completed and Phase II substantially completed, the TSA coverage has increased over the last two years. It now covers 551 MDAs (76 percent of budgetary expenditure), compared to 92 MDAs (48 percent of budgetary expenditure) in 2012 (Figures 1 and 2).

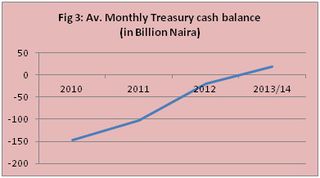

As a result, the average monthly ways and means financing from the Central Bank has substantially reduced from 102 billion Naira in 2011 to 19.38 billion Naira in 2012. In 2013, the average monthly cash balance became positive at 18.13 billion Naira (Figure 3).

FAD’s continuous engagement and support (including through headquarters-led missions in 2010, 2012 and 2014) helped the authorities to update the reform strategy from time to time and keep the TSA implementation on track. The reform was also facilitated by several other factors:

- There was political support for this reform at the highest level. A high-level committee was set up by the President to accelerate the implementation of the TSA and GIFMIS. The Accountant General, as head of the Treasury, played a key role in steering the reform process.

- FAD missions, through a series of seminars/workshops, played an important role to ensure buy-in from key stakeholders who were initially opposed to this reform. An effective communication strategy (including workshops, clarificatory sessions, etc.) was also followed during TSA rollout to showcase the benefits of the TSA.

- The choice of the TSA Model – A centralized TSA with Distributed Transaction Processing System (i.e., each MDA being directly responsible for making payments out of the TSA based on the allotment/warrant issued by Budget Office) – provided assurance to MDAs that they will remain in charge of their budgets.

- The electronic funds transfer functionality of the new GIFMIS (sponsored by the World Bank) provided the platform for smooth implementation of the TSA. Late President Yar’Adua’s directive for MDAs to adopt an e-payment system and the Central Bank’s mandatory e-payment policy for banks also served as an impetus.

To derive full benefits from the TSA, the FGN needs to make further efforts to address the following issues, with FAD support as required:

- bringing all the remaining government agencies under the TSA and the GIFMIS;

- fully leveraging the feeder transaction processing systems such as the payroll system (IPPIS) by providing automated interfaces with GIFMIS and expanding their coverage;

- operationalizing the direct deposit functionality of GIFMIS for remitting the MDAs’ internally generated revenues from collecting banks into the TSA;

- formalizing service performance standards through a service-level agreement with the banks, and setting up an institutional mechanism to monitor and enforce these standards; and

- ensuring that cash and debt management operations are fully integrated to smooth the TSA balances during the year.

[1] Salawu Zubairu is currently the Director Consolidated Accounts in the Accountant General’s Office of the FGN and played a key role in TSA implementation while he was a Deputy Director in charge of Fiscal Accounts and Cash Management. Sailendra Pattanayak is a Senior Economist in FAD's PFM 1 Division and led the FAD missions to Nigeria in 2010, 2012, and 2014. Yasemin Hurcan is a Technical Assistance Advisor in FAD’s PFM1 Division, and participated in FAD missions to Nigeria.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.