Posted by Benoit Taiclet

IMF Managing Director Christine Lagarde’s visit to Bamako in January took place while Mali is still healing its historical wounds. In 2012, the defeat of the army against insurgents led to a coup d’état which was met with condemnation by the international community and sanctions by the Economic Community of West African States (ECOWAS). Faced with the withdrawal of external funding, Mali downsized budget appropriations by one-third and fended off challenges to budget discipline. In spite of these efforts, Mali’s total debt rose by 2 percentage points to 35 percent of GDP.

In the wake of the political and financial crisis, there has been uneven progress in strengthening PFM systems in Mali. The credibility of the budget scored a commendable “A” in the 2011 PEFA assessment. However, this assessment also revealed a number of weaknesses, including in the areas of expenditure procedures and fiscal reporting. In particular, the existence of more than 3,000 accounts held by government agencies in commercial banks, drains liquidity from the government, and severely hampers effective cash management. The situation worsened in 2012-13, when the treasury, in light of the central bank’s shut down, transferred revenue to commercial banks to meet mandatory expenditures, such as wages and suppliers’ bills.

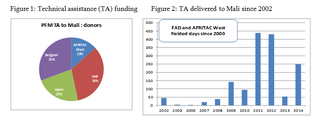

Resuming FAD’s assistance at an early stage was an important factor in Mali’s recovery. Since 2002, there has been the equivalent of one to two FAD missions and four or five expert visits each year, together with the assistance of a resident advisor to the treasury (see Figures 1 and 2). This support by FAD, momentarily suspended in the aftermath of the 2012 coup, resumed as soon as the security and international situations permitted. In February 2013, a rapid-response HQ mission was fielded in Bamako, while military operations were still taking place, to assist in meeting urgent post-crisis needs in cash management and the control of arrears. This mission helped to restore donors’ confidence, and thereby played a significant role in the success of the May 2013 conference in Brussels at which donors' pledges for Mali reached approximately US$4 billion.

Mali’s recovery still depends heavily on FAD support to strengthen its PFM governance. Although the PFM system did not collapse in 2012, and most reforms did not backtrack, fiscal challenges remain. These include strengthening budget credibility; eradicating the mismanagement of public funds; boosting public investment, notably in the Northern provinces struck by war; and optimizing the government’s revenue resources, still scarce despite the resumption of external aid. In this context, good financial governance is instrumental to restoring taxpayers’ and donors’ confidence.

In light of these urgent requirements, the post-transition authorities have shifted their priorities away from more advanced reforms towards consolidating basic PFM functions. The government’s efforts have been re-focused in the following key areas:

• Implementing a full-fledged treasury single account (TSA). The TSA architecture has been re-designed, and banking arrangements with the central bank refined. Recent research demonstrates that the commercial banks would not be unfavorably affected by the closure of their accounts with government agencies and the transfer of liquidity to the central bank.

• Strengthening the treasury function. In September 2013, a resident advisor was reassigned to the Malian treasury to assist in restoring the TSA, resuming the implementation of the new IT system, and streamlining procedures for preparing the financial statements.

• Strengthening the expenditure chain. A January 2014 FAD mission carried out an audit of expenditure procedures to discourage fraud and reduce delays in implementing spending decisions.

• Modifying the macro-fiscal framework and decentralization process. The government’s plan to devolve significant resources to local governments requires that the fiscal framework be modified to carefully monitor intergovernmental transfers.

• Strengthening the legal framework. A fiscal responsibility law was adopted late 2013, in compliance with the requirements of the West African Economic and Monetary Union (WAEMU), and the required implementing regulations have been endorsed by the government. Establishing a satisfactory legal framework for external audit remains work in progress.

• Multiyear and result-oriented budgeting. Use of the medium-term budget framework was maintained during the 2012 crisis, and the latest projections will be presented at a 2014 mid-year debate in the parliament. A further move to performance-related budgeting will be made in 2015, while information on spending at the line item level will be presented in an annex to the budget.

Given the good results achieved so far, and the challenges that lie ahead, FAD and AFRITAC West are eager to continue with their support to the government in Bamako.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.