Posted by Sanjeev Gupta and Michael Keen

These are difficult times for ministers of finance. Fiscal constraints are tight and raising economic growth a priority. At the same time, income inequality is on the rise, and so is public pressure for governments to do something about it through their tax and spending policies. What’s a minister to do? How can he or she meet these seemingly incompatible demands?

A new IMF paper provides some guidance. Governments, of course, will have their own equity objectives. What the paper aims to do is look at precisely how countries can achieve their distributional goals—whatever they are—at the least possible cost to (and maybe even increasing) economic efficiency. This can help achieve sustainable growth and, in many cases, lead to fiscal savings. An earlier study by IMF researchers found that on average, fiscal redistribution has been associated with higher growth, because it helps reduce inequality.

A key message from the latest paper is that design matters. At the same time, there has been a diversity of experience: if poorly designed, or pushed too far, redistributive policies have proven to be distortive. But experience also shows that some redistributive fiscal policies can in fact help improve efficiency and support growth, such as those that enhance the human capital of low-income households. This suggests that the devil is in the details.

Impact of taxes and spending on redistribution

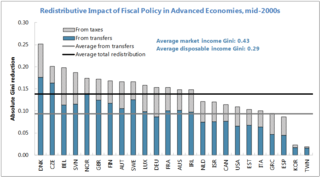

Fiscal policy plays a significant role in reducing income inequality in advanced economies, mostly through transfers—such as pensions and other social benefits. Income taxes also play a role. For instance, transfers and income taxes have been found to decrease inequality—as measured by the Gini coefficient—in advanced economies by an average of around one-third (Figure).

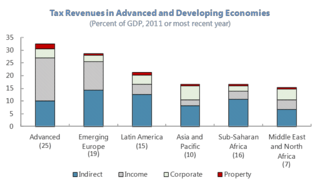

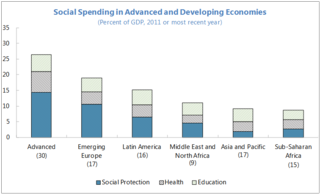

In developing economies, low levels of taxes and spending limit the extent of fiscal redistribution, as does the incomplete access of the poor to public education and health.

Reflecting lower revenues, developing economies also have much lower social spending, with a relatively smaller share allocated to social benefits (social insurance and social assistance). The redistributive impact of social benefits is diminished further by incomplete coverage of lower-income groups and the large share of transfers leaking to higher-income groups. Unlike in advanced economies, the distribution of in-kind spending (education and health) reinforces, rather than reduces inequality, reflecting the fact that the poor—who often live in rural areas—often have less access to public schools or health facilities.

Smart design—at the top and at the bottom of the income ladder

To be efficient and avoid distortions, redistribution requires careful design of taxes and spending, with a special focus on those at both the top and the bottom of the income distribution. All income groups should pay their fair share of taxes, including those at the top. But tax rates should not be so high that this leads to a big reduction in work effort and investment, since this could depress economic growth, to the detriment of all. Taxes should also be designed so they are not easy to evade.

To help those at the bottom in an efficient manner, priority should be given to spending programs that improve their health and education. Because these programs increase labor productivity, they can both improve equality and raise economic growth. Another important guideline for spending programs is to target them to lower-income groups, rather than provide them to rich and poor alike. It is important to not withdraw these benefits as income rises so rapidly as to significantly discourage work effort. But, done well, this targeting can help countries achieve their distributive goals at a lower fiscal cost.

What exactly does this imply for a minister looking to enhance equality? First, it means looking at the tax and spending side together, rather than each separately. On the tax side, advanced and developing countries can consider the following possibilities:

• A greater role for recurrent property taxes. Property taxes are underutilized in many countries, particularly in developing economies where they have significant potential.

• More progressive personal income taxes. There is room for a number of countries to move away from flat tax rates to more progressive rate structures. The progressivity of these taxes is also often impaired by deductions that disproportionally benefit those with higher incomes.

• A revival of inheritance and gift taxes. While these have never been, and probably will not be, big revenue raisers, a modest revival in such a way that it prevents ample evasion and avoidance—the mistake of many systems in the past— could have a marked effect.

On the spending side, the minister may consider:

• Expanding the access of low-income families to education and health. One way to do this for education is by expanding scholarships for low-income families. In developing countries, access to health care should focus on providing essential services; advanced economies should focus on maintaining access for the poor, even during periods of spending restraint.

• Targeting social benefits and strengthening incentives to work. Untargeted benefits, such as energy subsidies, should be replaced with more targeted programs (strategies for doing so are discussed in a recent IMF book). In advanced economies, linking social benefits to labor force participation (including through childcare subsidies and child tax credits) can strengthen incentives to enter the labor market and decrease welfare dependency.

• Safeguarding pensions and raising retirement ages. In the advanced economies, this means ensuring that benefit levels for poor pensioners are not reduced. In developing economies where only a small share of the elderly poor receives pensions, the focus should be on expanding coverage through noncontributory, means-tested social pensions. A new IMF book looks into these issues in detail.

Concluding thoughts

Efficient policy design requires an eye for detail. But governments should not lose sight of the bigger picture. The impact of tax and spending should, for instance, be considered jointly and not separately for each single instrument; and redistribution must always be consistent with other macroeconomic objectives. Design should also properly account for constraints in administrative capacity. But these are not insurmountable hurdles—the good news is that quite a lot is now known about how governments can best set about squaring their equity and efficiency concerns.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.