Posted By Abdoul Wane[1]

In this latest in the series of blog posts by IMF area department country teams, IMF Resident Representative Abdul Wane reviews the mixed progress of PFM reform in Guinea.

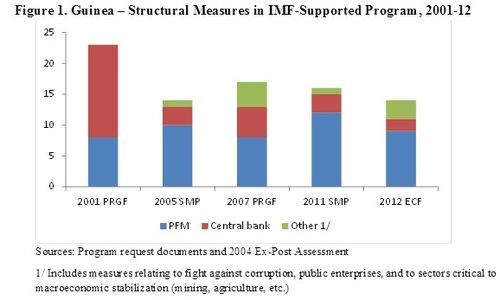

Against the backdrop of economic fragility and fiscal challenges, Guinea’s medium-term programs supported by Fund arrangements over the last decade aimed to reduce financial imbalances. The growth objectives were predicated on greater fiscal discipline and an improved quality of public spending. Fiscal consolidation was to be supported by tax policy and tax administration reforms and a gradual shift in budget allocations toward priority spending, including investment. To address these challenges structural measures in Fund programs – as well as program conditionality - focused largely on PFM reforms (Figure 1 below). The 2001 PRGF request included three structural performance criteria (PC) of which two were on PFM reforms. Likewise, the 2007 PRGF request included six PCs on PFM out of a total of nine PCs.

However, since Guinea never implemented fully a program supported by the IMF, several measures had to be reprogrammed in successor programs. The sluggish implementation of reforms partly reflects Guinea’s political and institutional fragility. Vested interests stalled the reform agendas, in the absence of checks and balances. Important structural measures could not be implemented fully or were reversed because of insufficient political support, and control systems were bypassed under the watch of the political leadership. As a result, overall performance in PFM reforms has been feeble as periods of regression followed episodes of progress.

What areas of PFM have been covered?

In the Fund-supported programs, the focus has been on revenue mobilization, including from the mining sector, together with reforms of budget formulation and execution. Given Guinea’s weak revenue base and to beef up basic services and infrastructure, reform strategies emphasized revenue-based fiscal consolidation combined with a growth-friendly rationalization of spending.

- Revenue measures included computerizing the tax and customs directorates and reducing exemptions. The aim was to extend the tax base to cover untaxed activities, including informal ones, and to improve mining taxation. Additional revenues from mining companies would come from a more investment-friendly mining code and by leveling the playing field with standard mining contracts. The introduction of an automatic adjustment mechanism for domestic petroleum prices was proposed to protect government revenue and reduce its volatility.

- Public expenditure management reform aimed at improving budget formulation and strengthening budget nomenclature for tracking priority spending. Budget execution reforms targeted prohibiting off-budget spending through the establishment of a Treasury Single Account (TSA) that would enhance spending control and tracking. To improve ex-post control of budget execution, measures to strengthen the Parliament and the Supreme Court were introduced to ensure the production of administrative and management accounts and the timely submission of draft settlement laws. Regular audits of public procurement contracts were introduced as a trigger for reaching the HIPC Completion Point to reinforce governance.

How much progress has been made in implementing the reforms?

Some progress was made, but challenges remain, especially on public expenditure management. Rising to these challenges will help reduce Guinea’s tax gap and improve the quality of government spending.

- Revenue measures have borne some fruit. Government revenue almost doubled from an average of 11 percent in the early 2000s. Key tax policy measures were: (i) the application of the common external tariff of the West African Economic and Monetary Union (WAEMU); (ii) the elimination of ad hoc exemptions from customs tariffs and the extension of the list of products subject to import verification; and (iii) the increase in excise tax rates on beer and tobacco. On the administrative side, collection of back taxes was boosted and control of revenue-collecting autonomous agencies was strengthened. Over the medium term, the emphasis should be on adapting the tax and customs codes to the evolving economic environment and finalizing tax reforms in the new mining code; drafting the manual on tax procedures should promote the credibility of the tax system.

- Successes in the area of public expenditure management were more limited, as illustrated by the surge in total expenditure from an average of 17 percent of GDP over 1995-2008 to 26 percent of GDP since 2011, without noticeable improvements in service delivery. Moreover, the composition of spending shifted toward current outlays, which increased from 54 percent of expenditures in the 1990s to 68 percent in the 2000s. Some progress was achieved, however. The authorities have (i) closed the loopholes allowing ministries to exceed budgetary allocations, and (ii) computerized the budget management system. Looking forward, enforcing laws and regulations introduced recently should be the authorities’ priority. The new public finance acts include (i) an organic budget law (ii) a public procurement law; and (iii) government accounting regulations and a chart of accounts.

How have FAD and other TA providers supported the design and implementation of the PFM reform strategy?

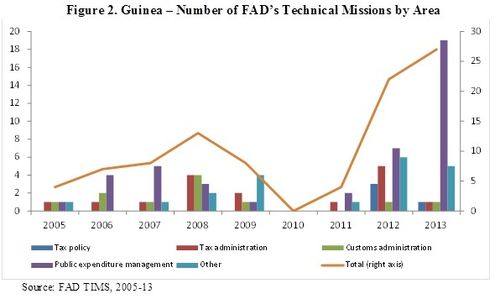

Guinea has been an intensive user of IMF’s Fiscal Affairs Department (FAD) technical assistance. Since 2005 FAD has sent more than one hundred missions on tax policy, tax and customs administration, public expenditure management, budget classification, and treasury management (Figure 2). Technical assistance staff spent in Guinea more than 2,000 person-nights. Guinea’s use of technical assistance has also increased over the years, from four missions in 2005 to almost 30 missions in 2013. Technical assistance focused less on revenue reforms than on expenditure management and treasury operations, perhaps reflecting lackluster progress on the latter.

Other donors were involved in providing technical assistance on PFM as well. FAD led the dialogue on tax policy and tax administration with inputs from some bilateral donors on issues relating to governance and the credibility of tax processes. On expenditure management, FAD worked closely with the World Bank, which focused on strategic resource allocation and operational efficiency of public spending (MTEF, budget allocation process, procurement code, etc.). FAD focused on developing a new legal environment for public finance, strengthening government accounting, and on establishing a Treasury Single Account. A large part of PFM TA delivered by FAD over the last 18 months was financed by the European Union.

What impact is PFM reform providing to economic and fiscal performance in Guinea?

Periods of progress in redressing Guinea’s PFM system have generally been followed by fiscal consolidation and lower inflation. This was the case during the 2007 PRGF program and the ongoing ECF program, when the authorities engineered impressive policy shifts toward macroeconomic stability.

However, Guinea’s episodes of relative success in PFM reforms have been short-lived. The lack of steady and broad-based progress prevented reaping the benefits of the authorities’ efforts. Progress in boosting revenue provided fiscal space to address Guinea’s daunting challenges for reducing poverty. However, lackluster performance in strengthening public spending kept at bay improvements in service delivery and poverty reduction. The challenge for Guinea’s first democratically elected regime is thus to sustain the progress in PFM reforms. Implementing fully, for the first time, an economic program supported by the IMF will be a sign of its resolve to embrace a new route toward shared prosperity.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.