Posted by Sanjeev Gupta and Alvar Kangur

“... less-accountable poor-country governments are likely to be disproportionately less efficient (relative to the private sector) than rich country ones. Hence, there are good reasons to expect the government to play an especially detrimental role in the productivity of investment in poor countries.” - Francesco Caselli (2005)

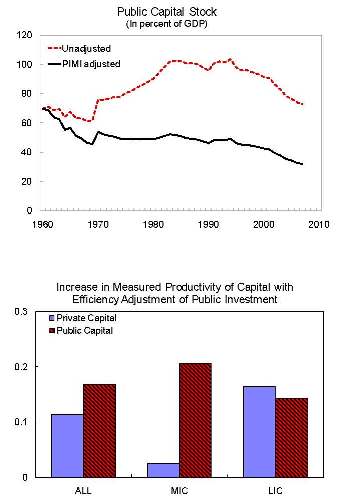

Not all public investment spending in developing countries translates into productive capital assets (Pritchett (2000)). This is due in part to weak investment processes, including the lack of transparent and open competition for award of contracts, ineffectiveness of internal audit and the absence of medium-term budget frameworks. A recent study by Gupta and others (2011) takes these weaknesses into account in constructing an “efficiency-adjusted” public capital series for 52 low- and middle-income countries during 1960-2008.

Quantitative analysis shows that:

- Adjusting public capital for public investment efficiency better explains the evolution of relationship between public capital and growth.

- Public capital is productive in both low- and middle-income countries. The marginal productivity of both private and public capital increases once public capital is adjusted for efficiency. While the increase in private capital productivity is higher in low-income countries (LIC), the increase in public capital productivity is higher in middle-income countries (MIC).

- For low-income countries project implementation (which comprises competitive and open bidding and internal audit) is the most critical component of the investment process, followed by project selection (that is related to medium-term framework). For middle-income countries project appraisal (which comprises transparency of appraisal standards) and projection evaluation (which comprises external audits) are relatively more important. Therefore, new public investment must be accompanied by strengthening of investment processes to enhance productivity of public capital.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.