Posted by Martha Cubillo[1]

In July 2021, the IMF’s Technical Assistance Center for Central America, Panama and the Dominican Republic (CAPTAC-DR) conducted a webinar on modernizing treasury management in the region. A full report of this event was published on CAPTAC-DR’s website [Gestion de Tesoreria 1.pdf (captac-dr.org)]. Senior officials from the seven countries of the region participated in the webinar. The participants shared their countries’ experiences in responding to the COVID-19 pandemic and identified the challenges in modernizing their systems in line with good international practices.

Traditionally, the role of a public treasury is limited to the execution of payments and the management of liquidity. However, its modern form encompasses other objectives such as the automatization of financial systems, the minimization of financial costs, the profitability of liquid balances, coordination with monetary policy, and the development of the financial markets.

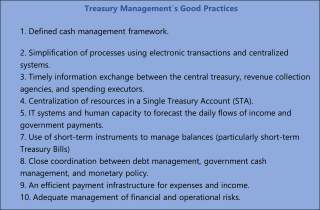

According to Gros and Vargas (2018)[2], ten good treasury management practices can be identified (see box below). Their adoption by a country´s public treasury requires a deep analysis of the systems, capacities and institutional characteristics that may condition their implementation.

An evaluation of the scope for introducing these good practices was carried out in five of the seven countries in the region. This diagnostic assessment used an instrument called the Treasury Management Reference Framework. It revealed that all the countries surveyed had introduced some of the recommended improvements, for example in the management of liquidity, particularly at the central government level. The state treasuries were also aware of the rapid evolution of financial instruments such as FinTech and Crypto Currencies. Yet some reforms had been held back since the onset of the COVID-19 pandemic.

During this global health crisis, the Treasuries’ main objective has been to guarantee the availability and mobilization of funds to spend on emergency and high priority payment obligations. Participants in the webinar highlighted the importance of sound and nimble treasury management in responding to urgent needs caused by the pandemic. At the same time, the seven countries have continued their efforts to improve the underlying treasury management processes.

Regarding fiscal transparency, the region has improved the identification of COVID-19 related expenditures. The Single Treasury Account (STA) has played an important role in improving access to information on public liquidity. While some countries provide open access to information from the STA on their transparency portals, this is still not universal practice in the region.

The pandemic has stimulated the adoption of electronic payment methods and the “virtualization” of governmental treasury services. Some of the countries have extended the use of the STA and of cash flow programming. Nevertheless, the crisis has also brought some setbacks to the region´s treasury management. For example, the profitability of liquid balances has not yet been consolidated as an objective of the regional treasuries.

At the end of the event, the participant countries emphasized that the communication, collaboration, and sharing of experiences with other countries is valuable and contributes to improvements in public treasury management across the region and in dealing with the challenges that lie ahead. These challenges include improving STA consolidation, advancing with the automatization of the treasury´s income record, and modernizing cash flow management and forecasting.

[1] PFM Advisor, CAPDR Region (Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, Nicaragua, and Panama)

[2] Gros, J & Vargas, J, 2018, Marco Analítico de una Gestión Moderna de Tesorería, CAPTAC-DR.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.