Posted by Aura Martinez[1]

Ten Latin-American governments within the Global Initiative on Fiscal Transparency’s (GIFT) Network came together in late 2020 to create the Portals Working Group. This Working Group aims to assist the public in contributing to the development of public policies and monitoring their implementation. The participating countries are: Argentina, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Mexico, and Uruguay. The Working Group is currently led by the Office of Planning and Budget of the Presidency of the Republic of Uruguay, and GIFT’s Coordination Team.

In January 2021, the Group completed an internal survey of the current status of Fiscal Transparency Portals (FTPs) in the region. In this article, we summarize the results of this survey.

What topics are covered in portals?

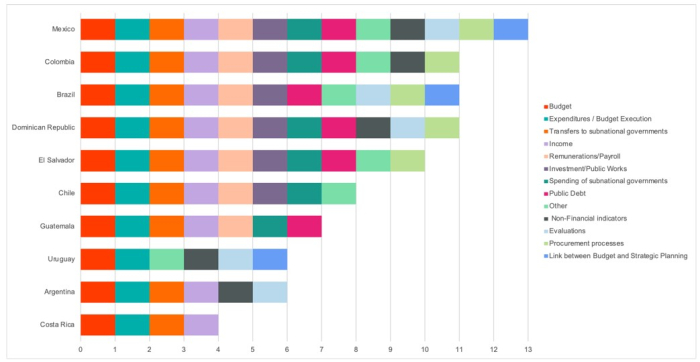

FTPs generally cover 12 broad fiscal policy areas: budgets; income and revenue flows; expenditure/budget execution; remuneration/payroll; procurement processes; transfers to subnational governments (SNGs); infrastructure investment and public works; non-financial indicators; financial evaluations; the linkages between budgets and strategic plans; spending of SNGs; and public debt. The results of the survey are summarized in Chart 1 which shows that:

- The most frequently covered areas are budgets, revenue, budget execution, and transfers to SNGs.

- The least covered areas are linkages between budgets and strategic plans, procurement processes, non-financial indicators, and financial evaluations.

- Few countries in the sample have a fully automated financial management information system, which probably reduces the quality and sustainability of the data provided.

Chart 1. Topics Covered by FTPs

How open is the information published?

Information should ideally be presented in machine-readable formats, thus providing significant scope for the reuse and distribution of data by anyone, anytime, anywhere. In this regard, the survey shows that:

- The use of CSV (comma-separated value) formats is a prevalent practice in transparency portals in the region. This format can be used without the need for proprietary software, and rates 3 out of 5 stars on the Tim Berner Lee’s data openness scale.

- The use of APIs (Application Programming Interfaces) is on the rise.

- On the downside, no country is yet publishing information on all 12 topics in open data formats.

What communication channels are used?

Communication channels and data visualizations are key to understanding published information. The survey highlights the following practices:

- We can all speak budgets! Training tools or resources, such as manuals, tutorials, and user guides, are widely used in the region, to assist in overcoming barriers to accessing information.

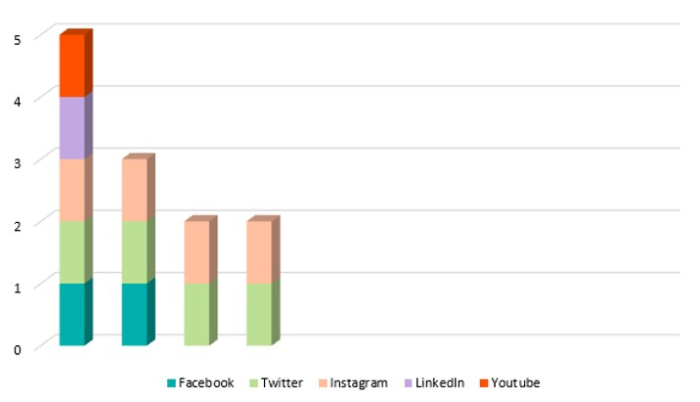

- Surveys and forms included in FTPs are the most widely used means to communicate with users, as well as social media, particularly Twitter, as shown in Chart 2.

- The governments of Argentina, Brazil, Chile, Colombia, El Salvador, and Uruguay use the Data-Driven Documents (D3.js) library to manipulate and visualize their data-based content.

The survey finds that although there have been efforts to inform, train and interact with audiences such as academia, organized civil society, journalists, legislators, executive agencies, and higher education students, the teams implementing FTPs could benefit from engaging these groups more actively and closely.

Chart 2. Social Networks Directly Linked to FTPs

Interoperability and standardization: Pending agenda

The sustainability of FTPs depends mainly on how they source data to publish information. The surveyed countries are still in the process of implementing or exploring innovations to overcome data sourcing challenges, and to integrate different types and sources of information. For further details see info@fiscaltransparency.net

How do we know if we on the right track?

Governments should establish clear objectives and goals for the publication of fiscal information, and in monitoring the use and impact of FTPs. According to the survey, this represents one of the biggest challenges for current FTPs:

- The monitoring of statistical browsing data, mainly through Google Analytics, is the main current mechanism for measuring the use of portals.

- The tracking of search engine indexing statistics is not a common practice, and SEO positioning practices are not incorporated.

- The use of impact-related metrics is still under development.

Conclusion

For the GIFT network, this survey provides key information to guide future collaboration and peer learning efforts. Given that the results reflect the FTP implementers’ own assessment of the current strengths and weaknesses of their portals, improvements are more likely to take place.

The survey demonstrates the significant improvement in the region with regards to the FTPs’ thematic comprehensiveness, format openness, coverage, and collaboration with users. Nonetheless, there is still work to be done to improve the gathering, standardization and publication of data and measuring the impact of FTPs on fiscal policies.

For the GIFT network, these lessons form the basis of an agenda of activities that will focus its peer learning and collaboration efforts on:

- Defining target groups for communication and participation activities.

- Budget literacy efforts to broaden audiences and encourage better use and understanding of fiscal information.

- Expanding communication channels.

- Increasing citizen involvement, interaction, and feedback.

- Technology collaboration and visualization to standardize the publication of information, encourage automation and promote sustainability.

[1] Coordinator for Knowledge and Technical Assistance and Collaboration, Global initiative for Fiscal Transparency (GIFT).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.