Posted by Fritz Bachmair, Celeste Kubasta, Lesley Fisher, and Nabil Hamliri[1]

Fiscal risks can be a rowdy crowd, as the COVID-19 pandemic and the Global Financial Crisis have shown. If left unchecked, overexposed governments may wake up with a persistent headache. Being a good chaperone, the IMF is developing the Fiscal Risk Assessment Tool (FRAT) as part of a suite of tools to assess and manage fiscal risks.[2]

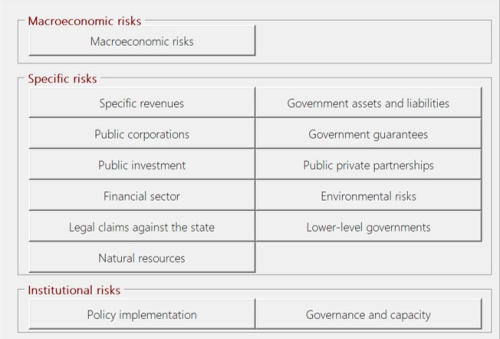

The FRAT provides a high-level portfolio perspective on 14 macroeconomic, specific, and institutional sources of fiscal risks to which governments may be exposed (Figure 1).Figure 1: Sources of Fiscal Risks Included in the FRAT

Source: FRAT.

The tool is designed to be simple and user-friendly to facilitate its use in environments with limited capacity and data. It is Microsoft Excel-based, utilizes questionnaires to guide users in the comprehensive identification of risks, and provides helpful information buttons to explain key terms and help users navigate the tool. If the information required to answer questions in the questionnaire is not readily available, the FRAT enables users to identify information gaps.

The outputs from the FRAT can support policymakers in making better-informed decisions. The tool can help prioritize risk mitigation measures (e.g., by not underwriting certain risks), adopt prudent macro-fiscal policies (e.g., by provisioning for risks or setting appropriate financing strategies), strengthen institutional arrangements (e.g., by assigning clear responsibilities for risk management), and foster transparency and accountability (e.g., through a fiscal risk statement).

To support these policy decisions, the FRAT generates a range of specific outputs that can be included in a fiscal risk statement. For example:

- Risk-by-risk reports for each source of fiscal risk (e.g., underlying risk drivers, availability of information and data, institutional responsibilities for risk management).

- Portfolio level reports across all sources of fiscal risk (e.g., interactions among risks, historical risk realizations, a likelihood-impact matrix for risk prioritization – see Figure 2).

- Forecast error analysis and fan charts for key macroeconomic variables and fiscal aggregates.

- International comparisons along 24 indicators (e.g., macro-fiscal indicators, the age-dependency ratio, PPP capital stock, damages from natural disasters).

Figure 2: Illustration of the Prioritization of Risks

Source: FRAT.

The FRAT is a starting point for fiscal risk analysis. The tool’s prioritization of risks helps governments focus attention and resources on the most significant risks. Governments may use targeted analytical tools, including those developed by the IMF, to conduct more detailed analysis. For example, an in-depth analysis of risks from PPPs may be carried out using the PPP Fiscal Risk Assessment Model (PFRAM) following their prioritization using the FRAT.[3]

The FRAT is currently being piloted in several countries and will be made available in English, French, Spanish and Portuguese. While the tool is primarily designed for central governments, the experience from Odisha, a large Indian state, has illustrated its relevance for subnational governments as well.

With the IMF’s support, the Government of Odisha has piloted the FRAT, thus providing helpful feedback to the IMF on the tool’s functionality, ease of use, and applicability to subnational governments.[4] The exercise has highlighted the importance of cooperation with units responsible for managing risks outside the Department of Finance, and the need to prepare clear and accessible reports for users both inside and outside government.

In Gabon, also with the support of the IMF, the authorities are in the process of setting up a dedicated fiscal risks unit. They initially focused the use of the FRAT on identifying fiscal risks from public corporations and local governments but are now extending this analysis to a fuller range of fiscal risks. Officials also plan to develop a workplan for fiscal risk mitigation and to further upgrade their fiscal risks statement.

The FRAT will be updated based on the experience from these pilots and made available online. The FRAT team stands ready to support you in reeling in your fiscal risk crowd through dedicated technical assistance. Your comments and any interest are welcome at FADM2AST@imf.org

[1] Fiscal Affairs Department, IMF.

[2] These tools include the Public Sector Balance Sheet, a Fiscal Stress Test Tool, a COVID-19 Stress Test Tool, the Public Private Partnership Fiscal Risk Assessment Model, an SOE Health Check Tool, an SOE Forecasting and Stress Testing Tool, and a Loans and Guarantees Tool.

[3] The IMF’s and World Bank’s PFRAM 2.0 analytical tool and user manual are available at https://infrastructuregovern.imf.org/content/PIMA/Home/PPPs-and-PFRAM.html.

[4] Odisha has also established a Fiscal Risk Unit at the Department of Finance, a Committee on Fiscal Risks (CFR), and has published a fiscal risk statement (available at https://finance.odisha.gov.in/sites/default/files/2021-02/21-Fiscal%20Risk%20Statement.pdf).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.