Posted by Bryn Battersby and Greg Rosenberg[1]

The debt stock continues to grow in much of East Africa. In some cases, high levels of debt and non-discretionary expenditure constrain the state’s capacity to respond to economic shocks. This recent experience has strengthened regional appreciation of fiscal risk statements as tools for policy-making and communication, rather than as another compliance exercise.

Teams from the IMF have been working with East African finance ministries to develop fiscal risk statements (FRSs). Fiscal risk analysis and management is the third pillar of the IMF’s Fiscal Transparency Code, which notes that governments should publish regular summary reports on risks to their fiscal prospects. The six members of the East African Community (Burundi, Kenya, Rwanda, South Sudan, Tanzania and Uganda) have committed to produce such statements. Over the past year, the IMF has been helping Rwanda and Uganda, as well as Ethiopia and Malawi (which are not EAC members), to develop FRSs.

Fiscal risks vary across the region. Exchange rate and commodity price volatility are major concerns for all governments, as are the accuracy of economic forecasts and fiscal projections. Specific risks range from the extent of government guarantees to large contingent liabilities associated with state-owned companies, unfunded pension fund commitments, and natural disasters. Substantial contingent liabilities are often associated with public-private partnerships, and in much of the region these risks have not been adequately reported or understood. Nearly all countries acknowledge institutional risks and are working to strengthen the focus of PFM reforms to address these gaps.

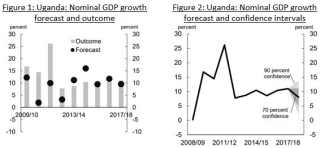

Work with the authorities of Ethiopia, Malawi, Rwanda and Uganda has involved setting out principles, collecting and analyzing data, and drafting a FRS. The process usually begins with a workshop defining fiscal risks and setting out the principles of clear communication. Officials then develop a preliminary outline of what risks should be covered in the statement. At that point, data collection and initial drafting responsibilities are assigned. Much work goes into developing sensitivity analyses to different macroeconomic variables, accompanied by fan charts. Figures 1 and 2 present examples from the Ugandan FRS.

(Click on the figures for a better image resolution)

Source: Uganda Fiscal Risk Statement 2018-19 https://budget.go.ug/sites/default/files/National%20Budget%20docs/Fiscal%20Risk%20Statement%20FY%202019-20%20-%20PDF%281%29_0.pdf

To develop a coherent report that speaks with one voice, ministries typically assign a primary author with responsibility to bring together the various contributions. The lead author works intensively with the IMF’s team to edit this draft, which is reviewed by the entire group of participating officials for accuracy, tone, and balance. Once the draft is complete, it is brought to senior officials for review and possible publication.

Universally, these working sessions have led to a process of discovery in which the authorities shed light on fiscal risks that were previously underreported or not well understood. This in turn has raised awareness of fiscal risks across the region, created capacity to understand these risks, and broadened ownership of the risk identification and reporting process.

Common challenges encountered have included an absence of data in some areas, unwillingness of data holders to share information with finance ministries, and concerns that publication will open governments to unwelcome criticism. A process of sensitization within ministries is required to ensure that senior officials appreciate the value of these statements in their efforts to promote more transparent and accountable management of public finances. Among EAC members, Uganda has published its FRS, as has Kenya. Ongoing analysis, drafting and discussion is continuing in Ethiopia, Malawi, and Rwanda.

This work has proceeded from the standpoint that fiscal risk statements – and indeed all budget documents – should be understood as communication tools that can support effective policy-making, rather than as objects of compliance or obfuscation. We stress the need for clear, accurate, and concise statements that are accessible to a range of audiences. This approach is new for most officials in the region, and many relish the opportunity to demonstrate and develop their analytical and writing skills in this manner.

The next steps in the region include greater development of fiscal risk registries to collect and consolidate data, regularizing the work of fiscal risk committees, continual data updates, and the annual publication of fiscal risk statements.

[1] Bryn Battersby is the Macro-Fiscal Adviser at the IMF’s Regional Technical Assistance Center for East Africa. Greg Rosenberg is on the IMF’s Fiscal Affairs Department’s panel of experts, specializing in clear budget communications, and the Managing Director of Clarity Editorial, Cape Town, South Africa.

The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.