Posted by Mario Mansour [1]

In recent years, more developing countries have started reporting on their tax expenditures, however the quality of reporting needs to improve if it is to usefully contribute to fiscal transparency and the debate on domestic revenue mobilization.

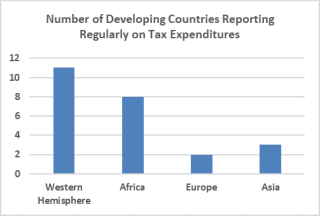

Unlike in most advanced economies, where reporting on tax expenditures has been part of general fiscal reporting for decades, reporting on tax expenditures in developing countries started in the early part of the 2000s decade, primarily in Latin America. More recently, the practice has gained ground in other developing countries, including in Africa, where eight countries now report regularly on their tax expenditures (Kassim and Mansour, 2018).[2]

The main purpose of reporting on tax expenditures—often referred to as “spending through the tax system”—is to provide transparency into how governments use the tax system to accomplish policy objectives, and the cost, in terms of foregone revenue. [3] This, in turn, allows for assessing the cost-effectiveness of tax policy vis-à-vis non-tax instruments, in particular direct spending, which is normally reported in government budget. For example, instead of foregoing revenue from VAT exemptions or corporate income tax holidays, governments can reduce or eliminate them and spend the revenues directly on health or education, which can be better targeted in developing countries. However, unlike direct spending, whose accounting is relatively easy, costing tax expenditures is problematic because it involves identifying what is a tax expenditure, and how much revenue governments would gain from eliminating it. To complicate things, assumptions must be made on how individuals and companies react to changes in tax policy, and whether such reactions have implications for other tax expenditures.

In their evaluation of tax expenditure reporting in developing countries, Kassim and Mansour (2018) find that key good practices are missing in several country reports. These include, but are not limited to, the following: (1) 50 percent of countries do not define the “benchmark tax system”, a hypothetical system against which actual policy is compared to identify tax expenditures; (2) 30 percent do not legally require tax expenditures to be published annually and on time, which could affect their frequency and usefulness in budget preparation and evaluation; (3) the description of the methodology and data to estimate the cost of tax expenditures is often lacking or poorly defined; (4) the coverage of the tax system, to include both tax laws and all other laws with tax provisions is often incomplete. Interestingly, some of these weaknesses are not confined to developing countries; they are also found in advanced economies.[4]

The authors conclude that developing countries should focus on a set of good practices in reporting on their tax expenditures, rather than solely on their costs. This will enhance the credibility of such reporting in the eyes of policymakers and the public. It will also serve the general purpose of good fiscal management, of which domestic revenue mobilization through the streamlining of tax expenditures is one objective. To achieve this, countries should adopt a gradual approach to report on tax expenditures, that considers their institutional and data capacities. Heady and Mansour (2019)[5] suggest that such an approach can start with a simple annex to the budget listing tax expenditures according to their legal source, and reporting the revenue foregone from a few important ones. With time, this can be scaled up to report the revenue foregone from a longer list, and eventually to adopt more sophisticated micro-simulation models that provide granular analytical insight, such as the distribution of the benefits from tax expenditures by income group and economic sector for instance.

The recent increase in reporting on tax expenditures in developing countries is a welcome and encouraging development in improving budget transparency. But their overall quality remains weak, which could undermine their usefulness in fiscal management. Rather than focusing on the revenue foregone only, developing countries should adopt a gradual approach based on several dimensions defining good practice, and accounting for their institutional and data capacity.

[1] Center Coordinator, Middle East Regional Technical Assistance Center, International Monetary Fund.

[2] Kassim, Lanre and Mario Mansour, “Tax Expenditures Reporting in Developing Countries: An Evaluation.” Revenue d’Économie du Développement, 2018/2 (https://www.cairn.info/revue-d-economie-du-developpement-2018-2-page-113.htm).

[3] These can be very important. See, for instance, the blog by Sanjeev Gupta, Center for Global Development, at https://www.cgdev.org/blog/time-pay-more-attention-tax-expenditures.

[4] See Redonda, Agustin and Tom Neubig (2018), Assessing Tax Expenditure Reporting in G20 and OECD Economies, CEP Discussion Note 2018/3 (https://www.cepweb.org/publications/discussion-notes/).

[5] Heady, Christopher, and Mario Mansour, Tax Expenditures and Their Use in Fiscal Management: A Guide to Developing Countries, IMF How to Note 19/01, International Monetary Fund. (https://www.imf.org/~/media/Files/Publications/HowToNotes/HTNEA2019002.ashx).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.