Posted by Fritz Bachmair, Cigdem Aslan, and Mkhulu Maseko[1]

Recent experience has shown that the realization of contingent liabilities can have significant fiscal costs (The Fiscal Costs of Contingent Liabilities: A New Dataset). It is, therefore, essential for governments to understand and monitor contingent liabilities, including from guarantees, to guard against risks and manage their potential impact.

South Africa is a good example of how a government can implement such a framework. The South African government provides credit and payment guarantees to support Eskom, the state-owned electric utility, and the independent power producers in providing low-cost electricity.

A recent World Bank Policy Research Working Paper (Managing South-Africa's Exposure to Eskom: How to Evaluate the Credit Risk from the Sovereign Guarantees) explores how the National Treasury of South Africa assesses and manages credit risk from such guarantees extended to Eskom.

A dedicated Credit Risk Directorate in the Asset and Liability Management Division at the National Treasury has implemented a risk assessment and management framework, supported by the World Bank Treasury. The team employs two methodologies to assess Eskom’s creditworthiness: First, a credit rating methodology based on an energy sector-specific scorecard; and, second, a scenario analysis methodology to assess Eskom’s ability to service debt from cash flows and cash reserves.

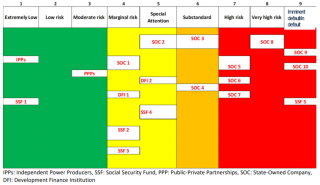

The energy sector scorecard includes business risk indicators and financial risk indicators. Industry prospects, corporate governance, and market position are rating subfactors to assess business risks. Profitability, debt capacity, efficiency, cash flow adequacy, and liquidity ratios are used to assess financial risk. Aggregating scores across risk factors, Eskom’s credit quality is rated on an internal scale from 1 (extremely low risk) to 9 (imminent default or in default).

Risk assessments are reported to South Africa’s high-level Fiscal Liabilities Committee which advises the Minister of Finance on the issuance of new guarantees and exposure to other contingent liabilities. Figure 1 shows a high-level summary of risks in the contingent liabilities portfolio.

Figure 1: Visualizing creditworthiness of guarantee beneficiaries (Click on the Figure to view the image in a better quality)

Source: National Treasury of South Africa

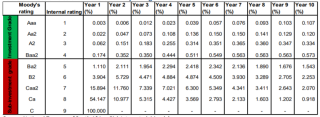

To quantify credit risk beyond an ordinal rating, National Treasury matches internal ratings with the ratings of Moody’s, a ratings agency, and uses Moody’s default frequency studies (https://www.researchpool.com/download/?report_id=1751185&show_pdf_data=true) to infer probabilities of distress for Eskom (Table 1). National Treasury is currently working on calculating expected losses based on these inferred probabilities.

Table 1: Converting internal ratings into probabilities of initial distress (Click on the Table to view the image in a better quality)

Source: National Treasury of South Africa, Moody’s Investor Services

To complement these credit ratings, a scenario analysis methodology has been developed, and is used in response to specific requests by management or other units within National Treasury. The scenario analysis approach aims to offer insights into Eskom’s financial health and its ability to service debt obligations if certain scenarios materialize.

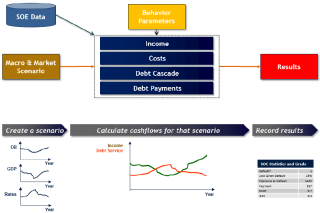

As any scenario analysis tool, this model consists of inputs, a cash flow engine, and results (Figure 2):

- Inputs include macroeconomic variables (e.g., economic growth, inflation, interest rates) and industry relevant variables (e.g., oil and coal prices), and Eskom’s five-year corporate plan. Analysts construct four to five scenarios for relevant variables: one consistent with Eskom’s corporate plan, one based on National Treasury’s baseline forecasts, and two or three downside scenarios.

- The cash flow engine estimates Eskom’s cash flows for each scenario. For example, a slowdown in economic growth would impact demand for energy and hence the quantity of electricity sold by Eskom. Another example would be an increase in generation costs if commodity prices increased.

- Eskom’s cash position is an important result of the analysis. Based on an opening cash balance, and cash flows from operations and investment activities, the tool shows whether Eskom would have sufficient cash to service its debt payment obligations under different scenarios. A cash shortfall may require government action.

- Another output of the scenario analysis tool is to determine what the likely credit score would be under different scenarios, which then also gets reported to internal stakeholders.

Figure 2: Scenario analysis model for Eskom (Click on the Figure to view the image in a better quality)

Source: Risk Integrated, National Treasury of South Africa, World Bank Treasury

Scenario analysis is an excellent tool to determine potential cash flow shortfalls of Eskom. However, the National Treasury’s Credit Risk Directorate recognizes that additional work needs to be undertaken to improve its robustness and utlility.

[1] Fritz Bachmair is an international expert in public financial management. Cigdem Aslan is a Lead Financial Officer at the World Bank Treasury. Mkhulu Maseko is the Director of the Credit Risk Directorate at the National Treasury of South Africa.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.