Posted by Alpa Shah, Sailendra Pattanayak and Thomas Baunsgaard[1]

The IMF has recently published an updated Fiscal Transparency Code (FTC) that includes a new fourth pillar (Pillar IV) covering specific transparency issues related to natural resource revenue management. The FTC is the most widely recognized international standard for disclosure of information about public finances, and forms part of IMF efforts to strengthen the institutional framework for fiscal governance, support policymaking, and improve fiscal accountability among its member countries. In this context, the FTC also forms the basis for IMF Fiscal Transparency Evaluations (FTEs).

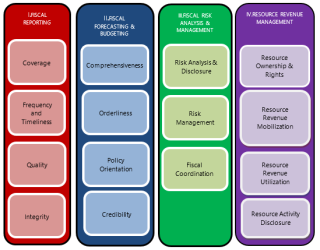

The updated FTC provides a comprehensive and unified four-pillar fiscal transparency framework for all countries, including resource-rich countries, by integrating resource revenue issues with broader transparency principles. Pillars I-III of the FTC, which were published in 2014, focus on transparency principles for (i) fiscal reporting; (ii) fiscal forecasting and budgeting; and (iii) fiscal risk analysis and management. Pillar IV now expands the FTC by addressing issues specific to resource-rich countries across the entire resource revenue management chain, from the ownership and allocation of resource rights, to resource revenue mobilization and its budgeting and utilization.

Pillar IV reflects both established transparency practices in the extractive industries, as well as emerging norms, such as the publication of resource payments and contracts, and the disclosure of beneficial owners of resource rights. It also reflects the lessons learned from several pilot modular FTEs of Pillar IV (Peru, Tanzania, United Kingdom, Mexico, and Trinidad and Tobago), and takes into account extensive stakeholder feedback on earlier drafts of Pillar IV that were released for public consultation in 2015 and 2016.

The Four Pillars of the Fiscal Transparency Code

FTEs, which are conducted by IMF staff upon request by an IMF member country, are voluntary exercises to assess country practices against the FTC and make specific recommendations for improvements in fiscal transparency. The FTC has been designed to allow for both full four-pillar assessments as well as modular assessments of individual pillars, allowing countries to tailor their FTEs to specific areas of interest. For an example of using the full integrated four-pillar FTC in a resource-rich country context, see the recently conducted FTE for Mexico.

Looking ahead, the new Pillar IV will inform a second volume of the Fiscal Transparency Handbook (forming an update to the 2007 Guide on Resource Revenue Transparency) to be released by the end of 2019.

The new Fiscal Transparency Code is available at the following link: https://www.imf.org/external/np/fad/trans/Code2019.pdf

For more information on Pillar IV of the code, see:

For further information on the IMF’s work on Fiscal Transparency, visit https://www.imf.org/external/np/fad/trans/.

[1] Alpa Shah is an Economist in FAD. Sailendra Pattanayak and Thomas Baunsgaard are Deputy Division Chiefs in FAD.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.