By Vicente Fretes Cibils[1]

When Teresa Ter-Minassian and I took on the task of looking back to the fiscal performance of Latin America and the Caribbean in the last few decades we expected to find a lot of “could haves” and “if only’s”. A lot of academics and journalists commonly refer to Latin America as “the region of the future”. And that is mostly true. But there is still a large hurdle that the region as a whole has to overcome if it is to achieve sustainable and inclusive growth: namely, much improved fiscal performance.

Our recently published book[2], “Decentralizing Revenue in Latin America: Why and How” looks at the extent to which seven countries — Argentina, Bolivia, Brazil, Colombia, Mexico, Peru, and Venezuela — have succeeded in decentralizing their tax systems to increase their overall revenue collections. The book also discusses why most countries are still far from exhausting their revenue potential. The short answer is that taxes in many countries of the region are not yet designed to promote development and growth.

As the decentralization process deepened in the region, spending by subnational governments as a percentage of total government expenditure grew from 20% in 1985 to about 30% in 2010. In contrast, the percentage of own-source revenue collected by these governments remained unchanged at about 10 percent of the national total.

The uneven pace of decentralization in the region has created a growing gap between subnational spending and own-source revenue, known as vertical imbalance. Such imbalances have prompted subnational governments in Latin America to rely heavily on central government transfers to finance their spending. Unfortunately, this dependence on transfers has had adverse consequences for fiscal responsibility, the delivery of socially-sensitive public services, and political incentives to provide such services at an acceptable standard of quality and efficiency.

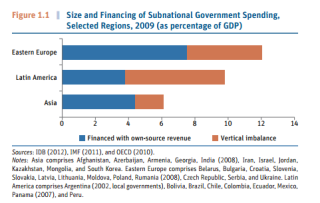

Across Latin America, almost two-thirds of subnational revenue are transferred from national governments, which makes subnational government finances in the region more vulnerable and less predictable. The average vertical imbalance in Latin America is significantly larger than in OECD countries, but also larger than in Eastern Europe and Asia, as shown in Figure 1.1. (click to enlarge)

Sources of Subnational Revenues

The study shows that vertical imbalances can vary substantially within countries, depending on economic and social characteristics such as the level and sectoral composition of subnational GDP, the incidence of poverty, the degree of urbanization, and demographic structures. These disparities influence the distribution of subnational tax bases across the countries and, depending on institutional and political factors, also affect the efforts of individual subnational governments to raise own-source revenue.

As shown in Table 1.2, all countries in the region, except Mexico, rely heavily on indirect taxes, especially on turnover (Argentina and Colombia), value-added (Brazil), and excises (Colombia and Venezuela) as their main own-revenue source. Property (real estate and vehicle) taxes are levied in almost all countries. Mexico is the only country that levies a subnational payroll tax. (click to enlarge)

Policy Opportunities

The analysis in the book shows that subnational own-source revenue systems in Latin America differ significantly with regard to the level of the tax burden, the distribution among the different types of intermediate and local governments, the weight of different taxes, their effects on productive efficiency and equity, and the effectiveness of revenue administration. These differences argue for a diversified set of reform strategies and priorities across the region.

The book also demonstrates that most countries combine formula-based revenue sharing mechanisms with a variety of block or special purpose grants. The weight of the different mechanisms in total transfers, the criteria used to horizontally distribute the shared revenues, and the degree of discretion involved in the grants, vary from country to country and can impact on the efforts of subnational governments to mobilize their own revenues.

Among the policy options – and opportunities – for governments of the region to consider are the following. Countries could allow subnational governments to implement surcharges on existing national taxes - such as the personal income tax or retail sales taxes - to avoid predatory tax wars among subnational entities, like the ones that have occurred in Brazil. Governments could also support initiatives to prevent the erosion of property tax revenue of local governments. Such measures could include investing in the modernization of tax management systems to ensure proper titling information, and establishing clear processes for evaluating the value of real estate properties.

In order to encourage local governments to increase their own sources of revenue, central governments should ensure that the level of transfers take into account financing needs from subnational entities, and that resources transferred are assigned to finance specific expenditures at the subnational level.

Conclusion

To sum up, the book shows that decentralization of tax revenue varies greatly among countries, but that overall the region suffers from a clear imbalance in fiscal decentralization that has had serious consequences for local development. Lack of a stable tax revenue base undermines the autonomy of subnational governments to choose and implement policies that are better tailored to their needs and preferences. The lessons learned from the study offer countries in the region important insights to continue advancing their fiscal decentralization agendas.

[1] Vicente Fretes Cibils is the Division Chief of Fiscal and Municipal Management at the Inter-American Development Bank.

[2] Download free publication www.iadb.org/descentralizacion

IDB Blog in Spanish RecauDando Bienestar www.iadb.org/recaudandobienestar

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.