Posted by John Grinyer

With support from FAD, and funding from the EU, Botswana has made good progress towards the development of a Medium-Term Fiscal Framework (MTFF). This article discusses the key measures taken by the government to better understand Botswana’s fiscal horizons.

Botswana is clearly recognised as one of Africa’s success stories. Sound mining revenue management, principally from diamonds, has supported the government’s budget since the 1970s, allowing substantial investments in human and physical capital, together with establishing one of the largest sovereign wealth funds in Africa. In per capita terms, Botswana is now one of the wealthiest countries on the continent, having been one of the poorest at independence in 1966.

The 2008 international financial crisis, however, hit Botswana hard. The economy shrank by 8 percent and government revenues fell. Lower revenues and an infrastructure-focused stimulus package saw the traditional 5 percent of GDP fiscal surplus turn into 3 years of deficits averaging over 8 percent of GDP.

These events provided an impetus for Botswana to revisit its public financial management system. The starting point was a PEFA assessment in 2008, which led to the development of Botswana’s Public Financial Management Reform Programme (PFM-RP). A key aim of the PFM-RP was to adopt an MTFF that provided a closer link between the government’s medium-term fiscal objectives and the annual budget, whilst also placing more emphasis on efficiency and performance and a policy goal of restraining government spending to below 30 percent of GDP.

A common question raised by government insiders was “so what is an MTFF and how does it differ from what we do now?” Previous 5-year National Development Plans have included “proto-MTFFs” where forecasts of revenues and expenditures are produced that cover the Plan period. More recently, a set of medium-term forecasts have been published with the annual budget. A full MTFF, however, was a new departure for Botswana.

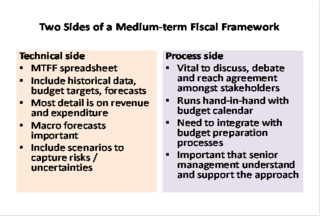

Answering this question involved creating understanding of the two sides of an MTFF (see table below):

• Technical aspects. A spreadsheet model - one that brings together historical data, budget targets and forecasts of the government’s finances, principally revenues, spending and financing – is required. This is likely to incorporate forecasts of GDP and possibly inflation, the results of policy costing exercises, details on loan disbursements and repayments, and estimates of donor commitments.

• Procedural aspects. A fiscal framework needs to be driven by agreed policy objectives and/or a fiscal rule. Discussing, debating and reaching agreement between stakeholders on the assumptions on which the forecasts are based is also vital.

In addition to the technical aspects, a strong emphasis was placed on developing the process side. Whilst it is relatively straightforward to develop a spreadsheet that churns out deficit forecasts for the next 3 years, this is of little use if decision makers do not understand and trust the numbers the framework is producing, or if they disregard the fiscal policy objectives underpinning the framework.

Developing such a framework in Botswana involved many overlapping activities, principally the following:

Analysing past forecasting errors in the annual budget: This important first step involves comparing deviations to the original budget (as opposed to any revised budget) as a percentage of GDP. In Botswana it was clear that forecasting revenues was the greatest challenge. Projections of mineral revenues, VAT, income tax, and customs revenue all had average errors in excess of 0.5 percent of GDP. In addition “other charges” on expenditure also varied considerably from the original budget. Given Botswana’s prominence as a prime safari destination these items were termed the “Big 5” – easily memorable!

Team building: Care was taken to ensure that team members were drawn from appropriate institutions and had sufficient seniority and experience. A Macro-fiscal Working Group (MWG) was established that linked the Ministry of Finance, the Department of Mines and the Unified Revenue Service. Membership was limited to these core institutions so to avoid taking up the time of officers whose work is only peripherally related to the framework. Links were also established, however, with engaged institutions (e.g., the central bank) and their input (e.g., inflation forecasts) was requested at set intervals.

Agreeing key outputs of the MWG with senior management and incorporating these outputs in the budget process: Integration with the budget calendar is vital if the MTFF is to have an impact on budget preparation. The two main outputs of Botswana’s MTFF are the aggregate budget ceilings, produced in July, and the fiscal forecasts based on the draft budget that is presented to the Cabinet in November. The MTFF is also incorporated into a Budget Strategy Paper drafted in August.

Training and learning by doing: Weekly training sessions were held on constructing a fiscal framework as well as related topics requested by ministry staff. When the framework required updating a “spreadsheet session” would be held, at which members of the MWG worked together, laptops and a projector at the ready, to add a new module, update the spreadsheet with the latest information, or revise a formula.

Presenting the framework to stakeholders and incorporating feedback: Before the “final” MTFF was presented that informed the spending ceilings for the 2014/15 budget, several presentations to stakeholders and senior management were made, with the focus on agreeing assumptions rather than numbers. Most useful were the feedback and suggestions to refine the assumptions on which the framework is built, helping to infuse more ownership of the framework by decision makers.

Managing resistance to the new framework: The incentive structures facing some institutions presented a challenge. There was, for example, the need to reconcile the objective of realistic tax revenue forecasts with the natural desire of revenue collectors to have as low a target as possible. This raising of the ante can create considerable friction within the government that is best overcome through dialogue and agreement at senior levels.

The next step along the road is to develop a medium-term expenditure framework (MTEF). This will incorporate the “bottom up” aspects of the budgeting process, with line ministries developing medium-term strategies and forward estimates of their spending requirements. Establishing a credible and effective MTEF is likely to be a more challenging task, but one which, with the help of the MTFF, Botswana is now ready to face.

1 Macro-Fiscal Advisor, Ministry of Finance, Botswana. The author is grateful to Peter Murphy, FAD for his valuable comments.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.