Posted by Deanna Aubrey, PEMPAL Community Facilitator

On September 27-29, 2011, PEMPAL[1] Treasury Community of Practice (TCOP) held a workshop in Astana, Kazakhstan. Astana provided a spectacular backdrop for the meeting with the modern capital, only established some 14 years ago, preparing for events to celebrate Kazakhstan’s 20 years of independence.

Most countries participating in the TCOP from the Europe and Central Asia (ECA) region are in the process of modernizing or developing their Treasury information systems and many of them are either considering or already moving towards expanding system functionality and creating integrated Financial Management Information Systems (FMIS). Given the importance of this theme to TCOP PEMPAL members, PEMPAL already organized previous meetings, including on the use of digital signatures in treasury operations, and more are planned for the future. The Astana meeting focused on the development and application of FMIS solutions, as well as the effective utilization of such web-based platforms for the public financial management needs of decentralized budget institutions and their spending units, in support of various reforms such as improvements in accounting and reporting and strengthening internal control frameworks.

More than 80 participants from 17 ECA countries attended the meeting which was hosted by the Ministry of Finance of the Republic of Kazakhstan. The Kazakhstan Minister of Finance opened the event and highlighted the reforms undertaken by the Government over the last 12 years to modernize its treasury system. The Ministry of Finance then gave an in-depth overview of the existing information system and the ongoing implementation of an FMIS (eMinfin) solution including a live demonstration and site visit to the Treasury. This overview covered the following topics: system functionality; interfaces with other Government IT systems; user coverage and delimitation of user access; methods used to assure information security within the system and when exchanging the data with external systems; types of internal controls supported by the system; and possibilities available for risk analysis. The Ministry of Finance also presented information on existing gaps and plans for the further development of the treasury system and its integration with other government IT systems. Kazakhstan’s Centre for Training, Retraining and Professional Development of Financial System Specialists was also showcased which provides training and professional development for accountants and auditors of government agencies in accordance with the accrual-based IPSAS (refer to www.ecmf.kz).

The World Bank then presented an overview of FMIS implementation in the ECA region gathered from the results of a survey conducted before the workshop. It also shared key findings and recommendations from a recent FMIS study[2] which presents the challenges, achievements and lessons learned from the World Bank’s experience in financing 87 FMIS completed/active projects in 51 countries since 1984. The World Bank also shared its internal procedures for compliance with international information security standards, as well as good practices for information security, user management, IT audit and data reliability. A Community of Practice has recently been established by the World Bank as a platform to exchange information, good practices, and experiences gained in the design and implementation of FMIS solutions. Membership is open to all specialists and officials from the development agencies and countries involved. The FMIS COP is also focused on the development and dissemination of leading edge knowledge products, as well as the creation of a discussion forum to assist in improving the quality and performance of ongoing and planned FMIS projects.[3]

According to the World Bank, ‘Financial management information systems can be broadly defined as a set of automation solutions that enable governments to plan, execute, and monitor the budget by assisting in the prioritization, execution, and reporting of expenditures, as well as the custodianship and reporting of revenues. Accordingly, FMIS solutions can contribute to the efficiency and equity of government operations’ (World Bank Study, 2011, page 1).

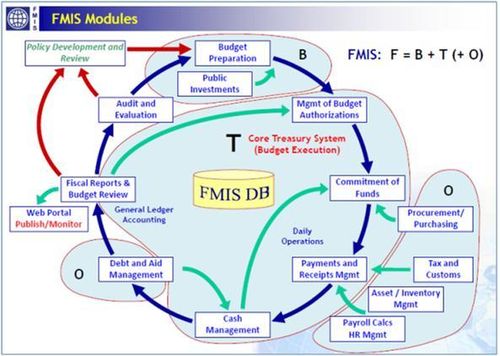

Within the context of the study, integrated FMIS occurs whenever FMIS and other public financial management systems (such as payroll) share the same central database to record and report all daily financial transactions, offering reliable consolidated results as illustrated in the diagram below. Possible options for the development of FMIS include the gradual expansion of FMIS modules around a core Treasury system; integration of existing in-house developed PFM information systems; or the introduction of a full scale FMIS.

Source: World Bank Study, 2011, page 2.[4]

At the TCOP Astana meeting, four invited countries – Russia, South Korea, France and Denmark – also presented the current status of their Treasury/FMIS solutions within the context of the conceptual modules presented in the diagram above.

Within the group discussions that followed these presentations, specific challenges of integrating treasury systems with external systems were discussed with a focus on integration with budget preparation systems, as well as with information systems supporting accounting and reporting at the budget user level.

Countries were at different stages of reform, but the main shared goal was to ensure the completeness, integrity and accuracy of financial statements and the departure from paper reporting and eventual move to electronic document management. Many countries were experiencing challenges with such reforms due to partial or lack of integration between different information systems that were being used at various stages of the budget process. Extensive use of paper and multiple data entry in the budget process was also leading to wasted time and resources. However, participants acknowledged that the integration of budget preparation and treasury execution systems was important to improve budget performance monitoring and cash and commitment management. According to the World Bank, the technical and operational challenges of such integration can be reduced by properly integrating related application software solutions and databases; operating a shared data centre and network; harmonizing budget classification/chart of accounts for all budget levels; and ensuring adequate secure access to all budget institutions (central and local levels) for planning, execution, monitoring and reporting.

Broader challenges of implementing FMIS solutions were also discussed with problems being exacerbated by lack of appropriately skilled IT professionals in the public financial system, a high level of turnover among data professionals, and a lack of sufficient country wide telecommunication networks in some countries. The length of time required to implement an effective FMIS solution – with design and implementation taking at least 6-7 years despite advances in technology – was also seen as a major challenge to ensuring ongoing political commitment and high level ownership. Furthermore, participants acknowledged that in developing an integrated system, it is important to take into account the following:

- the need for a clear statement of objectives and adequate analysis of business processes;

- the need to work closely with vendors and to build an effective dialogue between developers and clients to get a quality product to meet all user requirements;

- the importance of getting auditors involved in the design stage;

- the importance of using digital signatures for user identification, authorization and access control; and

- the need to establish reliable and adequate audit trails.

Other issues discussed included the expansion of existing treasury information system capabilities through web portal access to external users, and the information security issues associated with such a conversion. The two ways used to support spending units operations through a centralized web-based FMIS solution were examined; web portal access and direct access. Web portal was seen as providing a cost-effective, secure access to spending units whilst still allowing adequate internal controls.

It was acknowledged by all participants that implementing FMIS solutions is a difficult task and requires the allocation of significant resources and capacity building efforts. However, there was general agreement that FMIS can be a powerful tool if designed to meet specific user requirements and implemented within the context of a realistic action plan and well-defined public finance management strategy. According to the World Bank, the development of a countrywide FMIS solution and infrastructure is most effective when it is an integral part of a coherent and realistic national e-government strategy as is the approach taken by the Kazakhstan Government. Furthermore, the risks of market driven choices of FMIS solutions are high and must be counterbalanced with significant focus on the design of the tool to ensure it is adaptive and responsive to the needs of the ultimate users. In summary ‘These systems are no replacement for good management and robust internal controls and will not be very useful if budget coverage itself is limited or budget planning/execution practices are not well established.’ (World Bank, 2011, pg 2)

For workshop materials in English, Russian and Serb-Croat: http://www.pempal.org/event/eventitem/read/46/109

For more information on the FMIS Community of Practice and to register for access go to: https://eteam.worldbank.org/FMIS. The FMIS Study was translated into seven languages and these can be downloaded in PDF format from the FMIS COP web site.

For more information on Ministry of Finance Republic of Kazakhstan: http://www.minfin.kz/

For information on the Centre for Training, Retraining and Professional Development of Financial System Specialists: www.ecmf.kz

Postscript: PEMPAL would like to acknowledge the significant contribution from the World Bank in the preparations for this workshop, in particular Cem Dener, Elena Nikulina, Ion Chicu and the World Bank office in Kazakhstan. A special thank you is also extended to the TCOP Leadership Team, the Center of Excellence in Finance, and all participating countries; in particular the gracious and warm hosts the Ministry of Finance of the Republic of Kazakhstan.

[1] PEMPAL is a Public Expenditure Management Peer Assisted Learning (PEMPAL) network whereby government representatives from up to 21 member countries from across the Europe and Central Asia (ECA) region regularly meet in ‘communities of practice' to discuss reform issues in the areas of budget, treasury and internal audit. See www.pempal.org for more information.

[2] Dener, C., J.A., Watkins, W.L., Dorotinsky, 2011, ‘Financial Management Information Systems: 25 years of World Bank Experience on What Works and What Doesn’t,’ World Bank, Washington, D.C. Refer to previous blog posting http://blog-pfm.imf.org/pfmblog/2011/05/financial-management-information-systems-25-years-of-world-bank-experience-on-what-works-and-what-doesnt.html

[3] To access the FMIS CoP external web site at https://eteam.worldbank.org/FMIS, create a Member Center account to login and request membership.

[4] In the diagram, B refers to budget; T refers to treasury and O to other. Integration of B and T includes necessary interfaces for data exchange with external information systems of the line ministries, central bank (and private banks), revenue collection agencies, social security agencies etc. Other (O) PFM modules/systems are developed and/or interfaced with these core systems to create an integrated FMIS solution.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.