Prepared by Teresa Dabán

Paraguay’s budget highly depends on the revenues derived from the hydroelectric, bi-national power plant, Itaipú. The management of these revenues poses important macroeconomic, intergenerational, and political economy challenges. Addressing these challenges is especially important given the temporary nature of the forthcoming windfall related to the recent agreement with Brazil and the projected decline of Itaipú revenues over time. This post draws on the IMF Country Report No.10/170 on Paraguay.

How Itaipú revenues are generated?

The Itaipú revenues derive from the hydroelectric resources of the Paraná River, which in 1973 Paraguay and Brazil agreed to exploit jointly with the creation of the bi-national dam Itaipú. It was agreed that (i) the two countries will acquire all of the power produced by Itaipú, (ii) Itaipú would pay royalties, in U.S. dollars, to each country for the use of the water of the Parana River; and (iii) each country would have the right to purchase the energy not used by the other country for its own consumption. At present Paraguay acquires only 9 percent of Itaipú’s total production, while the rest, up to Paraguay’s 50 percent share, is acquired by Brazil in exchange for a compensation, also paid in U.S. dollars. The royalties and compensation that Paraguay receives every year accounts for some 2⅓ percent of GDP. They will increase by an extra 1½ percent of GDP because of a July 2009 agreement to increase the compensation that at present Brazil pays to Paraguay.

What are the challenges posed by Itaipú Revenues?

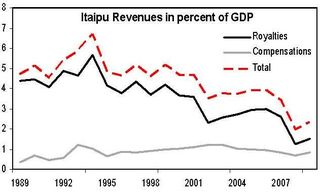

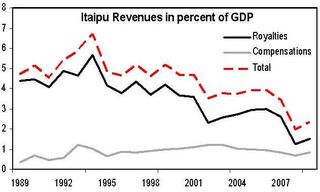

Volatility. Since they started to come on-stream in 1989, Itaipú revenues have presented a certain degree of volatility, mainly reflecting exchange rate variability and ad hoc revisions in the underlying parameters used in their calculation, such as the one derived from the recent agreement with Brazil.

Volatility. Since they started to come on-stream in 1989, Itaipú revenues have presented a certain degree of volatility, mainly reflecting exchange rate variability and ad hoc revisions in the underlying parameters used in their calculation, such as the one derived from the recent agreement with Brazil.

Budget dependence. At present Itaipú revenues represent around 20 percent of total Paraguay’s government revenues. In fact, when they are excluded, the budget surplus of 0.1 percent of GDP achieved in 2009 becomes a 2⅓ percent of GDP deficit. This is mainly the result of Paraguay’s low tax ratio, which at present accounts for only 12.7 percent of GDP, even lower than in peer countries with similar income per capita and volume of resource revenues.

Rentier mentality. Itaipú revenues have also discouraged in the past, and may continue to discourage in the future, tax mobilization in Paraguay, especially at the level of subnational governments, which at present receive 30 percent of Itaipú revenues.

Declining profile over time. Although hydroelectric resources are considered to be renewable, Itaipú revenues are estimated to decline overtime in relation to GDP, reflecting that (i) the unitary price, in U.S. dollar per GWh, used to compute royalties and compensations is adjusted monthly in line with the U.S.’s CPI and the Industrial Production Index, which probably will grow by less than Paraguay’s nominal GDP; and (ii) the electricity surplus currently exported to Brazil is expected to shrink over time, in tandem with the envisaged increase in Paraguay’s domestic consumption of electricity.

Declining profile over time. Although hydroelectric resources are considered to be renewable, Itaipú revenues are estimated to decline overtime in relation to GDP, reflecting that (i) the unitary price, in U.S. dollar per GWh, used to compute royalties and compensations is adjusted monthly in line with the U.S.’s CPI and the Industrial Production Index, which probably will grow by less than Paraguay’s nominal GDP; and (ii) the electricity surplus currently exported to Brazil is expected to shrink over time, in tandem with the envisaged increase in Paraguay’s domestic consumption of electricity.

How to address the challenges posed by Itaipú Revenues?

To address these challenges Paraguay’s government should adopt a forward-looking fiscal strategy. The strategy’s main goals should be to (i) increase tax revenues to help diversify the government’s revenue sources away from Itaipú revenues; (ii) implement a medium-term fiscal framework, to keep public expenditure in line with Paraguay’s absorptive capacity and preserve fiscal discipline; and (iii) adopt a mechanism to save part of the Itaipú revenues to insure future financing of public spending, as Itaipú revenues decline overtime. The implementation of such strategy could be supported by the adoption of a rule-based fiscal framework. Options could include:

Bird-in-hand rule. Under this rule the government would spend only the interest income accruing from accumulating the Itaipú revenues in a fund, the Itaipú Fund. A similar rule is used by Norway, for instance, where the oil revenues contribution to the annual budget cannot be larger than 4 percent of the assets accrued in the oil fund. This rule would yield small annual payments during the first years, while the stock of additional revenues accumulates.

Permanent Income Hypothesis. Under this rule, the government would use in fiscal year t only the sustainable (permanent) annual income, which is the maximum amount that can be spent from the Itaipú revenues in that year and still leave enough savings. This amount would equal the real rate of return multiplied by the net present value of all Itaipú revenues expected in the future.

Declining budget dependence on the Itaipú windfall. Another option is a rule that links the share of hydroelectric resources to be spent with progress on increasing tax revenues. If the authorities make good progress in increasing the tax ratio (and reducing dependence on Itaipú revenues), the Itaipú resources could be spent more rapidly. The rest of the Itaipú revenues would be deposited in the Itaipu Fund and used to derive an annuity over time.

What should be the key design features of the Itaipú Fund?

A separate special account. According to best practices, the savings generated from the management of Itaipú revenues should be deposited in the government’s treasury account, together with the rest of government revenues. However, Paraguay could benefit from creating a separate account, which could help (i) insulate the Fund deposits and withdrawals from political pressures, which in turn could help mobilize public support for using Itaipu revenues to build a buffer for the future; and (ii) provide an easy and transparent way to present and manage the stocks and flows associated to Itaipú revenues.

Special legislation. Paraguay could benefit from enacting a special piece of legislation for the Itaipú Fund, which could be altered only under special majorities in congress to ensure a high degree of legal stability. Such a law could: (i) establish the main purpose of the fund (e.g., a saving and stabilization fund); (ii) outline the rules that will govern the annual withdrawals and deposits; and (iii) specify the circumstances (e.g., national emergency) under which the law would authorize annual withdrawals above the rules.

Purposes of the Itaipú Fund. The legal framework could also establish the criteria for the allocation of the Itaipú Fund among line ministries. To enhance the project effectiveness and efficiency, the legal framework could establish that the Itaipú Fund will be distributed among line ministries in response to their project submissions, which could be assessed by the ministry of finance.

Management of the Itaipú Fund. In case the Itaipu Fund accumulates small-to-moderate balances, which are expected to be used in the short to-medium term, and mainly on domestic transactions, the fund could be set as a domestic currency-denominated account at the central bank. The main transactions will entail manageable deposits and withdrawals and unsophisticated and limited investment operations. In case of large balances, which are expected to be saved for the long run, it would be advisable to maintain the fund as a foreign-currency denominated off-shore account, which could be managed by the central bank (e.g. Norway) or outsourced to a financial institution (e.g., Sao Tome and Principe). The investment strategy could be return-driven, yet conservative, with prudent provisions for diversification of risks and liquidity. A non-partisan Investment Committee could assist the ministry of finance in designing the investment strategy to add an extra layer of independent control.

Transparency. The success of the Itaipú Fund—in terms of both actual financial returns and public perception—will depend in part on the transparency of its operations. Therefore, it would be advisable to establish specific reporting mechanisms, including: (i) a short report describing the Itaipú Fund’s annual activities, comprising an inflow and outflow statement and a balance sheet presentation; (ii) the overall annual return on the assets of the fund; and (iii) a statement by independent external auditors.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.