Posted by Mark Silins

Cheque it Out

It’s been 12 months since I arrived in the Caribbean after almost a decade of working in between different countries. I thought it might be useful for me to relate one of my first impressions of doing business here verses what I had experienced in other countries in the world. As always when you arrive in a new place to live (my wife and I have relocated ourselves nine times in the last 20 years) you must buy certain household and other items. During our earliest shopping expeditions to buy these, what struck me was the continued, extensive acceptance of cheques here in the Caribbean, especially given the risks and costs involved with this form of payment. I am aware that this practice is not restricted to the Caribbean but is also true for North America. I have not owned a personal cheque book for 25 years and was, therefore, not in a position to make payments in this way. Fortunately, as we all know, most larger businesses do accept debit and credit cards as an alternative payment option.

Government Chequing-in as well

A number of years ago, an efficiency study was undertaken in Australia to determine the full costs of producing a single payment in government. The final cost was about $45 AUD (from memory) but, most importantly, cheques represented a much more expensive method of payment for government verses payment by direct credit. This study resulted in immediate action to replace cheque payments with direct payments to recipient bank accounts.

While there was some resistance initially, and concerns were expressed about what the impact would be on the most vulnerable groups in society, when we examined the options objectively it was difficult to justify producing cheques even for this group of recipients.

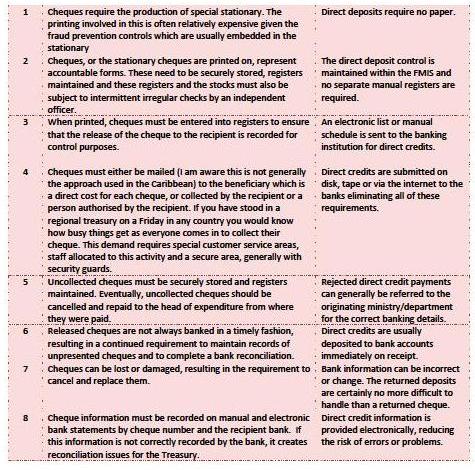

Let’s consider the workload impact of these two types of payments and the related risks.

Weighing up Cheques verses Direct Credits

This list is not exhaustive, as the additional costs of using cheques verses direct credits in part depend upon the practices in place in each treasury. For example, does your Treasury only print the cheques which are to be released for payment on either the day or day before the payment release? If this is the case, then you are adhering to “good practice”. If, however, you print cheques as soon as you process the payment vouchers in your system, you are creating large additional costs for your operations, requiring the maintenance of control registers and risking duplicate payments the longer you hold onto the cheques (simply because the system shows that a cheque has been paid and may therefore result in the business submitting a second (duplicate) invoice as they have not actually been paid).

An additional benefit of requiring vendors to have bank accounts is that we can also check to see if they are being compliant with their tax obligations.

Treasury challenge

Why don’t you take steps today to reduce your country’s dependency on cheques and move to payment by direct credits?

In February, after this issue was discussed at a CaPFA/CARTAC PFM workshop, the Belize Treasury issued a circular to ministries indicating that no new vendors would be added to the vendors’ database in the IFMIS without bank account details. Well done to Dorothy Bradley and her staff for this initiative. Of course, Belize still needs to continue to focus on further automation for all other vendors and also other beneficiaries of public money.

If you have any comments or concerns about the cheque verses direct credit issue, drop me a line or give me a call to argue your point. It would be great to get some dialogue going about this issue. But don’t forget, I also worked in a treasury that used to print cheques and subsequently moved to direct credits, so I have seen both sides of this argument first hand. I would also like to hear from countries about other initiatives you are taking to reduce workloads through enhanced use of technology.

CaPFA/CARTAC dates

FMIS Conference, Anguilla, September 2010

PFM Conference, Barbados, November 2010 – The main theme is Internal Control

PFM Workshops in the next six months – Dominica, Montserrat, Antigua and Barbuda, St Lucia, and Turks and Caicos.

If you are considering approaching CARTAC/CaPFA about convening a PFM workshop, you should read the attached document “Checklist for convening a PFM workshop”, which highlights the responsibilities of all the parties in this process.