Achieving higher “value for money” is a universal goal for governments, and has lately returned to mainstream interest as public debt levels are projected to remain elevated, limiting fiscal space (Fiscal Monitor October 2025). A critical step toward this goal is understanding the true cost of public services—how resources are consumed, what drives expenditure, and where efficiency gains can be realized.

Cost accounting—the systematic process of identifying, measuring, analyzing, and reporting the costs associated with delivering goods and services—is re-emerging as a practical lever for strengthening public financial management (PFM), with several countries rediscovering its potential. Persistent obstacles, such as strategic misalignment and data and technical implementation challenges, continue to lead to underutilization of cost accounting. Our new IMF working paper shows that, when leveraging modern tools and a user-centered approach, cost accounting becomes a bridge that connects existing data to real-world improvements.

Why Good Cost Data Matters for Stronger PFM

When integrated effectively with …, instead of being a siloed reform, cost data can support PFM by providing granular insights needed to drive efficiency and accountability:

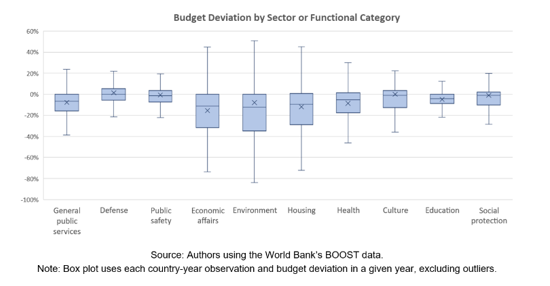

- Strengthening Budget Credibility: By analyzing historical costs and their underlying drivers, governments can formulate more realistic budgets.

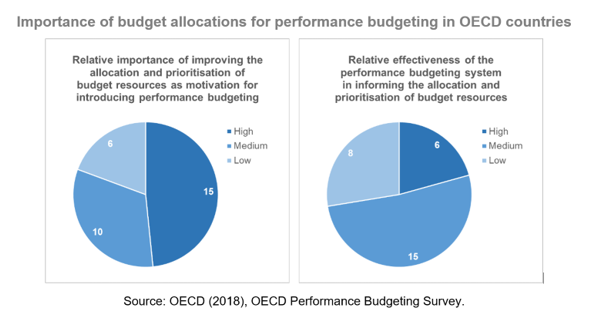

- Boosting Performance-Based Budgeting (PBB): PBB was designed to inform budget decisions, yet its practical use in decision-making has remained limited. Among 15 OECD countries (48 percent) that cited improving resource allocation as a main goal of PBB, only six (21 percent) found it highly effective in guiding allocation and prioritization. While PBB requires various types of indicators beyond cost measures, cost data are essential for constructing reliable efficiency indicators.

- Improving Public Procurement: Cost data can help ensure better value in public contracts. Understanding the total cost of ownership—not just the initial price—leads to smarter contracts. For example, in Denmark, 40 municipalities saved nearly 11 million DKK and 3,625 tons of CO2 by factoring in three-year energy consumption costs for new computers.

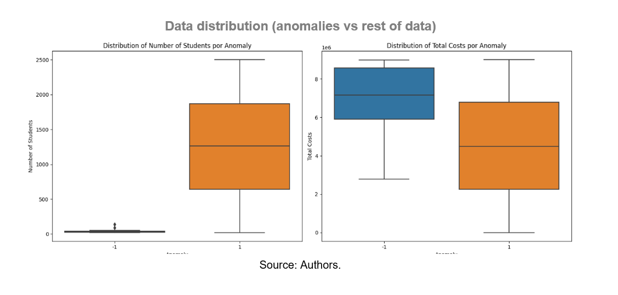

- Detecting Corruption and Mismanagement: Granular cost data makes it possible to spot anomalies that might otherwise go unnoticed. Unexplained variations in costs for similar goods, services, or public works across different agencies or suppliers can serve as red flags, signaling potential mismanagement, fraud, or corruption that may warrant further investigation.

Overcoming Old Barriers with New Technology

Cost accounting should not be about adding burden—but about giving existing data more purpose. Implementing cost accounting has historically demanded significant resources and time with limited use of the output. Many cost accounting initiatives rely on dedicated reporting tools that operate separately from budget, accounting, and PBB systems—replicating rigidity and fragmentation. Today, however, governments can overcome these limitations by automating data collection and analysis through digital tools.

- Automating Data Collection of Administrative Records: Cost data is often trapped in administrative systems across different ministries, such as health or education. Consolidating this information typically involves manual error-prone processes.

Our paper proposes a standardized data schema that allows different systems to "talk" to each other. This approach enables automated collection of timely and granular data without duplicating efforts or requiring a costly overhaul of existing infrastructure—in line with the UNICEF’s AdaMM.

Uncovering Insights with Machine Learning (ML): Once data is available, ML models—which can process vast and complex datasets to flag irregularities that humans alone cannot—can be used to uncover subtle patterns and anomalies that might signal waste. The paper tests different ML techniques and illustrates how an unsupervised machine learning model can successfully flag anomalies in an elementary school infrastructure program, and can be complemented by a supervised model.

From Better Cost Data to Better Decisions

For governments interested in adopting cost accounting, the working paper recommends three practical aspects to build momentum and ensure sustainable adoption:

- Institutional Integration: Embed cost accounting into core PFM processes, such as budget formulation, spending reviews, and procurement planning. Rather than treating it as a standalone policy.

- Emphasize data use: Officials should not only collect cost data but also analyze and use it effectively to inform their decisions. Building analytical capacity ensures that the effort generates value.

- Iterative Implementation: Conduct pilots in specific sectors to demonstrate value and refine the approach. Early wins can help build momentum, while helping refine the data schema for compilation.

The ultimate success of cost accounting lies not in the sophistication of the tools, but in their consistent use to inform decisions, improve public services, and enhance accountability. By leveraging modern digital infrastructure and analytical methods, governments can transform cost data from a passive record into an active tool for stronger PFM.

For a deeper analysis, including our proposed data schema and technical annexes on machine learning, read the full Working Paper: Making Cost Data Work for Public Financial Management.