Spending reviews march on in various forms in more advanced countries but lag elsewhere. A recently published paper[1] asks why this is so. It traces the development of spending reviews from their origins in a set of budgetary innovations in the United States in the 1950s and 1960s - notably zero-base budgeting (ZBB) and Planning, Programming and Budgeting Systems (PPBS) - to their application internationally for budget management and fiscal consolidation.

ZBB and PPBS reforms, while transitory in themselves, implanted important new ideas and concepts and rethinking of classical budget techniques that were gradually taken up by policymakers and practitioners in preparing and executing budgets.

Following Robinson (2012) the paper defines spending review as “a systematic scrutiny by the executive branch of government of baseline expenditures defined as expenditure on existing programs and policies, at a level required by prevailing policies or laws, namely on an ‘unchanged policy’ basis”. The paper includes short case studies of four countries: France, the Netherlands, South Africa, and the United Kingdom.

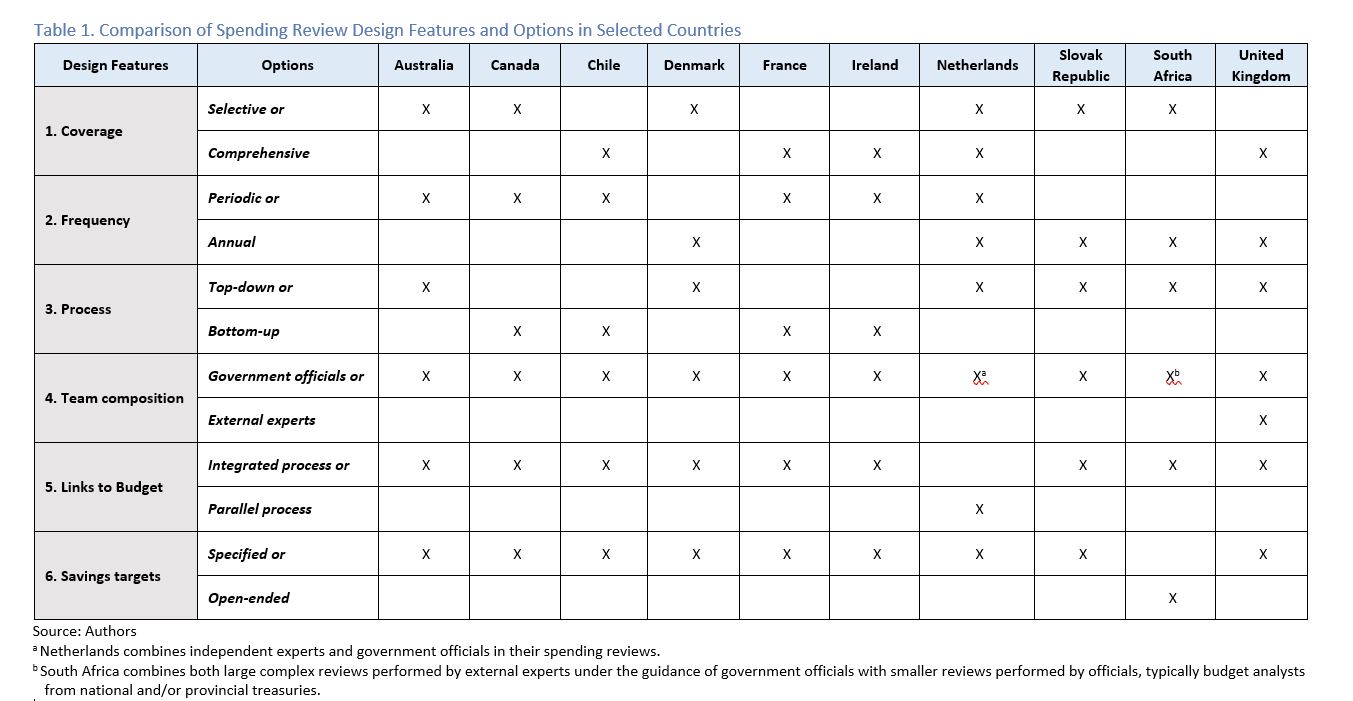

Table 1 provides a comparison of the main design features and options for managing spending reviews in a range of (mainly developed) countries. It identifies six key elements: the coverage of spending reviews (selective or comprehensive); their frequency (annual or periodic); whether the process is top-down (led by the finance ministry), bottom up (led by spending ministries), or a mixture of these elements; the composition of spending review teams; the links to the budget; and whether the reviews identify ex ante savings targets.

The table indicates a wide range of practices across countries, driven by differences in administrative and political structures and policy objectives, while some common features apply. For example, most countries have adopted a mixture of top-down and bottom-up processes to conduct their reviews and link the process to their budget preparation cycle to ensure that options developed are considered by budget decision-makers. Some countries specify savings targets in their spending reviews, but others have chosen to distance their reviews from the budget process itself.

What are the main lessons to be learned from the experiences of countries in designing and implementing spending reviews over the last 30 years?

First, ZBB and PPBS were fundamentally an attempt to get away from incremental budgeting toward a more strategic and analytical approach. They stressed the importance of better analysis of public spending, improving the amount and quality of budget data that are available, and identifying and analysing cost drivers and expenditure dynamics. All these elements are marks of modern budgeting.

Second, the finance ministry is generally regarded as the central element in the spending review process. However, the most successful spending reviews also draw in specialists from other parts of government and the private sector.

Third, the choice of approach – or indeed whether spending review is a tool worth applying at all – is country specific, strongly influenced by political and institutional factors, Consequently, the approaches followed by countries such as Australia, Denmark, France, the Netherlands, South Africa, and the UK have been very different.

Fourth, experience shows that the spending review process takes time to mature and may evolve over time as trust among the partners is gained. Carrying out reviews too frequently may lead to reform fatigue, although one-off efforts are usually limited in impact. Some countries prefer a softer and more flexible approach that is decoupled from the process of identifying and budgeting for specific efficiency savings. Countries with coalition governments may prefer to carry out a comprehensive review at the beginning a new government’s term of office when its policy agenda is first presented.

Fifth, many low- and middle-income countries may not have the political commitment, institutional cohesion, or technical capacity to apply spending review with a similar coverage and depth as advanced countries. Such countries would be well advised to focus on strengthening the PFM foundations (credible annual budgets, and reliable financial reporting, for example) that enable effective spending reviews to be carried out.

Another approach, followed in South Africa, is to focus on “pocket problems” which are smaller is scale and more manageable in terms of data and analytical requirements – examples from South Africa include residential care homes, vaccination centers, and health screening facilities.

Finally, experience shows that the technical aspects of a spending review and identifying potential savings is the less challenging part. More demanding may be the need for the finance ministry to negotiate the results of the review with its partner ministries, pass any legislation in the parliament, and drive through any necessary changes in budgetary practices and procedures.

[1] See Richard Allen and Robert Clifton, “From zero-base budgeting to spending review – achievements and challenges”, Development Southern Africa, 2023. The paper originated in a workshop on ZBB organized by the South African National Treasury in January 2021. Several experts including Sami Yläoutinen, Gerhard Steger and Julien Dubertret contributed to the workshop and to the ideas expressed in this paper.