Fragile and Conflict-Affected States (FCS) are often characterized by poor infrastructure and significant infrastructure gaps. Public investment projects in these countries are less effective, prone to waste, poor governance, and misappropriation. Their governments often fail to provide basic services such as health, education, water treatment, and the infrastructure required for their delivery. These challenges are compounded by the countries’ high vulnerability to natural disasters and climate change exposure, which pose further risks to infrastructure if resilience requirements are not met.

Supporting investment in infrastructure is therefore crucial to address protracted fragility, restore basic services, build trust between the state and citizens, overcome inequalities, and create opportunities for all. However, if poorly managed, infrastructure investment can undermine peacebuilding efforts, aggravate social inequalities, and may contribute to prolonged instability and fragility.

In general, poor results in infrastructure usually reflect institutional deficiencies in a country’s public investment management (PIM) system, whose performance can be assessed using the IMF’s Public Investment Management Assessment (PIMA) diagnostic framework[1] The IMF has recently added a climate module of the framework (C-PIMA), which assesses countries’ capacity to manage climate-related infrastructure.

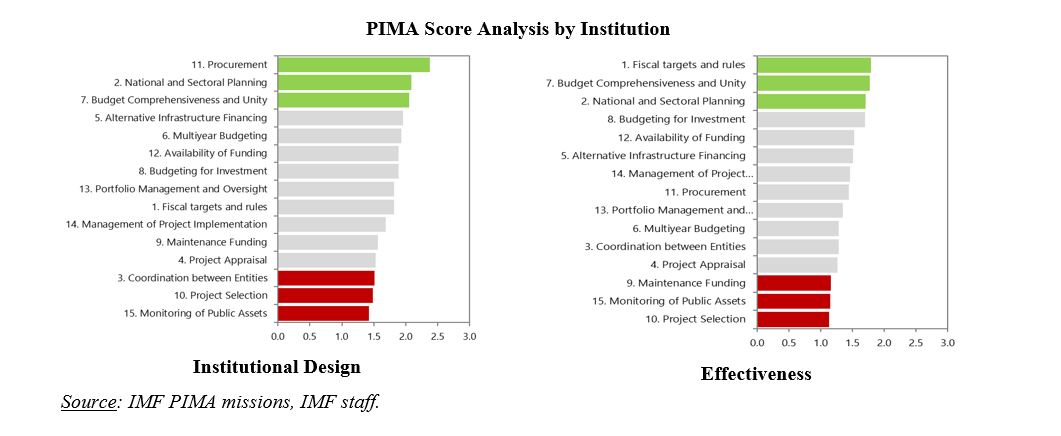

PIMA assessments carried out in 15[2] FCS countries since 2016 highlight the large efficiency gap in public infrastructure, estimated at around 68 % compared to the world average of 30 %. This suggests that the amount and quality of infrastructure produced in FCS is some two-thirds lower than in the most efficient countries. FCS countries achieved lower scores compared to the world average in almost all the 15 components of the public investment cycle (see charts below). Weaknesses affect both the laws and regulations that define how public investment is managed and the effectiveness with which these regulations are implemented.

The PIMA score analysis highlights that deficient coordination between entities, poor project appraisal and selection, the lack of public infrastructure maintenance, and the limited monitoring of public assets are among the main PIM weaknesses in FCS. Moreover, limited capacity (human and financial), a weak institutional and governance environment, and the absence of political and financial stability pose further challenges that adversely affect the efficiency and impact of public investment projects, and the achievement of good economic and social outcomes.

To help FCS improve their investment performance, PIMA reports make tailored recommendations and propose a sequenced PIM reform plan that takes account of institutional and capacity constraints and prioritizes easy-to-implement measures. Recommendations might include, for example, the drafting of a new legal framework for PIM, the development of guidelines and operating manuals to improve the quality of project appraisal and selection, the development of practical tools such as project concept and pre-screening templates, and organizational restructuring of finance and planning functions. PIMA reports may also suggest more transparent disclosure of information on investment projects selected for financing, and measures to improve the coordination among key PIM stakeholders.

Despite much diagnostic analysis and capacity building support, progress on improving PIM in FCS can be challenging and slow. However, there are some encouraging exceptions. For example, in Timor Leste the authorities have introduced a standardized methodology for project appraisal. The government of Madagascar has implemented a project selection tool. Embedding PIM reforms in an IMF program can also help. For example, in Kosovo, the authorities’ commitments to address PIM shortcomings are included in the Stand-By Arrangement. The IMF has also delivered PIM-related workshops and hands-on training sessions to build capacity and encourage peer learning in several FCS which are delivered through the Fund’s regional technical assistance centers.

Among the 15 FCS countries reviewed, five of them have conducted a C-PIMA. These assessments have raised awareness of the importance of including a climate dimension in all phases of the investment cycle to ensure climate-resilient infrastructure. However, climate-sensitive public investment management is at its nascent stage in FCS countries and their governments’ priorities for reform reside more on strengthening the core functions of PIM.

[2] The analysis includes 13 FCS countries where a PIMA was conducted from 2016 to 2023 Q1, namely Burkina Faso, Cameroon, Chad, Congo, Democratic Republic of Congo, Republic of Haiti, Kosovo, Lebanon, Mali, Mozambique, Niger, Nigeria, Timor-Leste. These countries are included in the World Bank’s FY 2023 FCS list, to which we added Madagascar and Guinea.