Prior to 2015, taxpayers in Georgia were required to use numerous specific tax codes when making tax payments. These codes were designed for each administrative and local government unit within the country and varied based on the types of tax and other factors. Consequently, there were hundreds of different codes, leading to frequent misuse by taxpayers when paying taxes. When errors were detected, taxpayers had to file with the State Treasury and wait for the staff to correct the mistake. This process was time-consuming and resource-intensive, given the high number of errors made by taxpayers and the subsequent generation of tax credits, which necessitated numerous corrective transactions. As tax revenues constituted a significant portion of the budget (in 2015, 92% of current revenues and 76% of total revenues), addressing this issue became a top priority in Georgia’s PFM reform agenda.

In 2015-2016, the State Treasury and Revenue Service collaborated on the implementation of a Single Tax Code. The extensive list of codes was replaced with a single code, referred to as "101001000." In Georgia, there are six distinct taxes: personal income tax, profit tax, VAT, property tax, and excise and import duties. All tax receipts began to be deposited under this unified tax code in the Government's central Integrated Financial Management System (IFMIS). To facilitate this, a two-way data sharing service protocol was established between the Revenue Service System (RSS) and the IFMIS. This allowed all receipts under the Single Tax Code to be processed in the RSS.

Taxpayers now understand that all tax liabilities must be paid to Treasury Code "101001000," in one lump sum. The system itself automatically distributes the funds according to the existing liabilities recorded in each taxpayer's account. These obligations arise from the taxpayer's tax declaration and the due dates determined by tax legislation.

As a result of this reform, tax recording and reporting have become more accurate and cost-effective. Taxes are accounted for and distributed across the relevant budget in a timely and precise manner, in line with the declared tax liabilities. Furthermore, the government realized significant savings by eliminating unnecessary paperwork and reducing the number of corrective transactions. Businesses gained by substituting numerous chargeable banking transactions for various tax payments by a single unified transaction.

The technological capacity of the Ministry of Finance has proven sufficient to respond to evolving functional requirements and emerging needs. The IFMIS is an internally developed system supported by an in-house team of business analysts and software developers, allowing for greater flexibility in implementing changes.

The implementation of the single tax code has also paved the way for further reforms to improve tax administration. Once tax payments have been cleared against all tax liabilities on a taxpayer's account, any positive balance is automatically sent to the State Treasury, generating a refund payment for the taxpayer after relevant checks have been made through the risk management system.

This automated tax refund process replaces the previous time-consuming and resource-intensive process which was initiated by individual taxpayers. During the transitional period of the reform, a partially automatic refund mechanism was introduced, where the system identified the refundable amount and assigned it a "Green" status. Final confirmation was required from taxpayers.

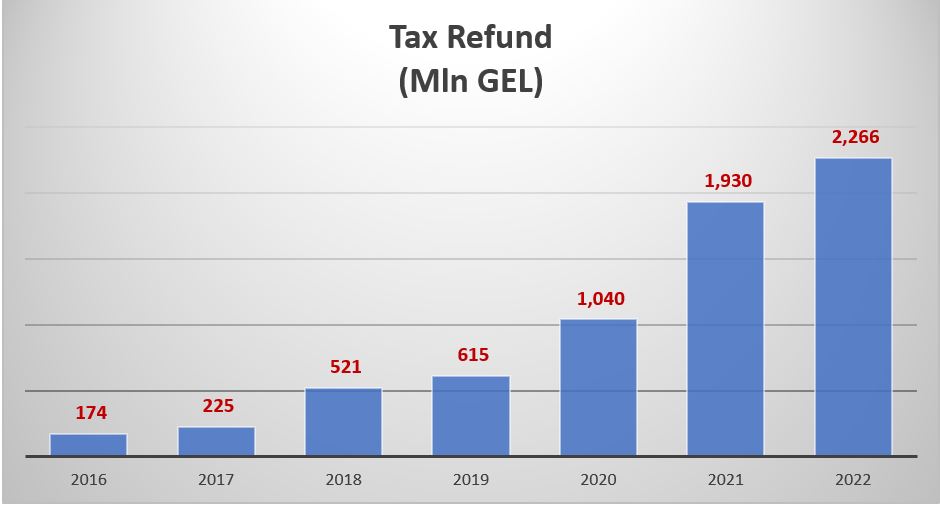

Since 2019, the refund mechanism has been fully automated and no longer requires manual intervention. As a result, the tax refund rate has dramatically increased, as indicated in the chart below:

The implementation of the Single Tax Code system and the automated tax refund process have contributed to the following outcomes:

- Increased trust in government systems

- Improvement in tax administration

- Higher efficiency in utilizing human resources

- Enhanced fiscal forecasting and planning

- Accelerated economic activity in the country

- Facilitated recovery from the pandemic.

Georgia has demonstrated a strong track record in improving fiscal discipline in recent years. The Ministry of Finance has placed PFM and revenue administration at the forefront of its reform agenda. The commitment of political leaders, coupled with the support of international financial institutions, has played a vital role in delivering these reforms.