Fiscal risks are considered as any deviations in fiscal outcomes compared to the government’s fiscal and budgetary forecasts or projections. Addressing such risks periodically is important to avoid further government obligations, public financing difficulties, increases in public debt and sometimes prolonged fiscal crises.

The crises that have occurred in Somalia following the collapse of the republic in 1991 led to a loss of institutional capacity and poor management of public finances. Moreover, Somalia has become officially dollarized, which means that the role of the state as lender of the last resort is no longer applicable.

Fiscal policy thus became the only regulatory option available for the government to manage the economy. However, the lack of institutional capacity and severe economic fragility accompanied by poor fiscal risk management practices have escalated the policy constraints across all spheres of governance. The country has a federal government and five member states (including Puntland), together with many subnational governments.

Three types of fiscal risk may be identified – macroeconomic risks, institutional risks, and specific risks. Macroeconomic risks are those that are associated with errors in forecasting and their implications for the budget. The federal government of Somalia and the member states are experiencing many macroeconomic risk factors including balance of payments deficits linked to dollarization, currency outflows, and limited capacity to control inflation due to the country’s high dependency on foreign commodities.

Institutional risks are related to the ministry of finance’s approaches in both federal government and member states to risk management, policy formulation and institutional capacity. Across the different levels of government in Somalia fiscal risk management practices remain unconventional. Fiscal policy frameworks, formulation tools and forecasting methods do not follow a strategic approach to ensure that the impact of new policies are examined before they are officially introduced.

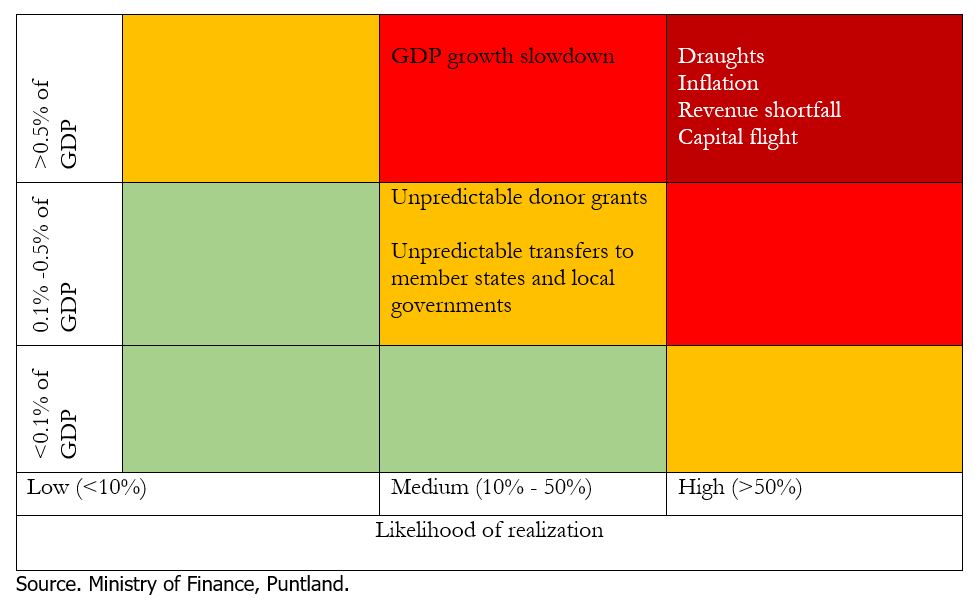

Specific risks are another important category of fiscal risk which occur as unexpected events such as droughts, floods or desert locusts impact the country, and the costs need to be borne by the federal government or member states. Another source of risk is the high degree of uncertainty associated with grants from international development organizations, and financial transfers from the federal government to the member states. These risks can result in large revenue shortfalls, an unplanned increase in the deficit or debt levels, and potentially a collapse of the government’s fiscal policy. The chart below indicates the likelihood and magnitude of these risks.

Somalia - Fiscal Risk Assessment Framework (Puntland State)

In response to these concerns, we recommend some actions that will help the respective institutions to better manage fiscal risks across the federal government and member states.

- Creation of a macro-fiscal unit/department. The role of this unit would be to promote the achievement of macro-fiscal and debt sustainability objectives as well as the recognition of fiscal risks. It could also serve as an advisory unit on structural reforms in Somalia to support better fiscal policies. This might ultimately lead to a new strategic approach to budget preparation, execution, macro-fiscal monitoring, policy consistency and fiscal risk management and thus improve the country’s overall fiscal performance.

- Strengthening institutional arrangements and capacity. Reshaping the organizational design of public institutions by establishing missing units and departments, creating information flows across related departments, and developing the capacity of personnel would boost the effectiveness of their work, narrow skills gaps and make macro-fiscal targets more achievable.

- Absence of common systems and standards of public financial management across the various levels of government. Such systems are required to cover all stages of the budget cycle in even its most basic elements – a functional chart of accounts, budget preparation and execution processes, accounting and financial reporting, cash and debt management, etc. Sustained efforts to build capacity in these areas are required both at the federal level and in the member states, with unified standards and systems being applied to the extent possible.