Estimates of the global infrastructure financing gap are massive – roughly USD 6.3 trillion with an additional USD 0.6 trillion per year needed to make these investments compatible with climate goals between now and 2030 (OECD, 2017). The private sector could help close this financing gap via increased use of public-private partnerships (PPPs). However, private sector participation in infrastructure is difficult to achieve – especially in developing economies where the institutional capacity and legal framework for PPPs are relatively nascent.

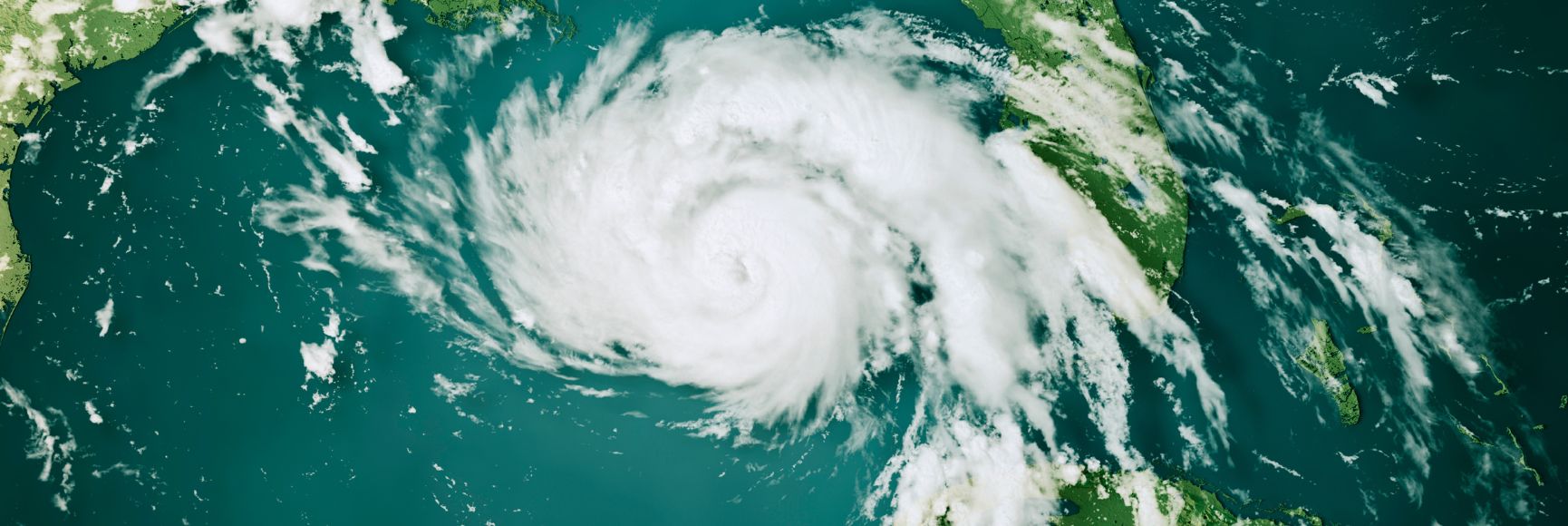

Climate-proofing PPPs presents an additional layer of complexity in developing countries, complicating the need to create an investment-friendly environment. Despite this challenge, such an approach is critically needed and will likely bring substantial net benefits to developing countries and increase the cost effectiveness of infrastructure investment. The cost of infrastructure service disruptions due to climate change is estimated to be far greater than the cost of resilient infrastructure investment over the long-term (Hallegate, Rentschler, and Rozenberg, 2020).

In a paper recently published in the Journal of World Association of PPP Units and Professionals (WAPPP), we further elaborate the economic case for climate-proofing PPPs and present a set of recommendations to operationalize the approach. In essence, climate-proofing PPPs requires a proactive understanding and management of climate-related risks (CRR). These risks include (i) physical risks associated with climate-related disasters, (ii) transition risks resulting from a societal shift towards a lower-carbon footprint, and (iii) liability risks arising from future damages of present-day carbon emissions. Some key recommendations on climate-proofing PPPs are outlined below.

1. Governments should take precautions in PPP design against multiple hazards and “cascading failures” arising from physical risks. This approach requires that policymakers proactively anticipate and address complexities in risk allocation between the public and private sectors. In addition to direct service disruptions of economic infrastructure, climate catastrophe can trigger a long chain of adverse impacts. These include hospital closures due to power outages, shutdowns of businesses due to logistical difficulty, and water source pollution. Such failures pose a major challenge for risk allocation among infrastructure stakeholders in PPPs. Moreover, severe natural disasters can lead to economic and financial crises – as seen in the aftermath of the devastating magnitude 7.0 earthquake that hit Haiti in 2010.

2. PPP contracting authorities should manage climate-related risks as business risks in infrastructure PPPs. The rise of CRR necessitates changes in how PPP risks are understood, managed, and allocated. PPP risk categories which have traditionally been used to screen and manage transactions are still relevant. However, there are notable distinctions: first, the sources of risk will become more varied; second, certain risks will be realized more frequently; and finally, their predictability will become even lower. As such, PPP contracting authorities and participants must develop a more comprehensive understanding of the interaction between CRR and PPP risks.

3. Fiscal policymakers should embed CRR management in policy frameworks and public investment planning. Climate change can affect the sustainability of public finances via multiple transmission channels – increasing pressure on government revenues and expenditures in the wake of a climate disaster or due to weakening growth prospects. Preemptive CRR screening of infrastructure projects can increase the resiliency of infrastructure, reducing the future costs of climate disasters. In addition, better analysis of climate-related fiscal risks can help improve CRR management by informing fiscal buffers and contingency financing plans (see for example, Georgia’s analysis of climate fiscal risks).

When it comes to climate action, the world now faces a crucial window of opportunity to act quickly and proactively manage risks – before the increased frequency of climate disasters evolves into a full-blown climate crisis. The increasing cost and frequency of natural disasters and the climate under-preparedness of many developing countries demand that steps be taken urgently, making use of the support of the international community and various green financing options. Greater progress towards climate-proofing infrastructure in developing countries will pay dividends in the future. It will minimize the social, economic, and financial impact of climate-related disasters and ensure that these risks are fully incorporated into government risk management and public-private sector risk sharing arrangements.