iStock.com/ChakisAtelier

Posted by Bruno Imbert, Abdoulahi Mfombouot, Laura Gores 1

State-owned enterprises (SOEs) are important actors in francophone Sub-Saharan Africa. They provide essential services to populations, help manage natural resources, lead public investment projects, and provide employment in various sectors such as water, electricity, transport, telecommunications, and extractive industries. But they also generate fiscal risks that are commensurate with their importance for both the economy and citizens. According to IMF studies, bailouts of SOEs have averaged a cost of 3 percent of GDP, and in many countries SOEs are loss-making, generating a constant drain on public finances.

The IMF’s Fiscal Affairs Department (FAD), with the financial support of the European Union, organized the third regional seminar on fiscal transparency in francophone Sub-Saharan Africa 2 from 28 to 31 March 2022. This year’s seminar focused on the transparency of SOEs, with the aim to help countries strengthen their fiscal transparency practices through peer-to-peer learning and the sharing of tools and good practices. It gathered 120 participants from 14 countries 3 representing Ministries of Finance, line ministries, parliamentary finance commissions, supreme audit institutions (SAIs), civil society organizations and donors, to discuss how countries ensure the transparency and accountability of their SOEs.

There is room to improve the transparency of SOE’s, and thus better manage fiscal risks.

The overall picture of fiscal transparency in francophone Africa remains challenging. The International Budget Partnership’s (IBP) last Open Budget Survey (2019) found an average score of 28 out of 100 in the region’s overall transparency score – with some progress however since the previous 2017 Survey.

In most of the countries of the region, too little information is published on the operations of SOEs to ensure that citizens can hold them accountable. According to IBP, only the Democratic Republic of Congo and Senegal currently achieve good results when it comes to making information on the transfers to SOE’s transparent. Weaknesses are frequent when it comes to oversight of SOEs by SAIs and Parliaments, which are key actors for ensuring the accountability of those managing public funds. These findings are in line with those of the PEFA assessments conducted in the region, that assess - amongst others - the supervision of SOEs under the angle of fiscal risks management.4

The IMF’s fiscal transparency evaluations conducted in the region come to a similar conclusion. In many countries, monitoring beyond transfers to SOEs is limited and mostly audited financial statements of SOEs are not made available to the public on a yearly basis. Few governments have published an SOE shareholding strategy. This lack of transparency affects the capacity of governments and citizens to hold SOEs accountable.

Sharing country experiences and good practices: regional initiatives to improve SOE oversight

The workshop provided a platform for participating countries to discuss and exchange their mutual practices and reform initiatives to step up the supervision of SOEs. The Ministries of Finance of five countries shared a variety of innovative examples that illustrated their drive towards progress. These included Cameroon’s ongoing efforts to publish increasingly exhaustive information on its SOE portfolio with its annual budget law (“tome vert”) or Ivory Coast’s efforts to formalize relations with SOEs through a dedicated SOE management chart. Both Burkina Faso and Guinea presented mechanisms to supervise the financial performance of SOEs. Burkina Faso’s General Assembly of State Societies provides a joint annual forum for SOEs, the Ministry of Finance and other stakeholders to discuss and validate the SOE’s financial statements. The Ministry of Finance of Guinea presented its reform plans which include establishing a network of analysts to assess the financial performance of SOEs. Senegal’s SAI shared insights on how it strengthened its capacity to audit SOEs, notably via partnerships with private audit firms. As a special guest, the Ministry of Finance of the Kingdom of Morocco presented its practices and joined the discussions with the regional authorities.

Enhancing the transparency and accountability of SOEs in the future

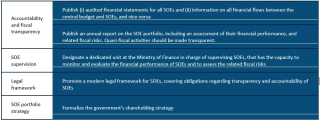

Even though many countries in the region have begun to improve the accountability ecosystem of their SOEs, much remains to be done. In their discussions, the participants explored several avenues for reforms pointing the way forward. These avenues are summarized below in Table 1.

Table 1: Reform Avenues Identified

[1] Bruno Imbert and Abdoulahi Mfombouot are senior economists, Laura Gores is technical assistance advisor at the Fiscal Affairs Department (FAD) of the IMF.

[2] The first seminar was organized in January 2019, in Dakar (Senegal) and focused on fiscal transparency in general. The second seminar in 2020 was held virtually and focused on the transparency of public spending to combat the COVID-19 crisis.

[3] Benin, Burkina Faso, Cameroon, Central African Republic, Republic of Congo, Côte d’Ivoire, Gabon, Guinea, Madagascar, Mali, Niger, Democratic Republic of Congo, Senegal, and Togo.

[4] According to the PEFA Secretariat, none of the twelve countries with recent PEFA evaluation, achieve a score of A or B when it comes to the monitoring of public corporations and only seven achieve a score of C (PEFA indicator 10.1).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.