Posted by Richard Allen and Nabila Akhazzan[1]

The IMF has recently published a Fiscal Transparency Evaluation (FTE) report on Jordan which was carried out by the Fund’s Fiscal Affairs and Statistics Departments.

Without comprehensive and reliable fiscal information, governments cannot properly measure the fiscal risks they face or make good budget decisions. And unless that information is made public, citizens and their legislatures cannot hold governments accountable for those decisions. Fiscal transparency is thus a critical element in effective fiscal policymaking and the management of fiscal risks.

Recent shocks in Jordan have shed light on the importance of fiscal transparency as a key entry point to evidence-based policy making, proactive citizen participation, and improved accountability. The FTE also provides a foundation for more inclusive and sustainable growth.

Jordan is only the second country in the Middle East and North Africa region (after Tunisia) to undertake an FTE. While the country has made some improvements in fiscal transparency practices over the past decade, the FTE identifies areas where further progress can be made. The evaluation looked closely at 36 principles of the Fiscal Transparency Code with the aim of providing an in-depth analysis of Jordan’s performance against best practices of fiscal reporting (Pillar I of the Code), forecasting and budgeting (Pillar II) and fiscal risk analysis and management (Pillar 3).

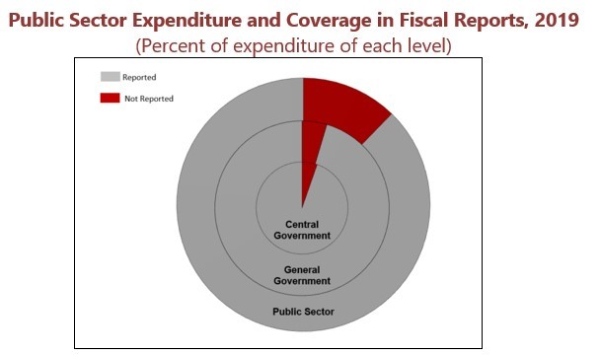

The analysis found that there is a sound legal framework for the management of public finances. Fiscal reports have become more comprehensive and cover a high proportion of public sector institutions (see chart). Fiscal forecasts and budgets are now more forward looking, and policy oriented with the introduction of a five-year medium-term budget framework and a program classification.

Nevertheless, the evaluation highlights several areas where Jordan’s fiscal transparency practices could be further improved. Particularly:

- There is no fiscal report that provides a comprehensive, consolidated view of public sector finances: Various fiscal reports are published but are fragmented and based on different standards and differ in terms of institutional coverage, flows and stocks, and accounting rules.

- Fiscal reports cover 88 percent of general government activity in terms of flows, but there are major gaps in the coverage of the government’s stock positions of assets and liabilities.

- Limited information is published on tax expenditure which represents 10 percent of GDP, and two-thirds of tax revenue.

- Macroeconomic forecasts have a huge optimistic bias (an average deviation of 35 percent in the GDP forecasts since 2007) thereby resulting in large errors in the revenue projections that underpin the budget.

- There is no analysis in the budget of how fiscal outcomes might be affected by different macroeconomic scenarios.

- The government’s total gross exposure to a range of identified fiscal risks is over 120 percent of 2020 GDP but there is only limited reporting and disclosure of these risks.

- Jordan faces additional fiscal risks from long-term pressures on health and pensions spending (127 percent of GDP) but there is no publicly disclosed analysis of the long-term sustainability of public finances.

The report proposes several short and medium-term policy actions to strengthen fiscal transparency. It identifies some “quick wins” such as publishing more information on the budget, fiscal forecasts, PPPs, and tax expenditures that should lead to early and substantial improvements in the country’s FTE ratings. Building up the Ministry of Finance’s Macro-Fiscal Department is a priority and – with its newly established Reform Unit – will help implement many of the FTE’s recommendations.

Finally, the report provides a comprehensive view of Jordan’s public sector financial position. It estimates consolidated public sector expenditure of 48 percent of GDP, public sector asset holdings and liabilities of around 152 and 159 percent of GDP respectively, and public sector net worth of minus 6 percent of GDP in 2019.

[1] Richard Allen led the IMF’s FTE mission to Jordan in March/April 2021; Nabila Akhazzan was a member of the mission team and works for IMF’s Statistics Department.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.