Posted by Robert Clifton, Vincent Tang, Xavier Rame, Prudence Cele, and Nompumelelo Radebe[1]

Despite advances in gender equality and women’s empowerment since the inception of democracy, South Africa is still confronting the challenge of gender-based inequality. For example, in 2018, women’s median monthly earnings were 76% of men's median monthly earnings. While some studies point out that the fiscal system is at least partially responsive to gender equity,[2] the COVID-19 pandemic has generally further exacerbated existing vulnerabilities in the society and economy, for both women and men.[3]

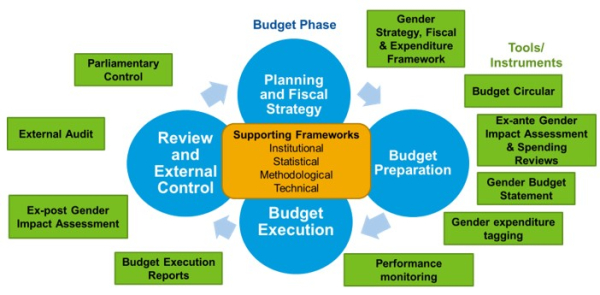

In 2017, the IMF developed a framework for an integrated approach to GRB. This framework goes beyond gender allocations but does not require a new approach to budgeting. Rather, it calls for an explicit incorporation of gender issues through adaptation and reinforcement of existing institutions and tools. Therefore, at all stages of the budget cycle—planning and fiscal strategy, budget preparation, budget execution, review, and external control—gender-specific analysis and instruments should be integrated (Figure 1).

Figure 1. Integrated Framework for GRB[5]

In July 2021, the National Treasury collaborated with the IMF’s Regional Technical Assistance Center for Southern Africa (AFRITAC South) and the Fiscal Affairs Department to apply the IMF’s GRB framework and develop a roadmap to advance the gender responsiveness of the budget in the context of the GRPBMEAF. The review found that:

- A multi-layered strategic planning architecture combined with well-established program-based budgeting are major enablers of GRB in South Africa. However, the development of ex-ante and ex-post gender impact assessments could support a better alignment of gender equality goals and budget allocations.

- There is an array of institutions in South Africa that play important roles in driving forward gender responsive budgeting. These include the Department for Women, Youth, and Persons with Disabilities (DWYPD) and the Department of Planning, Monitoring and Evaluation (DPME). Building on these existing institutions and strengthening coordination will be key to success.

- South Africa’s reporting systems have the potential to expand, but gender reporting would also require adjustments of the reporting templates and guidelines.

- South Africa benefits from an effective and respected Supreme Audit Institution, established parliamentary committees, and oversight bodies. Nevertheless, the audit framework does not yet explicitly integrate gender equality and parliamentary committees do not undertake systematic reviews of the gender impacts of service delivery programs.

- Incorporating a gender perspective in spending reviews and the budget challenge function could ensure that spending rationalizations are better targeted and do not have unintended impacts concerning gender or other vulnerable groups.

- The review recommends an approach that combines the preparation of a gender budget statement and a gender expenditure tagging mechanism. This mechanism builds on recent efforts by the National Treasury to tag gender spending as well as new requirements for departments to include gender disaggregated data in their annual performance plans.

- The approach could be implemented within a few pilot departments and gradually extended. The roadmap developed by the National Treasury through this collaborative process proposed a sequenced and flexible approach.

Finally, there was a recognition that GRB can be expanded as a wider concept of budgeting to prioritize other vulnerable groups. A more granular approach to budget making could be taken in the long term, targeting persons with disabilities and the youth. Ultimately, GRB can be a highly transformative initiative.

[1] Robert Clifton is a PFM Advisor in the IMF’s Technical Assistance Center for Southern Africa; Vincent Tang and Xavier Rame are Senior Economists with the IMF’s Fiscal Affairs Department; Prudence Cele is a Director in the Budget Office and Nompumelelo Radebe is a Director in the Public Finance Division of the National Treasury of South Africa.

[2] See, for instance, Goldman, Woolard, Jellema, The Impact of Taxes and Transfers on Poverty and Income Distribution in South Africa 2014/2015, 2020, AFD Research Papers

[3] See, for instance, Bluedorn, Caselli, Hansen, Shibata, Tavares, Gender and Employment in the COVID-19 Recession: Evidence on “She-cessions”, 2021, IMF

[4] For example, in 2020 Gauteng Province introduced its initial GRB reforms focused on strengthening data collection processes and identifying gaps to help departments strengthen interventions that directly support gender equality.

[5] Based on Gender Budgeting in G7 Countries, IMF Policy Paper, 2017.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.